Morningstar Names Best 529 College-Savings Plans for 2015

Twenty-nine plans are Morningstar Medalists, and two receive Negative ratings.

Each year, Morningstar evaluates and rates college-savings plans based on five key pillars--Process, People, Parent, Price, and Performance. When rating 529 plans, Morningstar also takes into consideration any unique benefits that plans offer to college savers, including local tax breaks, grants, and scholarships. Morningstar's "Choosing a 529 Investment," available here and summarized in an article tomorrow, covers some of these main considerations.

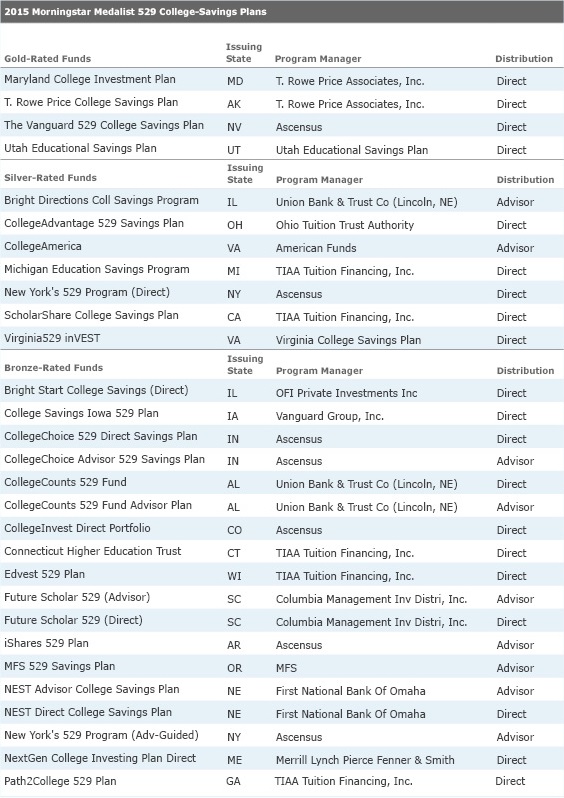

In 2015, Morningstar identified 29 plans expected to outperform peers on a risk-adjusted basis over the long haul, assigning those plans Gold, Silver, and Bronze Morningstar Analyst Ratings. Plans that receive Gold and Silver ratings stand out because of generally attractive investment lineups, well-resourced asset-allocation teams, capable oversight, and competitive fees. Bronze-rated plans also offer compelling features, though Morningstar’s analysts don’t have quite as much conviction that these plans will outpace competitors over time.

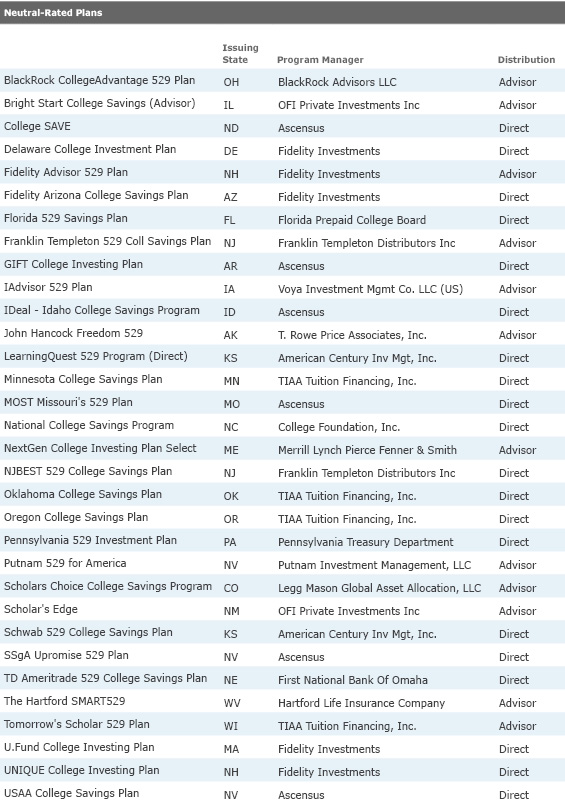

Meanwhile, 32 plans received Neutral ratings, a reflection of the team’s belief that, although these plans likely won’t deliver standout risk-adjusted returns, they are also unlikely to significantly underperform. Some Neutral-rated programs may hold appeal for in-state residents because of meaningful added benefits, such as local tax breaks, so investors should research their state’s particular benefits.

