Three Lessons From Yale's Endowment Fund

Everyday investors will not wish to copy the famed pension funds, but they can pick up some tips.

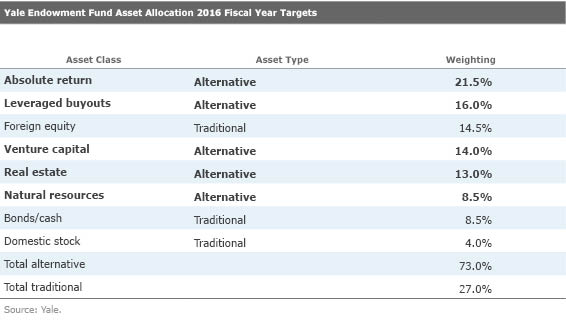

The Cheese Stands Alone The Yale endowment fund, run since 1985 by David Swensen, leads by exception. Just as Warren Buffett became the top corporate CEO by managing differently from other CEOs, and Vanguard grew into the world's largest fund company by doing what its competitors did not, so too did Yale ascend the top of the pension-fund rankings. While other pension funds dabbled with unconventional assets, Yale gorged upon them. At last report, the Yale fund held 73% of its assets in alternative investments.

The rest of the world invests by "Core and Explore"; Yale opts for "Explore and Core."

Yale is one of the few funds to thrive after its manager attained stardom. Since Swensen published "Unconventional Success: A Fundamental Approach to Personal Investment," in 2005, the fund has returned an average of 10% per year. That places it comfortably ahead of all major stock indexes, as well as 129 of Morningstar's 131 mutual fund categories. (The Yale fund trails only healthcare and consumer-defensive specialty stock funds.)

Is this pension fund's victory relevant for us? Not entirely. Much of Swensen's book, which targets retail rather than institutional investors, consists of advising, "Don't try this at home." As Swensen correctly writes, Yale's situation differs substantially from that of his readers'. This column, too, has stated the dangers of taking the Yale model too literally.

But there are some concepts that do translate.

Liquidity Comes at a High Cost Who doesn't like liquidity? It's distressing to pay a steep premium to buy a security or receive a haircut when selling; to be stuck with the investment when attempting to unload it; and to not know its true price because it has not recently traded. The attribute of liquidity makes a security more attractive. Unfortunately, it also lowers the security's expected gain, as investors in aggregate are willing to accept lower returns on a liquid security in exchange for the attribute's benefits.

Swensen is delighted to take the other side of that trade. Yale's fondness for alternatives is typically explained as an extreme application of Modern Portfolio Theory--adding individually risky assets so as to achieve a stronger overall portfolio. That is true insofar as it goes. However, Yale also achieves significant excess returns from its alternatives stake by forgoing liquidity. A venture-capital fund might have a 10-year investment term, with limited opportunity for shareholders to escape. It had better return more--a lot more--if it demands that level of commitment.

The boom in so-called liquid alternative funds--that is, registered mutual funds that use alternative strategies--suggests that this lesson has not been fully digested by financial advisors and their clients. Yes, these new mutual funds improve diversification, thereby extending the math of Modern Portfolio Theory. But they do not receive the premium of illiquidity. As a result, it's not clear that they will earn an acceptable return after their expenses are paid.

For example, Yale gained between 6.2% and 18% on its various alternative asset classes over the past decade. In contrast, long-short equity mutual funds made 2.1%, multialternative funds 1.4%, and market-neutral funds nothing. That is a massive, massive gap. Purchasing liquid alternative funds did not make retail investors like Yale. It made them go nowhere.

Mutual fund investors would have been better off thinking less about "alternative" and more about "illiquidity," which is where the real money is made. Admittedly, finding less-liquid securities is difficult for nonaccredited investors. However, there are partial solutions in the form of micro-cap stock funds, the more adventurous of mortgage and distressed-credit bond funds, and selected closed-end funds. And there is scrutiny to be given to the claims of alternative investments that may offer diversification but not sufficiently high returns.

Cut Fixed Income, If Possible Yale didn't whip almost every mutual fund because it slashed its stock position. Quite the contrary--its stock holdings were among the very best of its asset classes, gaining roughly 15% per year for the decade. Yale triumphed in large part because it lacked fixed-income. With yields low throughout the time period, bonds had no way to make anything like the double-digit gain that Yale achieved.

Nothing has changed for bonds. Yields remain low, at just over 2% for Treasuries. An investor seeking medium-to-high returns will not be served well by bonds. To the extent that fixed-income investments can be replaced by assets that have higher expected returns, without increasing the portfolio's risk level past that acceptable to the investor, the better the investor's prospective results.

Easier said than done, particularly as I've questioned the value of the natural fixed-income substitute, registered alternative funds. Swapping conventional cash/bonds for preferred stocks (my personal solution), convertible bonds, and/or high-dividend stocks is a possibility. So, too, might be the lowest-cost of liquid-alternative funds, which will retain most of their probably modest gains.

Fund Selection Matters As mentioned in a previous column, the least-known reason for Yale's success has been Swensen's remarkable skill at identifying successful active managers. His alternative investments are, of course, nearly all actively run, as there are few indexed hedge funds or private-equity funds. So too are most of the fund's equities, which have far outpaced their benchmarks. To cite one example, the composite index used by Yale to benchmark its foreign-stock performance was up 9% annually for the trailing 10 years, while Yale's foreign stocks registered 17.4%.

I can offer no advice as to how to beat an index by 8 percentage points per year! (Swensen's figures are borderline magic.) As Swensen states in his book, he is much better equipped, through both knowledge and manager access, to invest actively than is the typical investor. One should be very humble in attempting to be a poor man's Swensen. Nonetheless, the leading institutional investor--and leading institutional fund--profits handsomely from finding the right active managers. That is a fact at least worth considering for the rest of us.

A Better Lunch This column's suggestions consistently involve assuming more risk. Not necessarily purchasing more stocks, but lowering liquidity, increasing credit exposure, or perhaps assuming the uncertainty associated with active management. They are therefore most appropriate for portfolios with long time horizons, owned by investors who have relatively high risk tolerance.

There is also the issue of timing. Six years into an economic expansion (albeit a slowish one), and even longer into a bull market, may not be the best moment to become brave. As I don't put much faith in anybody's ability to predict the next downturn, this is not my personal concern--but I can understand why others might think, "Some of this might make sense, but not right now."

The Yale model cannot deliver a free lunch. It may, however, suggest how to get a better lunch, for those who have the appropriate tastes.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)