State Tax Perks and 529 Plans

Investors armed with the knowledge of their state’s tax benefits can readily narrow their 529 plan choices.

Morningstar recently released its 2015 ratings for 63 529 plans, along with a companion piece, Choosing a 529 Investment. The following article summarizes the first step for do-it-yourself investors in choosing a direct-sold 529 plan--determining whether state tax or other benefits make it worthwhile to stay in state, or if investors are better off searching nationwide for a 529 plan. Investors can open direct-sold plans through 529 plan managers without the aid of a financial advisor. College savers working with advisors presumably already have guidance on these issues, so while many of the same principles apply, this research does not go into detail on advisor-sold plans, which must be opened through an advisor.

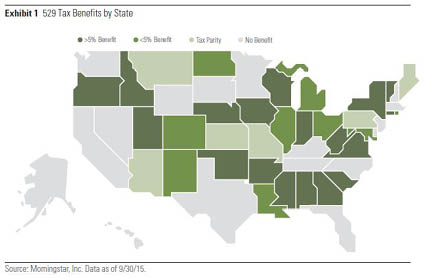

Tax Benefits Drive the In-State or Out-of-State Investing Decision Investors have their pick among the nation's more than 50 state-sponsored, direct-sold 529 college-savings plans, and they have no obligation to stay with their state's plan. All 529 investors skip federal taxes on growth and distributions to pay for beneficiaries' higher education costs. About 45% of the U.S. population lives in states that offer their residents additional state-specific tax benefits for investing within the state's 529 plan; 10% enjoy state tax benefits regardless of the state 529 plan used (these are commonly referred to as tax-parity states); and 45% reside in states that offer no additional tax benefits (either because the state has no state income tax or no 529-specific tax benefit). Exhibit 1 shows how states fall into the different scenarios.

For the 45% of the population living in areas with state-specific tax benefits, calculating the merits of staying in-state or going to an outside 529 plan can get complicated. Consider the state-specific tax benefit as a way to shrink the gap between plans with similar investment merits but differing fees, or for plans with similar fees but less-competitive investment options (such as when choosing between plans that have Morningstar Analyst Ratings of Bronze or Neutral). The size of the benefit matters, but so does the length of time that investors expect to hold on to their accounts, the regularity of contributions, and investors’ tax brackets, among other areas. As a general rule of thumb, those who enjoy a tax benefit that’s equal to at least 5% of their initial year’s investment (states shaded in dark green) tend to have the strongest incentives to stay.

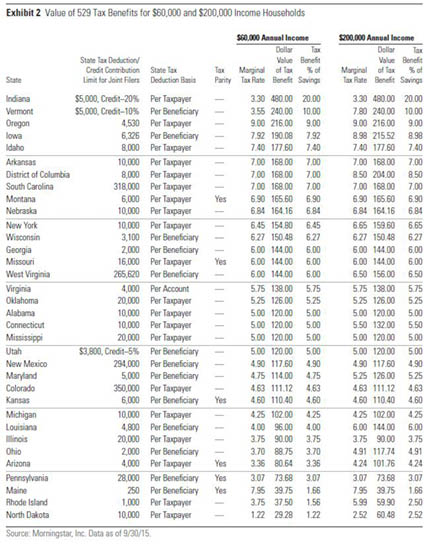

We determined that 5% threshold by evaluating scenarios for a household consisting of a couple with two kids filing a joint tax return under various saving and income levels. Under the first situation, the couple earns $60,000 a year--the median income of a four-person household in the United States--and invests $100 each month per child, culminating in total annual savings of $2,400. The second scenario holds those assumptions steady, save for a bump up in income to $200,000 per year in order to capture potential changes from states with progressive income taxes. Federal Reserve data shows that 70% of 529 account balances were held by households earning $200,000 or more annually. Of the states that offer a 529 tax benefit, Exhibit 2 shows how they rank, as sorted by the benefits enjoyed by households earning $60,000 annually.

Investors living in states with the most-generous tax benefits, such as Indiana and Vermont, have compelling financial incentives to stay within their states. In contrast to most states, which offer their benefits as tax deductions, those two states (as well as Utah) use a tax credit, which gives a dollar-for-dollar reduction in residents’ tax bills. The $480 dollar value of Indiana’s tax benefit amounts to 20% of the $2,400 invested. That’s also equivalent to a 25% instant return on investment ($480/ ($2,400-$480) = 25%). The investment merits of Indiana’s 529 plan don’t stand out on their own accord--fees are notably high, for instance. But its tax benefits are too generous to ignore, helping bump the plan’s Analyst Rating to Bronze. It is key to note, though, that the endorsement only applies to Indiana state residents.

Even states with the smallest tax benefits give residents a notable head start over investing out of state, at least in the initial year of investment. North Dakota’s College SAVE plan, for instance, has an average total expense ratio of 0.85%, so its tax benefit, which amounts to 1.22% in the example, pays for that year’s investment fees and then some. Any of these benefits become less meaningful over time as balances grow, however. For example, assuming a constant $2,400 annual investment and a 6% annual return, a tax benefit that was worth 10% of the balance at age 1 would be worth only 0.32% in year 18.

