A Workaround for High Alternative Fund Fees

This simple trick can help you halve some alternative fund fees.

Long-short equity funds can add useful diversification to an equity portfolio, but the strategy tends to come with a hefty price tag. The average long-short equity fund charges a whopping 1.85% expense ratio. Fees are, and have always been, the enemy of long-term returns, so it’s hard to blame anyone who considers a nearly 2% price tag a nonstarter. But with a little creativity, an investor can get a similar return profile from equity market-neutral funds at a much more appetizing price.

Equity market-neutral mutual funds are often touted as a fixed-income alternative, because of their low-return/low-volatility profile. Certainly, the category’s returns (1.25% annualized over the three-year period ended Aug. 31) and volatility (3.54% annualized standard deviation over the same period) look far more like bonds than stocks. But funds in the market-neutral Morningstar Category are fundamentally equity-based strategies, and with a relatively simple maneuver, it’s possible to transform an equity market-neutral fund into a long-short strategy with about half the fees. But first, a quick refresher on equity market-neutral strategies.

Equity Market-Neutral Explained Equity market-neutral strategies are similar to long-short equity strategies. Both make bets on stocks management thinks will go up (the longs) and on stocks expected to fall (the shorts). The key difference, however, is that equity market-neutral strategies make an equal amount of bets on both sides of the equation, while long-short equity funds tend to have around 50% more long exposure than they do short exposure. By making equal long and short bets, equity market-neutral funds are effectively hedging out most, if not all, of the market risk in the portfolio. Removing the stock market's risk, or beta, from a portfolio means that the fund's returns are going to be driven almost solely by a manager's ability to pick stocks. (The funds usually have a small amount of market exposure with equity market betas around 0.10, which means the fund tends to gain or lose about 10% of the market return plus or minus whatever excess returns the manager can generate through stock-picking.) That's opposed to long-short equity funds, where betas generally range from 0.4 to 0.6, although there can be a great deal of variation, as we covered here. To be included in Morningstar's market-neutral category, a fund must consistently exhibit an equity market beta of less than 0.3.

The Beta Test For most funds, beta is the primary driver of return. After controlling for beta and fees, very few managers generate excess returns, or alpha. Managers who can consistently generate alpha are few and far between. For example, the average long-short equity fund had a negative alpha of 2% (relative to the S&P 500) annualized over the three-year period ended Aug. 31. That suggests the average long-short equity manager detracts value through stock-picking. The market-neutral category average has been slightly better, with annualized alpha of 1.17% over the three-year period. But, since long-short equity carries so much more market exposure and stocks have been in a positive trajectory over the past three years, the long-short equity category average return is 5.83% annualized over the past three years, more than 400 basis points higher than the average market-neutral fund.

If paying for market exposure minus poor stock-picking sounds like a bum deal, you’re not mistaken. The good news is that a skilled manager is skilled regardless of how much beta, or systematic risk, the strategy takes on. With the increased availability of exchange-traded funds today, investors can easily and cheaply buy beta to layer on top of a lower-exposure, alpha-generating strategy and, in the process, lower the overall fees. Let’s take a look at three different examples of how this would work.

Example 1: Vanguard Market Neutral VMNIX

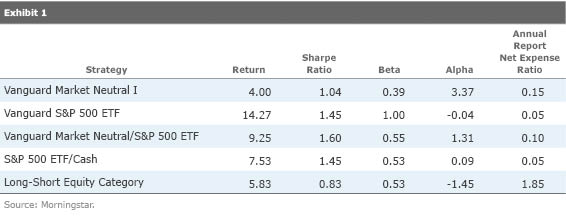

In our first example, we’ll start with a U.S.-focused market-neutral fund,

Over the past three years, combining Vanguard Market Neutral with an S&P 500 ETF would have led to better absolute and risk-adjusted returns than the average long-short equity fund or a do-it-yourself low-beta equity index strategy. Of course, if equity markets had tanked over the trailing three years, then adding beta would have detracted from the market-neutral fund’s returns. But as long as the market-neutral fund was delivering positive alpha, the returns would be an improvement over the comparison investments. Combining the market-neutral fund with a low-cost ETF didn’t have a particularly large impact on expenses in this case, since Vanguard Market Neutral is already the cheapest liquid alternative mutual fund (at 0.15% annually). In our next example, we’ll see a more dramatic impact on price.

Example 2: BlackRock Global Long/Short Equity BDMIX

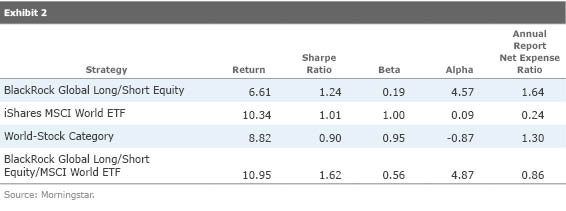

Bronze-rated

This is where the power of low-cost ETFs can come into play. By combining iShares MSCI World, which has an annual report expense ratio of 0.24%, with BlackRock Global Long/Short Equity, which charges 1.64%, the overall fees drop to less than 1%. That’s well below the average world-stock fund, which has an expense ratio of 1.30%. In this example, the lower risk-adjusted returns of the ETF bring down the overall risk-adjusted returns of our combined portfolio, but they are still better than the average long-only world-stock fund.

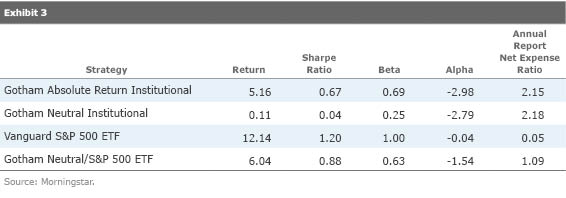

Example 3: Gotham Neutral GONIX

In this example, we’ll take a look at how an investor can use cheap equity market exposure to turn a high-fee market-neutral fund into a low-cost long-short equity fund. Both Neutral-rated

Adding a cheap large-cap ETF to the market-neutral strategy brings the investor’s returns in line with the long-short equity version of the strategy, but with an overall expense ratio that is about half that of the market-neutral fund. Since Gotham’s strategy has struggled this year through the end of August (Gotham Absolute Return was down almost 10%), the addition of the index fund has actually improved risk-adjusted returns and minimized the drag of the negative alpha. That’s why the overall returns of the combined strategy are similar despite having a slightly lower equity market beta. If the strategy’s alpha were positive, the combination strategy would exhibit half the overall alpha, as was the case in Exhibit 1.

Conclusion As our three examples show, it's possible to achieve returns on par with long-short equity funds while slashing fees by combining market-neutral funds with low-cost plain-vanilla ETFs. To be sure, investors still need to exercise the same prudence and due diligence in selecting managers of market-neutral funds for a strategy like this to be effective over the long term. And because there is some hassle involved in rebalancing the two investments, we'd still recommend as a first option identifying those long-short funds that offer competitive fees. In either case, we suggest focusing on managers that have a sound investment process, stable management, and low fees.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)