Economic Outlook: As World Growth Falters, the U.S. Consumer Rolls Along

Given stock market volatility, continued negative headlines out of China, and uncertainty over interest rates, one might rightfully expect consumers to be panicking. They are not.

- China, the U.S. Federal Reserve, and a renewed slump in commodities dominated third-quarter news, pressuring equity returns around the world, especially outside the U.S.

- Despite these pressures, the U.S. consumer continues to hold up well with restaurant sales, auto sales, and new home starts still in recovery mode.

- 2015 U.S. GDP growth could top our long-term 2.0%-2.5% growth target, given a strong consumer, slumping imports, and increased government spending; however, we are sticking with our long-term growth rates as demographics limit long-term growth.

Despite a softening world economy, our economic forecast remains relatively unchanged from our June 2015 forecast. We have upped the 2015 growth by a seemingly small 0.1%; however, we think the higher end of the range is more likely than we would have believed just three months ago.

If someone pinned us down now, we think GDP growth for the full year is likely to come in at 2.5%. That is partially because the second-quarter rebound was better than previously expected. In addition, the data we have seen so far in the third quarter, especially on the consumer side, suggest that annualized sequential growth in the third quarter could be close to 3%.

The consumer has continued to do well, net exports haven't yet proved to be the disaster everyone expected (mainly because imports have done as poorly as exports), and government spending is no longer falling. Housing continues to provide a meaningful contribution to overall GDP growth, too. Business investment spending remains soft as we dwelled on in our last quarterly column.

What Changed in the Third Quarter? Most of the change we saw over the past quarter related to China. The Chinese currency was devalued, and many Chinese economic indicators continued to slow. Many of us at Morningstar have been warning about China for some time. China has showed lower growth rates and missed growth forecasts for several years. It's not new news. Still, the devaluation brought some already well-known weaknesses to the forefront. And as we have long been expecting, a slowing China generally has helped the U.S. economy as the small decrease in exports has been more than offset by lower commodity prices, which puts more money in consumer pockets.

The other big news was that expectations of a Fed rate increase continue to get pushed out in time. At the end of 2014, some speculated that the Fed might take action as early as March 2015. Now in September, a rate increase by December is by no means a done deal. Oddly, the labor market improved more than the Fed expected, and inflation was just a little short of the Fed's plan, yet the Fed still deferred a rate increase at its September meeting. They noted worsening conditions in China that could potentially slow the U.S. GDP growth rate and employment outlook.

As we note above, we are less worried than the Fed about China and wish the Fed had just got on with it and implemented a small rate increase. Now the Fed has sowed doubts and created uncertainty for investors and business people as they openly fret about world growth rates. Uncertainty is the market's worst enemy, and the markets have reacted accordingly. U.S. equity and emerging markets were little changed at the 2015 halfway point. Now, nearing the end of the third quarter, the S&P 500's year-to-date performance looks to be down in the mid-single digits, and emerging markets a more worrisome mid-teens decline.

What We Got Right We have worried a lot about the manufacturing sector because the secret sauce of strong manufacturing growth--namely, goods related to the energy patch--is no longer providing a tailwind. In addition to energy issues, machinery, wood products, and paper continued to weigh on the manufacturing sector. A common theme is a slowing in demand for goods that flow to China as well anything related to the production of commodities. We had been hopeful that manufacturing growth for the full year would remain near its long-term average of 2.5%, but even that appears to be a little too optimistic.

Based on better employment levels, better wage rates, and low gasoline prices, we expected that the consumer would do well. And indeed they have done well and continue to be the major source of GDP growth. However, a higher savings rate suggests that consumers could have spent even more. As lower energy prices become a more permanent fixture in the economic landscape, we suspect that consumers just might open their wallets a little further.

We also started the year with a very optimistic view of the housing industry. But housing began the year on a very bleak note, at least partially due to weather factors. Our original goals for the year looked at risk. However, the spring and summer selling seasons performed better than many expected and brought the market back to the type of growth rates we had anticipated over the past several months. But with some of that catchup now complete, the last few months of the year might not look quite as robust as the stellar performance of the past several months.

What We Got Wrong Our perennial forecasting blind spot has been interest rates, which refused to budge much off of very low levels. A combination of low inflation, world central bank easing, and low demand for money has kept rates lower than we would have expected. While low inflation and central bank easing can't last forever, low demand for loans may be a function of demographics, slow world GDP growth, and a greater emphasis on service-oriented categories (which often demand less capital). That in turn may weigh on interest rates for longer than many of us previously believed.

Although we never pretended to know where energy prices were headed, we were surprised to see energy prices collapse this summer after a spring rebound. We thought suppliers would adjust faster to the glut. They did take an axe to the drilling rig counts, but the few rigs that did drill and existing fields both became miraculously more productive.

