Morningstar's Take on the Third Quarter

China fears and Fed uncertainty sent markets lower in the third quarter, but stocks still aren't cheap.

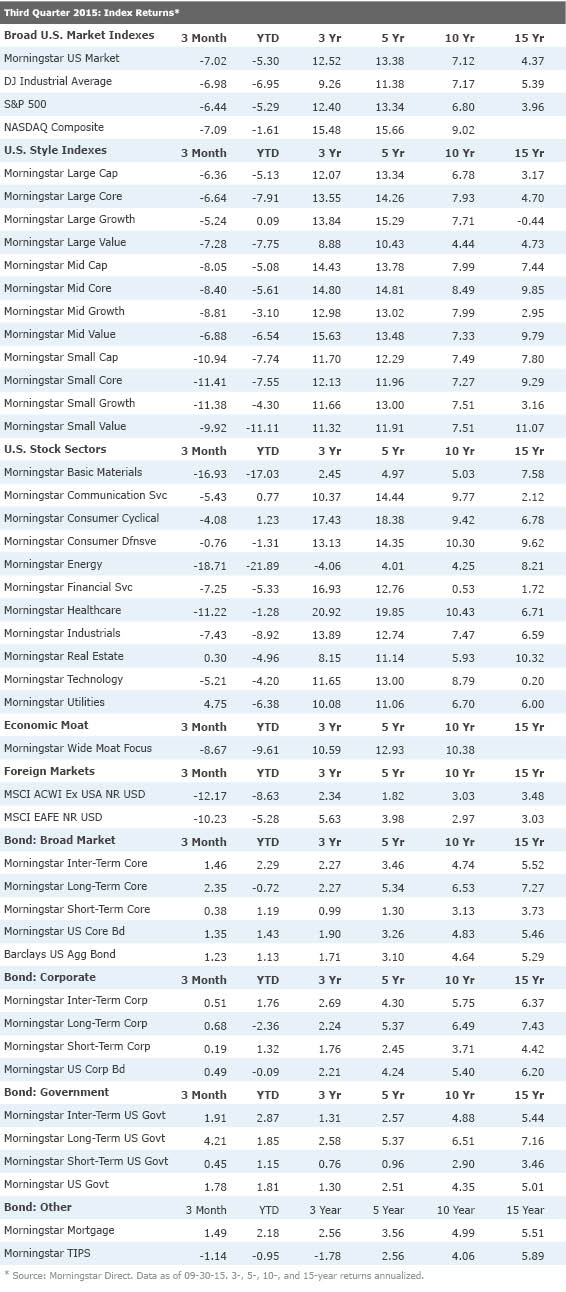

China woes, Fed uncertainty, and sliding commodity prices weighed heavily on global markets in the third quarter. In the last 13 weeks, the broad-based Morningstar U.S. Market Index was down more than 10%. The index is now off more than 7%, year to date, but still up at a nearly 13% annualized rate in the last five years.

The proximate cause of the global-growth worries that were responsible for much of the volatility in the quarter was the worse-than-expected news coming out of China. A surprise devaluation of the yuan in August, which was billed by the Chinese government as an effort to give market forces a bigger role in determining the exchange rate, was viewed by the market as a tool to try to make a slowing industrial sector more competitive. The move threw into focus other data during the quarter that underscored a slowdown in the Chinese factory sector, with data report after report coming in below expectations.

Amidst signs of slowdown in the real economy, Chinese stocks plunged; the Shanghai Composite lost more than 25% of its value in the quarter. The government rolled out a series of extraordinary measures to prop up the stock market, including outright purchase of securities and the halting of trading of several firms. The news from China also had a big impact on the currencies and markets of both developed and developing countries with strong trade relationships with the country.

Commodities prices were also dragged down by the economic slump in China. Morningstar's Matt Coffina noted that China has accounted for "as much as half of global demand for key industrial commodities, such as iron ore, copper, and coal." So, a slowdown there has a profound impact on pricing. Add in rising supply in many markets and you have a recipe for lower prices that could persist for some time.

China was hardly the only source of uncertainty in the quarter; the prospect of the Federal Reserve hiking short-term rates also weighed on investors' minds. For some time, the Fed was signaling that a hike was on the table at the bank's September meeting. In the end, the Fed stood pat, citing concerns about what impact the developments overseas could have on the U.S. Instead of the market cheering low rates, however, shares sold off on fears that the global economy was too weak to support slightly tighter monetary policy. The overwhelming majority of governors still expect the first increase to happen sometime this year.