Finding the level at which a benefit is too generous to ignore is tricky, but tax benefits that initially make up 5% of savings tend to be a good starting point. At that level, the annual tax benefit will basically pay for the average 0.36% expense ratio of a passively managed direct-sold plan over the full 18 years. It also pays for more than a decade of the average 0.76% expense ratio of an actively managed direct-sold plan.

The state rankings may slightly differ, but the data show households in the higher $200,000 income bracket can also generally follow the 5% guideline. The progressive taxing system of a number of states essentially magnifies the tax benefit of investing in the state’s 529 plan. So, whereas couples earning $60,000 in Louisiana have a 4% benefit, for instance, couples earning $200,000 have a 6% benefit because of the higher marginal tax rate they face.

Investors living in states with less-generous state-specific tax benefits may also have a reason to invest in state if their state’s plan boasts compellingly cheap expense ratios or particularly strong investment options. That’s also true if they’re facing a shorter investing time horizon, as the benefit’s value won’t erode as much as it otherwise would for an investor with a longer time horizon. The key to these scenarios, though, is that college savers invest every year rather than in a more sporadic manner in order to take full advantage of each year’s tax benefit.

When to Look Beyond State Borders for a 529 Plan For the 55% of the population living in states shaded light green (who enjoy tax parity) or gray (who have no state-specific benefits), those investors should generally look across the nation for the best 529 plan for them. Among direct-sold plans, Morningstar considers the best to be the four Gold-rated and five Silver-rated 529 plans, which come with a variety of investment options. Morningstar analysts have confidence in a number of Bronze-rated plans as well, though state tax benefits often tip the scales to Bronze from Neutral for those plans, so it's important to read the plan's Morningstar analyst report to determine whether or not that figured into the rating. Among those plans, out-of-state investors can generally find better options elsewhere.

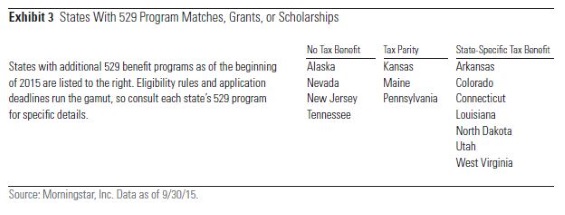

A few states--including tax-parity states and states with no state tax benefit--offer other incentives in the form of savings matches, outright grants, or scholarships, which can make their 529 programs more compelling. Some of those benefits are limited to certain income thresholds or a certain number of participants, among other restrictions. Exhibit 3 shows the 14 states that currently run those programs.

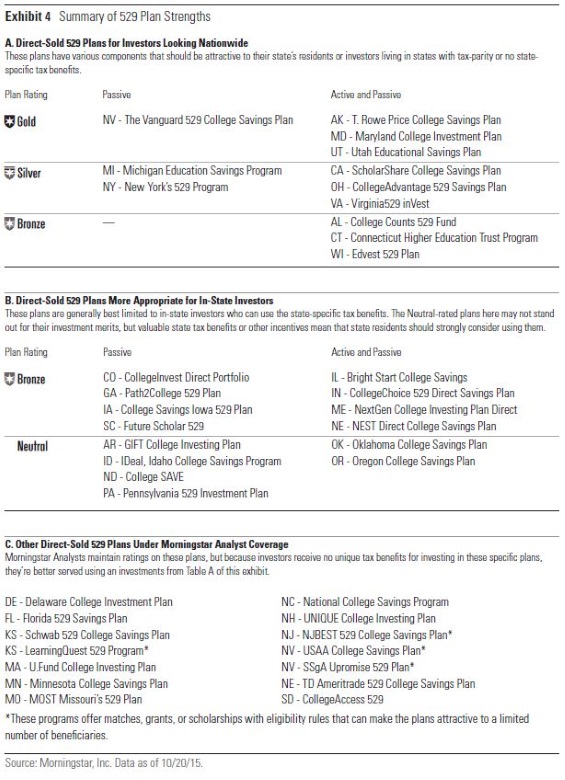

A Final Tally Exhibit 4 summarizes how the 40 direct-sold 529 plans under Morningstar analyst coverage as of October 2015 compare with one another. It is divided into three sections: plans that hold nationwide appeal, plans that should generally only be considered for use by in-state investors, and plans for which investors can find stronger alternatives. The table may seem to be missing a column for "active" plans. However, while there are a number of direct-sold plans that only offer passively managed options, among plans that use active management, all also have index-based offerings.

Direct-sold plans with nationwide appeal (Table A) are good choices regardless of the state of residence for the account owner or beneficiary. Nonresidents should take a particularly close look at these plans if their states offer no tax or other benefit for staying within the state or if their states' benefits are relatively small. All of these plans come recommended by Morningstar analysts, as designated by Gold, Silver, or Bronze ratings.

Plans best limited to in-state investors (Table B) generally have more-generous tax benefits. Absent those benefits (including cases where in-state residents cease regular annual contributions), out-of-state investors should look elsewhere because other states have cheaper or better investment options.

The remaining plans are mostly Neutral-rated (save for South Dakota’s Negative-rated CollegeAccess 529). Some plans in these states have program matches, grants, or scholarships that make them attractive to the limited number of beneficiaries that qualify for them. On the whole, though, these states either have no tax benefits or are tax-parity states. As such, Morningstar analysts believe that investors from these states should use a Morningstar Medalist plan from Table A. Similarly, nonresidents have little reason to consider these plans.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)