Indexes Can Be Passive, Active Can Be Indexes, but Passive Can’t Be Active

And why you should care.

Indexing: From One to Two Historically, active and index investing have been viewed as binary events. A fund is one or the other. And for some purposes, that simplicity suffices. If we wish to measure the public's dissatisfaction with traditional fund management, then the active/index dichotomy works well. It is fine to place exchange-traded funds and indexed mutual funds into the index group, put all remaining mutual funds into the active group, and calculate the flows.

Although even then, a third set is helpful. There's a difference between indexes that weight securities according to market capitalization, such as Vanguard's offerings or any company's S&P 500 funds, and indexes that incorporate viewpoints. One example of the latter is Research Affiliates' Fundamental indexes, which allocate to companies according to economic attributes rather than stock-market worth. Another would be a low-volatility index that favors an investment sector's less-risky securities.

Companies that sponsor such funds make arguments for their superiority that sound suspiciously active. The suspicion increases with the funds' self-described label: smart beta. Ummm, ... no. That's a name even a fund marketer should be ashamed to use. At Morningstar, smart beta is redubbed strategic beta. By our reckoning, the active/index duo should expand to three: 1) actively managed funds, 2) index funds weighted by market cap, and 3) strategic-beta index funds.

(There is some gray area between the second and third items. Specialized indexes, such as U.S. small value or high-dividend stock, use market-cap schemes but are active in intent; the funds are sold as being better than index funds that invest more broadly. Morningstar currently calls these funds strategic beta, but they could reasonably be categorized as market-cap indexes.)

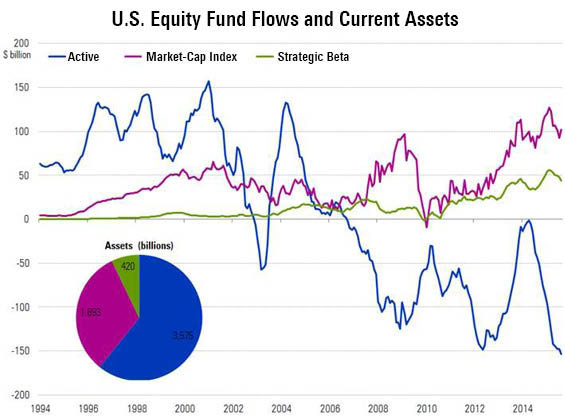

This is what the 20-year U.S. stock-fund flows look like for the three groups, as well as the current assets, shown in the pie chart.

The blue of active management dominated for the first 10 years; the purple of market-cap indexes took control after the 2008 market crash and has never looked back; and the green of strategic beta, the newest member of the troika, is rapidly becoming a major force. The pie chart remains mostly blue--but it's not difficult to envision the time when purple becomes the larger slice. If current trends persist, that will happen within the next decade.

Active: From One to Three Let's switch from discussing active/passive to active/index. Those are not the same things, because passive is not a synonym for indexing. A passive fund is a fund that does not express a viewpoint. An index fund is a fund that mimics a list of securities. Those are two different things. Thus, a strategic-beta fund is an index fund, but it is not a passive fund.

(This formal distinction between passive and index is new at Morningstar, at least from the sense of being consistently applied, so if you look through our materials, you may see the term "passive" used otherwise.)

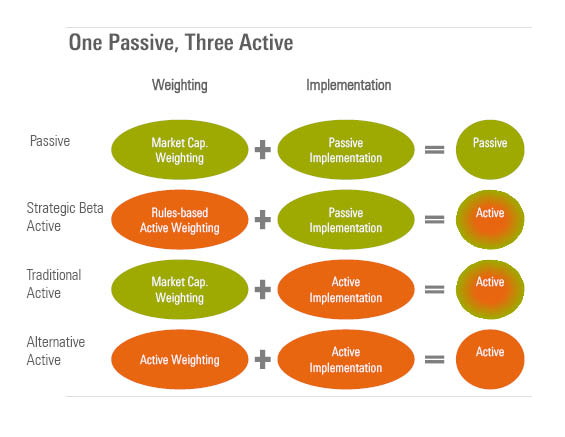

By Morningstar's definitions, there is one flavor of active and two flavors of index (that is, market-cap and strategic-beta) with the active/index classification, but three varieties of active and only one of passive with the active/passive classification. Yes, that sounds confusing. (And it does suggest that the word "active" is being stretched to cover too many meanings.) But a picture, created by Morningstar's Tom Idzorek based on a commentary by Don Phillips, should clarify.

Think of green as meaning neutral and orange as meaning an active attempt at improvement.

Passive funds are green across the board, because they start with the neutral position of weighting by market capitalization, and then implement passively, by copying that weighting without attempting to improve upon it. The other three fund types are either partially or totally orange, meaning that they cannot qualify as passive.

Strategic-beta funds echo passive funds in their implementation, so they score green on that column (and qualify as index funds). However, their weighting schemes are active, as befits a group that touts itself as "smart." Strategic-beta funds are the modern equivalent of the quantitative fund. Popular in the 1970s and 1980s, quantitative funds mined databases in the attempt to pick stocks. Strategic-beta funds similarly mine databases, but to select factors--or betas, as they call them.

Traditional active funds also echo passive funds, but with their weightings rather than in their implementation. Traditional active funds begin with the market's capitalizations. From there, they will deviate based on the managers' decisions, sometimes fairly substantially but often not. Examples of the latter include "closet index" stock funds that ape the market without admitting to the fact; "enhanced-index" funds that explicitly control for industry exposure but give the manager the freedom to pick stocks; and many plain-vanilla bond funds.

Alternative active funds have no green. (They may also end up with a new name; this label is provisional.) They do not begin with a common, market-cap-weighted benchmark, as they either limit their investment universes or mix their assets so as to create unusual starting points. (A fund that invests solely in U.S. small-value stocks is an example of the former--at least provisionally, as Morningstar mulls over this gray area--while a long-short equity fund is one of the latter.) They then implement actively. These funds are pure orange, and they charge accordingly, typically levying the industry's highest management fees.

Summary And now, why you should care. For one, it's nice to speak the same language. Most people have only a vague idea what is intended by the term "smart beta." Morningstar would like to nail that concept down with precision (as well as change the name). If we all write about strategic beta, indexing, passive, and active using the same meanings, we'll have much better conversations. We won't be talking past each other, as so often happens today.

Also, this taxonomy demonstrates that strategic beta substitutes for active management, not passive. Strategic-beta funds cost more than passive index funds and have greater ambition. They are purchased by investors--or recommended by advisors--to do what active managers have traditionally been hired to do, but who no longer are fully entrusted with the task: to add value. Strategic-beta funds will not slip between the lip and the cup, in the sense that they will deliver what they promise. But what they promise is far from a neutral event.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)