At least some of this newfound resourcefulness was due to companies in the oil patch fighting for their lives. The survival instinct at least partially explains recent productivity successes. The supply glut has lowered prices more than we would have thought possible, and most commentators are now expecting energy prices to stay low for several years with hopes of a sustained rebound now thoroughly dashed.

Our labor scarcity/higher wage/lower profits scenario has not unfolded as fast as we had anticipated. However, we can't pick up a paper without finding a new industry reporting a shortage of workers. The shortages include pilots, architects, chefs, and dry-wall installers to mention a few.

But this has not turned into broad-based shortages that push wage rates up. Inflation-adjusted wage increases are still stuck at around 2%. Profits, other than in the oil patch, are holding up pretty well.

I am still confident in our labor-shortage thesis, but it may take a little longer to play out than I thought, and the shortages may not be as broad based as I may have expected.

Our Measures of Consumer Sentiment Continue to Hold Their Own As we have said many times, the consumer is the driver of economic growth in the U.S., constituting almost 70% of GDP. For U.S. economic predictions, understanding the consumer is paramount.

With the stock market off mid-single digits year to date, continued negative headlines out of both China and Greece, and continuing uncertainty at the Fed regarding interest rates, one might rightfully expect consumers to be panicking. They are not, at least not yet, according to our favorite measures of consumer sentiment.

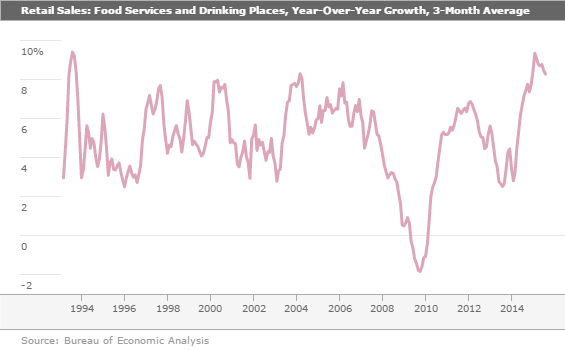

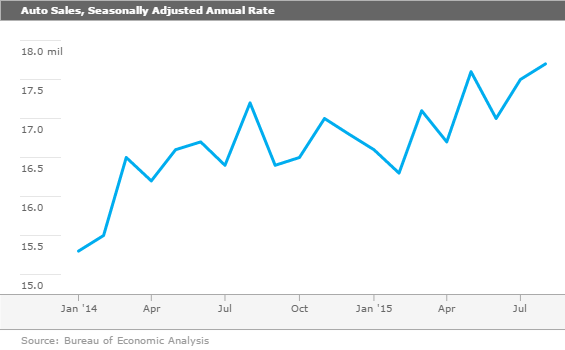

We like to use restaurant sales as a measure of short-term consumer confidence, auto sales as a measure of intermediate-term confidence, and single-family home starts as a measure of long-term confidence. We like to use these measure because the data is available quickly, usually a matter of weeks after month end. Auto sales are available the earliest, in the first week of the following month. This is even better than confidence surveys, which take more time to compile. And those sentiment surveys measure only intentions. Our preferred real spending data is almost in real time.

Restaurant Sales Growth Stabilizing After an Amazing Run Restaurant sales are a small luxury for almost all consumers, unlike autos and housing that have a more limited addressable market. Furthermore, these are expenses that can be dialed up and down in a hurry without a lot of thought. Plus, a lot of lunchtime meals are, in one way or another, related to having a job, so it is a secondary indicator of overall employment conditions.

The news here is excellent, with restaurant sales currently up over 8% year over year. One would have to go way back to the 1990s to find a time of higher restaurant sales growth rates. If someone asks me where consumers are spending their gas money savings, this category would be at the top of my list.

The year-over-year averaged data below shows a slight dip, but certainly not an industry that is falling apart. The month-to-month sequential data, which showed 0.3% growth for three months, accelerated to 0.7% in August. I am not a huge fan of sequential data, but growth acceleration after a pause is a very good sign.

Auto Sales Continue to Surprise on the Upside Auto sales are a very large consumer purchase. The average vehicle price is more than $30,000, so it is not a decision that consumers take lightly. The commitment is large and long term, with some auto loans extending out to seven years. If consumers were worried about their employment or wage outlook, they wouldn't be committing to big auto purchases.

With the help of low interest rates, cheaper gasoline, and better employment data, auto sales in 2015 have done better than almost anyone expected. At the beginning of 2015, most sales focused on the 16.8 to 17.0 million range. It now looks like sales are much more likely to fall in the 17.0 to 17.5 million range for 2015, compared with 16.4 million units in 2014. The unweighted monthly average through August is 17.1 million units, so even the high end of the estimate range looks quite doable.

