PIMCO Total Return: One Year Since the Revolution

Changes to PIMCO Total Return's portfolio are notable but consistent with its history.

In the initial wake of Bill Gross' resignation from PIMCO--less than nine months after CEO and co-CIO Mohamed El-Erian himself decided to leave--the biggest questions revolved around the future of the firm, when and how it would stabilize, and whether it would see an exodus of investment staff. While those questions aren’t entirely settled, there have been some good signs, as outlined most recently by my colleagues in June.

As important to many investors of course has been the stability and future of

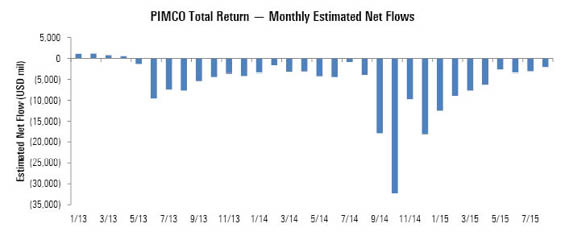

Outflows: Slowing but Persistent Once the largest mutual fund in the world, PIMCO Total Return has since shrunk considerably, recently sliding under the $100 billion mark as combined outflows from Sept. 1, 2014, through August 2015 totaled roughly $124 billion. (Gross left on Sept. 26, 2014, but outflows over the last three days of the month were massive.) Those redemptions have abated some--the $2 billion that left in August 2015 was the lowest monthly figure since Gross resigned--and shouldn't be hard for a firm with PIMCO's significant resources to manage at that level. But the outflows haven't yet stopped, much less reversed. From May through August 2015, they comprised nearly 8% of its assets, while flows out of the overall intermediate-term bond Morningstar Category were a more modest 3.5%.

- source: Morningstar Analysts

Still Looks a Lot Like It Always Has PIMCO Total Return's portfolio certainly looks different from a year ago. However, that's to be expected given the firm's evolving macro view. There's little evidence, meanwhile, that group head Dan Ivascyn (Gross' successor in the CIO role) and this fund's management crew are really doing anything significantly different from what Bill Gross had done while in charge. That's not surprising, given that they were a crucial engine behind his success for so many years. The fund boasts notable large-currency and emerging-markets bonds positions, but it is reassuring that, while there are limitations to all models, stress tests, and expected levels of volatility, PIMCO has demonstrated a knack as good as any for developing useful tools while not overrelying on any of them to be fail-safe.

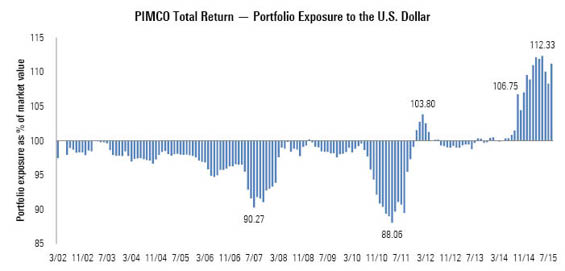

Change Afoot? Money That Makes the World Go Around, Up, and Down The most notable changes in the portfolio's exposures have been adjustments to the fund's currency exposures, which comprised a short position against foreign currencies totaling 11.2% at the end of August 2015. By contrast, until right after Gross' departure at the end of September 2014, the fund's overall currency exposure hadn't deviated by more than 5% in either direction around the dollar since August 2011 and most recently hadn't crossed more than 1.5 percentage points.

For those with a long-enough memory, the specter of that much currency risk in a core bond fund can easily become a source of angst. Currencies can go through long periods of muted volatility, but when they are volatile they can be much more so than bonds. In the early 1990s, for example, the Japanese yen posted rolling three-year standard deviations in the 10% range--already well ahead of most bond indexes--and spiked up to around 16% thanks in large part to an Asian crisis set off in part by the devaluation of the Thai baht in 1998. The euro has had its moments, too, with its trailing volatility briefly hitting similar heights in 2011 around the time that trouble in Greece began to call into question the future of the euro.

Not Really Anything New While the fund's sizable currency positioning is certainly notable relative to many core bond competitors who take little or no currency risk, it is a tool that PIMCO has used and used well in the past. In the past 15 years, a period during which the U.S. dollar mostly weakened until recently, the fund had taken similarly sized currency bets but had gone long (rather than short) non-U.S. dollar currencies. During April 2011, for example, the fund's nondollar currency exposure approached nearly 12%. And yet, those exposures have never historically been enough to cause significant spikes in the portfolio's overall volatility.

- source: Morningstar Analysts

The fund’s foreign-currency shorts (effectively giving the fund a long exposure to the U.S. dollar of an additional 11% above the level of its net assets) hadn’t broken a combined 5% at any time during the previous 12 years. However, group-head Ivascyn and lead PIMCO Total Return skipper Scott Mather make a compelling case that today’s environment is meaningfully different. In particular, they view the long dollar position--and the corresponding short to other currencies--as both a way to capitalize on their expectations of Federal Reserve tightening and a prudent tool to hedge risk. PIMCO believes it is an especially worthwhile effort given the current dispersion in economic growth rates across the globe, combined with expectations for more divergent central bank responses that should ultimately strengthen the U.S. dollar.