Against this backdrop, the U.S. economy continued its steady performance as consumer spending held up despite pressure. Bob Johnson, Morningstar's director of economic analysis, thinks this will continue throughout the rest of the year as restaurant sales, autos, and new-home construction remain in recovery mode. He expects full-year GDP growth to be in the 2.2% to 2.6% range. Europe, while not as strong as the U.S., also remains steady, as there are signs that the European Central Bank's stimulus program is having an impact.

On the corporate-news front, merger-and-acquisition activity continued apace in the quarter, despite market volatility. Health care continued to feature prominently with the announcement of two large managed-care mergers (

Sector by Sector Unsurprisingly, given the steep decline in commodities, energy (down 22%) and basic materials (off 21%) were the worst-performing stock sectors in the quarter. Health care (down 15%) was also under pressure in the quarter. The best-performing sectors were ones that are seen as more sensitive to interest rates and could stand to benefit from a slower pace of rate hikes. Utilities (up 2%) was the only sector with a positive return in the quarter. Real Estate (down 3%) and consumer defensive (down 3%) were the next-best performers. Morningstar's Matt Coffina doesn't think this sell-off has created many opportunities, however. He writes, in his quarterly outlook, that although investors may be tempted to see the pullback as a buying opportunity, given the fact that "the S&P 500 was richly valued before this downturn," it's still hard to get excited about the market as a whole. Still, there are some pockets of opportunity in areas such as financial services, railroads, and some media firms.

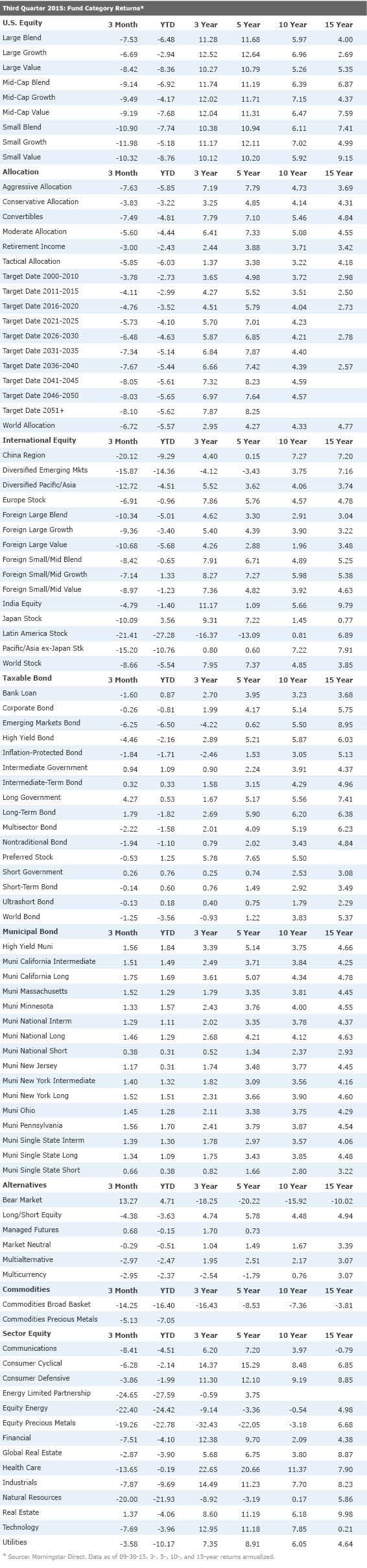

Small-cap open-end mutual funds (down 14%) underperformed mid-cap funds (down 11%) and large-cap funds (down 10%), but not dramatically so. As with stock sectors, the open-end sector funds most directly exposed to commodities prices had the worst performance. Energy limited partnerships (down 29%), energy equity (down 25%), natural resources (off 23%), and equity precious metals (down 22%) brought up the rear in terms of performance. Real estate (down 2%), global real estate (down 6%) and consumer defensive (down 7%) were the best performers in the quarter.

Latin America stock (off 25%) was the worst-performing international-equity open-end fund category, as investors worried about the impact of lower commodities prices. China region (down 22%) was the next-worst performer. India equity (down 8%) and foreign small/mid growth (down 10%) were the best performers.

Yields on the 10-year Treasury started the quarter at 2.43% but fell below 2.05% as the quarter came to a close, as investors looked for a safe haven. The fall in rates helped push up the long-government open-end category (up 6%) in the quarter. Long-term bond (up 3%) and intermediate government (up 1%) were the next-best performers. Emerging-markets bond (down 7%) and high-yield bond (down 5%) lost the most ground.

All data mentioned above as of 9/29/15

Click to see Third Quarter 2015 Index Returns and Fund Category Returns.

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)