October Ratings Activity Includes a Newly Minted Gold Fund

Seven other Morningstar Medalists are downgraded.

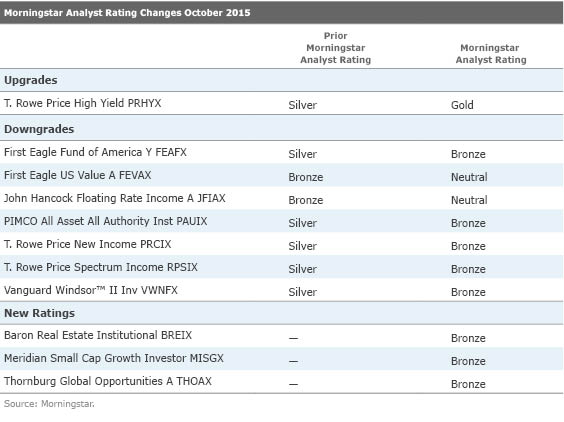

Morningstar manager research analysts downgraded seven Morningstar Medalists in October--two of them all the way to Morningstar Analyst Ratings of Neutral--and upgraded one Analyst Rating to Gold. We also rated two funds for the first time, and re-initiated coverage of a third. Some notable changes are highlighted here; a complete list can be found in the table below.

At the close of the month, Sequoia SEQUX was Under Review, owing to the resignation of two independent trustees on the fund's board of directors amid the controversy over Valeant Pharmaceuticals VRX, a huge stake for the fund. The fund's Gold rating has now been reinstated. Premium members can view the Analyst Report page for an updated analysis.

Upgrades:

T. Rowe Price High Yield PRHYX owes its rating upgrade to Gold from Silver to an experienced team, a strong and stable process, shareholder-friendly moves, low fees, and strong returns. Longtime lead manager Mark Vaselkiv has proved adept at navigating T. Rowe Price High Yield through choppy waters, and its experienced high-yield team has shown a knack for security selection, which has contributed most positively to the fund's returns over the long term. The fund's 10-year return as of September 2015 was better than 80% of its high-yield peers, though the ride hasn't always been smooth. The firm and this team put shareholders first in a number of ways, including closing the fund to new investors in April 2012 (the second time during Vaselkiv's tenure). In addition, the fund's 74-basis-point expense ratio is among the lowest of its similarly distributed peers.

Downgrades:

PIMCO All Asset All Authority PAUIX hasn't delivered on its long-term objective, bringing its rating down a notch to Bronze from Silver. The roving strategy aims to generate a 6.5% annualized return above the Consumer Price Index over the long run, but its 5.2% annualized gain since its 2003 inception through August 2015 fell well short of its 8.7% goal. That said, while the fund has seen significant outflows this year, investors should think twice before turning away. A steadfast, research-intensive subadvisor with a burgeoning toolbox keeps prospects bright for this exceptionally diversified strategy. Research Affiliates' Rob Arnott--the fund's sole portfolio manager since its 2003 inception--uses a models-based approach to steer the portfolio to undervalued assets with attractive real yields. The resulting portfolio tends to be heavy in what Research Affiliates calls "third pillar" assets to provide uncorrelated returns to more-traditional stock and bond pillars. The fund's contrarian approach may yet reward long-term investors.

T. Rowe Price New Income PRCIX was downgraded from Silver to Bronze due to lackluster performance. Manager Dan Shackelford has a solid process in place and expansive resources; he seeks to provide a reliable core bond portfolio that yields more than its Barclays U.S. Aggregate Bond Index benchmark. Government, investment-grade corporate bonds, and mortgage-backed securities make up the bulk of the portfolio's assets at any given time, and duration is kept within 20% of the benchmark. Riskier investments in high-yield, bank loans, and emerging-markets debt are peripheral. This flexibility to invest in out-of-benchmark sectors broadens yield opportunities, but missteps can offset gains made by the more modest bets within its core bond portfolio. A few calls have caused the fund to fall short of its average peer and benchmark over the past five years.

Vanguard Windsor II VWNFX is set to lose its longest-tenured manager, dropping its rating to Bronze from Silver. Barrow, Hanley, Mewhinney & Strauss' James Barrow will step down at year-end 2015. He has ably overseen the subadvisor's portion of this fund's assets, now roughly 60%, since the fund's mid-1985 inception. Barrow's departure does not come as a surprise. In early 2013, the firm added his successors, Jeff Fahrenbruch and David Ganucheau, as comanagers. They have 18 and 19 years of investment experience, respectively, and have managed money for the firm since July 2011. They'll rely on the same analysts as Barrow and use the same sound process. It's rooted in looking for dividend payers with strong balance sheets and business models, but whose shares offer above-average yields at below-average valuations. The fund should do well on their watch, but they nonetheless lack Barrow's outstanding record and must build their own.

New ratings:

Meridian Small Cap Growth MISGX earns a Bronze rating with a proven approach and management team. Managers Chad Meade and Brian Schaub left Janus Capital to join Arrowpoint Partners in mid-2013 just as the latter firm became the advisor to the Meridian Funds. In September 2013, Meade and Schaub took the helm of Meridian Growth and filled the portfolio with a mix of mid- and small-cap growth stocks (an approach they'd used successfully at Janus Triton JATTX). In December 2013, this fund was launched as a pure small-growth play similar to Janus Venture JAVTX, the managers' other former charge. Meade and Schaub have successfully balanced risk and prudence here. They favor companies with significant competitive advantages and relatively sturdy cash flows and balance sheets. But they've taken advantage of the fund's small size by buying many micro-cap stocks and investing in a smattering of IPOs. The fund has beaten almost all of its small-growth peers and trounced its Russell 2000 Growth benchmark since its inception.

We recently reinitiated coverage of Thornburg Global Opportunities Fund THOAX with a Bronze rating. Experienced managers Brian McMahon and Vinson Walden have been at the helm of this world-stock fund since it opened in mid-2006, and they employ a distinctive strategy. The managers hold just 30-40 names, regularly allow their stock selection to lead to sizable sector and country overweightings, and invest significant amounts in smaller-market and smaller-cap equities. McMahon and Walden have earned great returns with this strategy since inception, outgaining all other world-stock funds and crushing its benchmark, the MSCI ACWI Index. But this fund's issue, sector, and country concentration can backfire: Largely because of its hefty stakes in a quartet of healthcare stocks that have sunk--including Valeant--it has lost much more than its average peer and the index in recent months. This fund demands a tolerance for rough spells and a commitment to the long haul.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)