Why Have TIPS Been Such Poor Performers?

Low inflation expectations and meager real yields have weighed down TIPS.

Are you looking for tips on improving your portfolio? As part of Morningstar.com's Portfolio Makeover Week in December, director of personal finance Christine Benz will be making over five real-life portfolios to show how investors of all stripes may streamline and upgrade their holdings. To be considered for a makeover, submit a request to portfoliomakeover@morningstar.com. Include a general description of your situation, including portfolio size, as well as your goals for the makeover. We will alert you if we decide to feature your portfolio on the site and will remove any personally identifying information in any published material.

Question: Why have TIPS been such darn poor performers?

Answer: TIPS have been a tough sell lately. We have heard similar comments from other readers in recent months. In fact, one reader recently noted that inflation hedges have been a drag on portfolio returns for years. "Sooner or later they might pay off, but they seem like very expensive protection for a problem that has been nonexistent for a very long time," this reader said.

It's been a tough stretch for most asset classes that are considered traditional inflation hedges.

"There are basically two things that drive TIPS performance: real yields and inflation expectations," said director of fixed income Sarah Bush. Inflation expectations have come down recently, and became particularly low in the third quarter; with oil price volatility during the quarter, and concerns about global growth brought to a head with the devaluation of the Chinese currency in August, inflation is just not a fear that's keeping investors up at night, so demand for TIPS is slack.

To understand the "real yield" component of TIPS' returns, it may help to get a little more background on how TIPS work.

How Are TIPS Different Than Treasury Bonds? One of the biggest risks of investing in Treasury bonds is that the fixed yields they pay will not be able to keep up with the rate of inflation. To illustrate, consider the 10-year breakeven inflation rate, which is a market-based measure of expected inflation.

Essentially, this is calculated like this: The 10-year Treasury yield minus the 10-year TIPS yield equals the 10-year breakeven rate. Let's plug in real numbers (as of Nov. 10, from www.Treasury.gov): 2.32 (10-year Treasury yield) minus 0.77 (10-year TIPS yield) equals 1.55 (10-year breakeven rate).

If inflation runs 1.55% or lower over the next 10-year period, the Treasury bond with a 2.32% coupon will outperform a 10-year TIPS. But if inflation is higher than that, the 10-year TIPS would be the better-performing option.

Like Treasury bonds, Treasury inflation-protected securities are backed by the full faith and credit of the US government (meaning there is no credit risk involved). But, as their name implies, TIPS also offer inflation protection.

The actual mechanics of how this works are this: Unlike traditional bonds, TIPS' principal value will change, upward or downward, to keep pace with inflation as measured by CPI-U (with a lag of a few months). The coupon payments, which are paid twice per year, will also vary, then, because though the coupon rate is fixed, the inflation-adjusted principal amount is changing.

If an investor holds a TIPS bond to maturity, the owner receives the adjusted principal or the original principal, whichever is greater. This provision protects the bond owner against deflation.

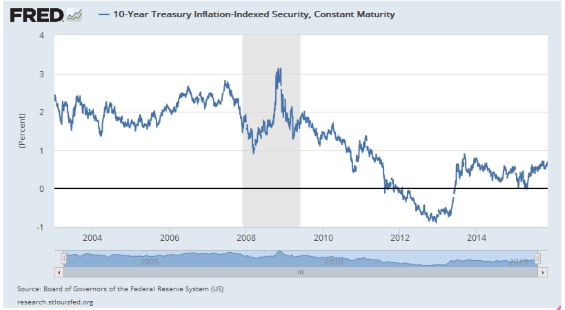

This protection has a cost; as the example above indicates, TIPS yield less than Treasuries of similar maturity, because TIPS holders receive an inflation adjustment that compensates for their lower yields. And because Treasuries' yields are currently so low owing to the current low interest-rate environment, TIPS' yields have been especially meager--and in some cases, even negative, as illustrated by this graph from the St. Louis Fed:

TIPS Can Be Volatile Yet even though TIPS have been called the only truly risk-free investment, some investors may be surprised to learn that TIPS' prices can be volatile, for a variety of reasons.

For one, although the principal values of TIPS are designed to appreciate with increases in inflation, inflation-protected bond funds are not impervious to changes in market yields, as floating-rate bonds are designed to be. When yields rise TIPS' prices come under pressure--the longer the bond, the more pressure--even if inflation is pushing up their principal value at the same time.

In addition, while they’re still Treasury bonds, TIPS tend to be less liquid than nominal Treasuries; this was really on display during the financial crisis.

"The inflation protection is really a long-term feature that works properly if you hold a TIPS bond until maturity. You should pretty much expect that changing market yields will drive TIPS market prices all over the map in the meantime, though," said Morningstar senior analyst Eric Jacobson.

Related Reading

To see a list of Medalist funds in the inflation-protected bond category, premium members can

.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)