Although there are some calendar effects that may be helping the number along a little, the ever-rising trend in recent months is hard to deny. It hardly suggests that consumers are feeling any fear.

As a side note, I cautioned earlier in the year that auto sales growth in 2015 was likely to be less than the growth rate in 2014. This no longer appears to be the case. Lower gas prices and huge demand for pickup trucks appear to have breathed new life into motor vehicle sales, which should now top 2014's 5% growth rate.

Housing Starts Continue to Build Requiring even more confidence than buying a car is buying a home. With average new home prices of about $360,000, a home purchase is 10 times bigger than a car and totally dwarfs a $100 restaurant meal. To eliminate the investment aspect of multi-family homes (apartment owners renting out multiple homes or apartments), we focus primarily on new home sales.

Current sales levels, as shown in the far right-hand column, remain near recovery highs. However, they are just off this spring's levels, which benefited from improving weather conditions. So while new home sales have slowed modestly, the year-over-year growth rates remain impressive and hardly indicative of any kind of consumer temper tantrum.

Putting It All Together: China Weighs on Markets, Valuations Modestly More Attractive, U.S. Trudges Forward In reviewing the major sector themes from our research teams, we were shocked at the commonality. China issues, currency, mergers and acquisitions, and, for the first time in years, more attractive valuations dominated almost every sector report. Even our health-care team noted that some of their companies were mentioning China issues. (Skeptical, our health-care team was quick to point out that despite corporate excuses, demand for health-care goods and services is highly dependent on demand from developed markets, not emerging markets.)

Needless to say, that raises the question about whether other companies are hiding behind China excuses, when larger issues such as demographics and slow growth in general may be the real problem. In fairness to large-company, multinational management teams, corporate revenues, profits, and especially growth opportunities are far more reliant on emerging markets than the U.S. economy overall. That's because a lot of goods sold overseas are now made overseas.

We will leave the discussion of valuations to our individual sector teams. However, with the U.S. market down 5% or so in the third quarter, and earnings having generally held up well (with the exception of energy and basic materials), more attractive valuations are not a surprise. The tone of our sector teams toward improved valuations and opportunities was welcome, but I'd note they aren't exactly giddy about valuations--at least not yet.

Sector Performance Relatively Uniform With Just a Few Outliers Stock performance was relatively similar across U.S. sectors this quarter, with most sectors down close to 10%. That said, energy and basic materials, with a renewed slump in commodity prices, did considerably worse in the quarter. Financials also performed a tad worse than the rest, as banks probably need higher interest rates to raise profits, and the Fed didn't provide any help on this front in the third quarter.

Meanwhile consumer staples and utilities were down about half as much as everything else, as investors turned cautious and domestic in their interests. In dollar terms, European, Japanese, and especially emerging markets did much worse than U.S. markets in the third quarter, with declines of 50% to over 100% greater than in the U.S.

U.S. Growth for 2015 Looks Healthy; But Longer-Term Headwinds Weigh Looking forward, the U.S. still appears to be in a decent position relative to the rest of the world, with smaller dependence on world trade than just about anybody else. And a very healthy U.S. consumer doesn't hurt, either.

That's not to say that the U.S. economy will be immune to world problems. While the metrics cited above for the U.S. consumer look quite positive, they aren't accelerating much, and some have looked slightly weaker going into the latest month. And after a brief pause, manufacturing is looking a little softer again, probably related to renewed weakness in oil and commodities.

However, with a lot of data available through the third quarter, the die is cast for a relatively strong 2015, which will likely be one of the strongest years of the recovery. But long-term demographics are likely to keep a long-term lid on growth at 2.0% to 2.5%.

More Quarter-End Insights

- Stock Market Outlook: Minor Correction Not Enough to Make Stocks Cheap

- Credit Markets: Plummeting Commodity Prices Take Their Toll

- Basic Materials: U.S. Construction Activity Provides Shelter From the Storm

- Consumer Cyclical: Near-Term Concerns Over China Create Buying Opportunities

- Consumer Defensive: Upside in Staples Companies With Long-Term Cost-Cutting Opportunities

- Energy: No Rapid Rebound for Oil Prices

- Financial Services: Re-Analyzing Banking Systems and Bank Moats

- Health Care: Recent Pullback Opens Door to More Compelling Valuations

- Industrials: High-Quality Industrials Are on Sale

- Real Estate: For the Strong Stomached, Commercial Real Estate Looking More Attractive

- Tech and Telecom: Still Watching Foreign Exchange Headwinds and the Cloud

- Utilities: Low Rates Keep the Sector's Lovefest Raging

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)