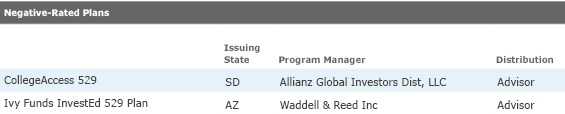

Just two plans earned Negative ratings in 2015. These plans have flaws that will most likely lead to underperformance over long investment horizons.

This year, Morningstar upgraded five plans and downgraded one, compared with five upgrades and 10 downgrades in 2014. In general, the industry continues to take steps in the right direction, with a number of plans cutting fees or improving the quality of their investment lineups.

Gold Medalists

The four Gold-rated plans represent some of the best options available to college savers. Investors who favor active management will find much to like with the Maryland College Investment Plan and Alaska’s T. Rowe Price College Savings Plan. Both enlist T. Rowe Price as the program manager and use highly regarded strategies from the firm. The plans also stand out for their asset-allocation glide paths. Unlike some plans that reduce equities in large, abrupt steps at various ages for the beneficiary, these plans’ age-based tracks gradually reduce their stock stakes each quarter to limit the risk of shifting out of equities shortly after a market sell-off.

College savers looking for low-cost, broad diversification should consider Nevada’s Vanguard 529 College Savings Plan, which uses all passively managed strategies. Although many plans have adopted a similar set of inexpensive Vanguard indexes, this plan has lower fees than most thanks to its economies of scale. With nearly $11 billion in assets, it is the second-largest direct-sold plan in the nation. It has passed along cost savings to investors, who can own the age-based portfolios for just 0.19%.

Gold-rated Utah Educational Savings Plan should particularly appeal to investors who want to build customized portfolios. In addition to its premixed offerings, it also allows account holders to design their own age-based tracks using a wide array of investment options. The plan offers primarily Vanguard index funds and mixes in a few strategies from Dimensional Fund Advisors.

Silver Medalists Four plans carried over their Silver ratings from 2014, including two programs from Virginia. With over $46 billion in assets, advisor-sold CollegeAmerica is more than twice the size of the nation's second-largest 529 plan. Investors in the program can choose from a compelling set of equity and balanced fund options from American Funds. These investments also underpin the plan's age-based and static-allocation portfolios, and the plan has some of the lowest-priced investments in the advisor-sold space. Virginia's direct-sold plan, Virginia529 inVEST, also receives a Silver rating. It uses an assortment of specialty asset classes within its age-based options that aren't always found in direct-sold 529 plans, such as stable value and global REITs. The age-based track blends active and passive management, favoring index strategies in more-efficient asset classes, and uses strategies from a variety of highly regarded firms.

Ohio’s CollegeAdvantage and Michigan Educational Savings Program also retained their Silver ratings. CollegeAdvantage offers investors a breadth options, including three all-index tracks and one age-based track that mixes active and passive management, while Michigan Education Savings Program uses index strategies from program manager TIAA-CREF. Both offer their investment options at low prices.

Morningstar also upgraded three plans to Silver from Bronze in 2015 thanks to various improvements made by the plans. New York's 529 College Savings Program previously omitted foreign equities from the age-based and static allocation options, though it lacked a solid investment-based reason for doing so. It addressed that shortcoming in July 2015, adding international stocks and bonds to the mix. The plan uses all Vanguard index options and remains one of the industry’s cheapest direct-sold programs.

California’s direct-sold ScholarShare reaffirmed its commitment to open architecture over the last year, which helped it to regain its Silver rating. The plan has long stood out for its use of best-in-class active managers regardless of fund company affiliation. However, in 2014, it quickly removed PIMCO Total Return from the lineup following Bill Gross’ departure and replaced it with Neutral-rated TIAA-CREF Bond Plus strategy, calling into question the state’s dedication to open architecture. It’s good to see that, following additional analysis, California elected to more permanently house this sleeve of bond assets with Gold-rated Metropolitan West Total Return Bond.

