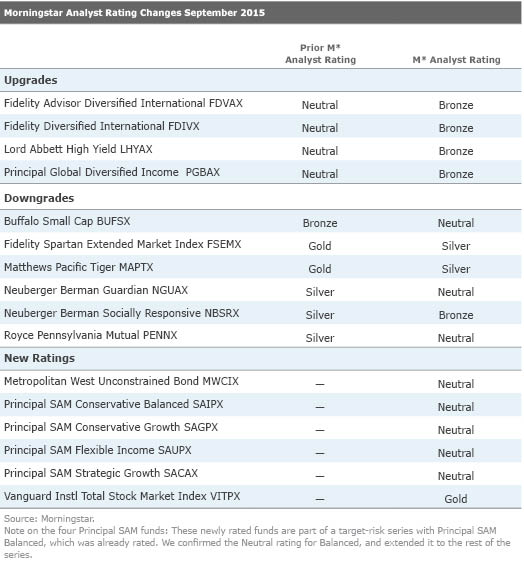

September Ratings Activity Includes 5 New Morningstar Medalists

But there were also six downgrades, including three to Neutral.

Morningstar Manager Research analysts upgraded the Morningstar Analyst Ratings of four funds in September and downgraded six. We also initiated coverage on six funds, including four that are part of the Principal SAM target-risk series. (Those funds are now rated Neutral, in line with the fifth fund in the series,

Upgrades

Downgrades

because of three significant modifications to its management team in less than 18 months. First, Richard Gao went from co-lead manager to comanager in April 2014, and Sharat Shroff became the sole lead. Then, Gao left the team altogether in July 2015 (he will be taking a leave of absence from Matthews later this year). Finally, comanager In-Bok Song left in September. The fund still has a strong management team in Shroff and comanager Rahul Gupta, its strategy remains intact and distinctive, and a relatively low expense ratio gives it a sizable edge. It remains one of the best options in the Pacific/Asia ex-Japan stock Morningstar Category. However, there has been a little too much turnover on this management team in a short period of time, and the fund no longer merits our highest rating.

New Ratings

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)