It is difficult to argue with that logic once you take into account that the U.S. dollar and U.S. Treasury bonds have become increasingly more attractive safe havens during periods of market instability. That sound reasoning, taken together with clear limits on the sizing of the position, provides a level of comfort. Mather has noted that he and the team wouldn’t want or allow currency bets to contribute more than 25% of the fund’s expected volatility relative to its benchmark, and they’re well below that level today.

De Rigeur Decisions in a Multi-Billion-Dollar Bond Fund They may not instill the angst of currency bets, but the portfolio's other notable shifts and sector allocations readily draw attention, too. By August 2015, the team had cut its net U.S. government-related exposure to 19% from 41% the year prior, a move that coincided with a 32-percentage-point jump in its agency mortgage stake during the same stretch. As usual for PIMCO, there's a lot going on under the waterline, even with a seemingly simple shift. The aforementioned U.S. government exposures include large stakes in both conventional Treasury bonds and Treasury Inflation-Protected securities. Those holdings easily surpass the fund's 19% net exposure to the U.S. government related sector, though, because they're balanced by a sizable short sale of ultrashort instruments, including eurodollar futures that are effectively money market instruments.

Those kinds of moves aren't especially out of character for the fund, though, nor has been its lightening of exposure to non-U.S. bonds hailing from other developed markets to 2.9%, a roughly 10-percentage-point drop over the same stretch. Gross made the same kinds of sector adjustments when he ran the fund, and mostly with the input of the same analyst and supporting manager staff that remains behind running things today.

Similarly, the fund’s relatively large 17.5% exposure to TIPS--which don't appear in the fund's benchmark--doesn't look out of place in this portfolio. That’s a sizable number for a core bond portfolio and roughly 3.5 percentage points higher than its level of a year prior, but PIMCO has built similarly sized TIPS positions in the past and, despite occasional complaints from others in the industry, TIPS remain more liquid than many other sectors and appear to offer particularly compelling valuations right now. PIMCO is convinced, for example, that the Fed is likely to overshoot its 2% target for inflation given its accommodative monetary policies, thereby giving a boost to TIPS that are otherwise priced as if inflation will stay below an annualized rate of 1.5% over the next 10 years.

Emerging-Markets Spice? A little more eye-catching, however, is what appears to be a meaningful increase in the fund's emerging-markets bond exposure. That stake looks to have more than doubled on a market-value basis to 22% as of August 2015, for example, from 10% at August 2014. That's mostly the result of a change in the way that PIMCO has been calculating its statistics since March 2015, though. Prior to that time, very-short-maturity, T-bill-like emerging-markets exposures--such as those from Mexico and Brazil that the firm has recently favored and which bore hedges back to the U.S. dollar--had been bundled together with the fund's cash holdings. The prior scheme was opaque to say the least, so the shift in reporting is a welcome change. But while it will make the statistics more transparent going forward, it also means that figures representing the fund's emerging-markets exposure are likely to whip around quite a bit. That's because PIMCO often shifts among a variety of countries' short-term debt instruments that the firm considers to harbor minimum volatility and which the firm views as relatively safe from a credit perspective.

Nothing Out of the Ordinary Meanwhile, the fund's performance since Gross' departure has been buffeted by the market's turns over the past couple of months but hasn't been extreme. The fund had a particularly strong first quarter during which PIMCO's currency and sector strategies did the heaviest lifting. It has gone back and forth some, at times trailing or besting the Barclays U.S. Aggregate Bond Index and the intermediate-term bond category in what's been an odd year for the bond markets. Along with high yield, however, TIPS took an especially rough beating in August and much of September, and its big exposure to that sector helped pull the fund down to the middle of the category.

It is worth noting that Gross’ intrepid style generally kept the fund's volatility (as measured by standard deviation) above the category average. And although it wasn't a complete departure from the fund's strategy, Gross went strongly against the grain with a few bets that misfired over the past few years. That had the effect of widening the gap between the fund's volatility and the category averages, putting it at the more volatile end of the group.

Gross himself pledged that he wouldn't repeat the kinds of bets that got him into trouble in recent years, though, and his successors aren’t likely to, either. It is still going to be important to keep an eye on those metrics going forward, though, as well as the bets that are driving them.

There are plenty of other things that remain worth monitoring at PIMCO, not the least of which are the functioning and success of its investment committee and the persistence of its outflows, though the latter do seem to be declining. As good of a job as its managers appear to be doing, those are reason enough to maintain the fund’s Morningstar Analyst Rating of Bronze for now. At this point, however, it doesn’t appear that big changes to the firm’s--or PIMCO Total Return’s--methods for day-to-day money management have materialized, despite the occasional eye-catching statistic to the contrary.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)