Fixed-Income Investors: Face the Facts

Current circumstances are a difficult pill to swallow for many bond investors, but that is no reason to offload your ballast, writes Morningstar’s Ben Johnson.

A version of this article was published in the June 2015 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

Financial pundits’ banter about the future direction of interest rates has droned on for years. All of this chatter has caused a great deal of angst amongst investors, many of whom are either saving for or spending their way through retirement and desperately need reliable sources of investment income. Meanwhile, many asset managers have mobilized to capitalize on investors’ fears, launching an array of new products designed to juice yields, mitigate the effects of rising rates, or both. It’s a recipe for bad investor behavior.

The facts facing fixed-income investors today are harsh. Rather than ignore them or try to defy them by investing in some freshly minted cure-all, investors should stand and face them.

Fact 1: Interest Rates Are Low We are in the twilight of a decades-old secular bull market in bonds. As of Sept. 28, the yield on the 10-year U.S. Treasury stood near 2.1%. After accounting for inflation, the real yield on the 10-year Treasury was about 0.3%. Interest rates are historically low. This is bad news for savers.

Low yields equate to low levels of current income.

I estimate that over the next decade the nominal annualized return of

Low yields portend low future returns; manage your expectations accordingly.

Fact 2: Interest Rates Will One Day (Maybe Soon) Head Higher Based on current 30-day federal funds futures prices, market participants are betting that the Federal Reserve will raise the federal-funds rate sometime late this year or early 2016. Of course, this is hardly a done deal. There will be plenty of economic data that will emerge in the coming months that could push back the timing of a rate hike. Also, if and when the Fed raises rates, there is no telling 1) the magnitude of the hike, 2) the timing and magnitude of subsequent increases, or 3) whether the rate hike could send the economy into a lurch and cause the Fed to subsequently reverse course. We are in uncharted waters.

Fact 3: Rising Rates Drive Bond Prices Lower Bond prices have a see-saw relationship with interest rates. As rates go up, prices go down, and vice versa. When rates rise, it will place downward pressure on bond prices. Just how much pressure will chiefly depend on the magnitude of the rate increase and the bond or bond portfolio's duration (holding all else equal, there are other factors to consider, of course). Assuming a 0.25% upward parallel shift of the yield curve, BND, with an average portfolio duration of 5.7 as of the end of August, would see its net asset value decline by approximately 1.4%. A 1% upward parallel shift would cause BND to decline by about 5.6%. These are hardly the catastrophic scenarios that one would imagine based on the prevailing "bondmaggeddon" narrative in the market today.

Facing These Facts, Some Investors Have Been Behaving Badly

These circumstances have been a difficult pill to swallow for a growing class of investors that needs reliable sources of income now more than ever. Rather than take their medicine, many investors are attempting to defy the odds, reaching for yield and piling on risk in the process.

BLK CEO Larry Fink describes this predicament in the firm’s 2014 annual report:

"However, while these actions are keeping borrowing costs low, they are also impacting how investors are saving for the future, forcing them to take increasing risk as core bond allocations are insufficient to meet the growing liability burdens of pension funds, insurers and retirees.

"Yield-starved investors attempting to meet future liabilities are turning to lower-rated credits and longer-duration assets. Not only is this driving prices ever higher in certain asset categories, but it is also contributing to greater portfolio concentration in more volatile areas of the market than historical norms.

"This increasingly desperate search for yield is now the greatest source of prudential risk in the financial system--and one that central bankers and regulators ignore at our collective peril if they hope to truly reduce risk in the system."

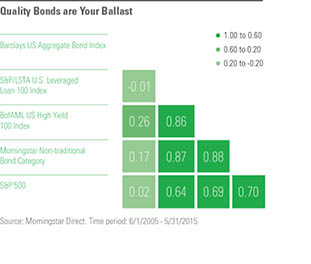

The Fed’s policy has pushed many investors into smaller, more-volatile areas of the market. We’ve witnessed this in the mushrooming of assets in bank-loan, high-yield, and unconstrained-bond funds. In all of these cases, investors looking to protect themselves against one type of risk are simply loading up on another one. In the process, many seem to be forgetting the basic case for owning high-quality bonds in a diversified portfolio.

Don't Forget Why You Own (Quality) Bonds High-quality bonds have a permanent place in an appropriately diversified portfolio, as they serve some of investors' most crucial needs, specifically: capital preservation, diversification, and income generation. In 2013, Bill Gross reminded investors why they own bonds:

"It’s important for investors to remember the reasons they own bonds in the first place--namely for the potential for the preservation of capital, income and growth, relative steadiness and typically low to negative correlations with equities. These needs--which will only become more urgent as millions of baby boomers head to retirement over the next decade and a half--are long term, regardless of what markets are doing today."

As discussed earlier, the expected returns of a diversified portfolio of high-quality bonds today are, to put it lightly, unappealing. That said, bonds still play the role of ballast in a diversified portfolio. Bonds are not stocks: They represent a debt owed to you by the issuer and sit atop a firm’s capital structure. Stocks represent a residual claim on a company’s assets and are at the very bottom of the capital structure. As such, quality bonds are inherently less risky than stocks and act as a good diversifier of equity risk. Rates may change, but this relationship will last.

What’s an Investor to Do?

Don’t offload your ballast. In fact, you should consider topping it up. Just over six years in, the bull market in stocks is growing long in the horns. Let’s assume you are so prescient as to have bottom-ticked the stock market (as represented by

Don’t replace your ballast with something that might only add risk to your portfolio. The chief culprits here are junk bonds, bank loans, and other nontraditional fixed-income strategies. These tend to be highly correlated to equities (see table above), and, as such, they offer little by way of diversification benefits. This is not to say that they absolutely cannot play a bit part in a diversified portfolio, but they are not a suitable substitute for a core allocation to quality bonds.

“It’s not return on my money I’m interested in, it’s return of my money.”–Mark Twain

*This is a rough approximation based on research conducted by M. Leibowitz, S. Homer, and S. Kogelman presented in the 2013 edition of Inside the Yield Book (Bloomberg Press). They demonstrate that the highest level of correlation between beginning yield and subsequent return occurs during a time frame approximately equal to 2 times duration minus one year. BND had an average duration of 5.7 years and a yield to maturity of 2.4% as of Aug. 31. Thus, the expected return for a core U.S. fixed-income portfolio--using BND as a proxy--over the next 10 years is about 2.4%.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)