Lastly, Illinois’ advisor-sold Bright Directions College Savings Plan cut fees significantly in the process of renegotiating a contract with program manager Union Bank and Trust. In addition to lowering program management fees, the plan eliminated its account setup and maintenance fees.

Bronze Medalists While not as attractive as Gold- and Silver-rated plans, programs that receive Bronze Morningstar Analyst Ratings also hold appeal. In some cases, generous tax benefits can boost a plan's rating to Bronze, as is the case with Indiana's direct- and advisor-sold plans. Hoosiers receive a 20% tax credit on contributions of up to $5,000 to the state's plan, which more than offsets some of the plans' high fees.

Morningstar bumped one plan’s rating to Bronze from Neutral in 2015: Maine’s NextGen College Investing Plan Direct has reduced fees in each of the past two years, and a few fixed-income funds used within the age-based track managed by BlackRock recently received upgrades of their Morningstar Analyst Ratings. The plan’s expenses now appear attractive, and it offers Maine residents additional benefits in the form of public and private grants.

Neutral Ratings In 2015, 32 plans received Neutral Morningstar Analyst Ratings, indicating that analysts believe those programs likely won't outperform or underperform their peers by a significant margin. College savers in these plans should expect returns to land near their peer-group norms over the long haul. Investors living in states with Neutral-rated plans without local tax breaks or other benefits should consider looking nationwide at a Gold- or Silver-rated plan.

In 2015, Morningstar upgraded one plan to Neutral from Negative and downgraded another to Neutral from Bronze. Kansas’ direct-sold Schwab 529 College Savings Plan has improved over the past year, garnering it an upgrade to Neutral from Negative. It had long charged hefty fees to investors, but in 2015 it slashed expenses for its passive and active age-based options by about 45% and 25%, respectively. Such fee cuts mark a meaningful commitment to providing better outcomes for investors. Meanwhile, Nevada’s USAA College Savings Plan’s rating fell to Neutral. The plan has a decent, but not standout, manager lineup, and its fees look middling versus competitors. Moreover, Nevada has no state income tax, so its residents have good reason to shop around.

Avoid These Offerings Morningstar assigned two plans Negative Morningstar Analyst Ratings in 2015. Both plans also received Negative ratings in 2014. High fees continue to detract from the appeal at South Dakota's CollegeAccess 529. Although South Dakotans can gain access to the plan for a relatively attractive price, out-of-staters--who make up the majority of the plan's assets--pay significantly higher expenses. Annual account maintenance fees of $20 create a further hurdle to results.

Arizona’s Ivy Funds InvestEd 529 Plan continues to look unattractive, owing largely to concerns about the plan’s oversight. Program manager Waddell & Reed, parent of Ivy Funds, receives a Negative parent rating stemming from concerns regarding the firm’s thin fixed-income resources and recent manager turnover. The state's oversight also fails to inspire confidence. Arizona defers heavily to Waddell & Reed and, unlike many states, has not hired an investment consultant to help monitor the plan. Arizona is a tax parity state, so residents receive a state tax benefit for investing in any state’s 529 plan--there’s no reason for Arizonans to limit themselves to their home state’s offerings.

Analyst Rating Inputs Since 2012, ratings for 529 plans use the same scale as the Morningstar Analyst Rating for mutual funds. Both Analyst Rating methodologies consider the same five factors to arrive at the final rating, though the 529 ratings reflect the quality of the entire plan--not a single investment, as is the case for the fund rating. To arrive at an Analyst Rating for 529 plans, analysts consider:

· Process: Did the plan hire an experienced asset allocator to design a thoughtful, well-diversified glide path for the age-based portfolios? What suite of investment options is offered?

· People: What is Morningstar’s assessment of the underlying money managers’ talent, tenure, and resources?

· Parent: Is the program manager a good caretaker of college savers' capital? Is the state managing the plan professionally?

· Performance: Have the plan’s options earned their keep with solid risk-adjusted returns over relevant time periods? How is the plan expected to perform going forward?

· Price: Are the investment options a good value?

Want to learn more about your plan's strengths and weaknesses? Go beyond the Morningstar Analyst Rating and read detailed analyses of 63 of the largest 529 plans. Click here to try a Premium Membership, free for 14 days.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)