Credit Markets: Plummeting Commodity Prices Take Their Toll

The combination of falling commodity prices and the continuation of heightened idiosyncratic risk has increased risk aversion, leading to a significant widening in corporate credit spreads.

- Corporate credit spreads widen to multiyear highs.

- Federal Reserve holds off, yet again, on raising the federal funds rate.

- High-yield market still poised to outperform investment-grade market.

- Chinese equity markets falling, despite Beijing's best efforts to halt the slide; emerging-markets fixed-income markets at risk.

Corporate Credit Spreads Widen to Multiyear Highs Between the dramatic decline in commodity prices and the ongoing onslaught of idiosyncratic risk caused by debt-funded strategic mergers and acquisitions and share buybacks, credit spreads have continued to widen out over the third quarter.

In the investment-grade market, the average spread of the Morningstar Corporate Bond Index widened 21 basis points so far this quarter to +174 and has widened a total amount of 34 basis points this year. In the high-yield market, the Bank of America Merrill Lynch High Yield Index has widened 54 basis points this quarter to +554. Earlier this year, spreads in the high-yield market had tightened slightly, but with the recent widening, it has more than offset the earlier gains.

While these spread levels are slightly tighter than their peaks a few weeks ago, credit spreads are still near the widest levels they have registered since mid-2012. At that time, the markets were still recovering from the Greek debt crisis and resulting European bank solvency fears. The current environment is more akin to the recession in the early 2000s after the tech bubble burst.

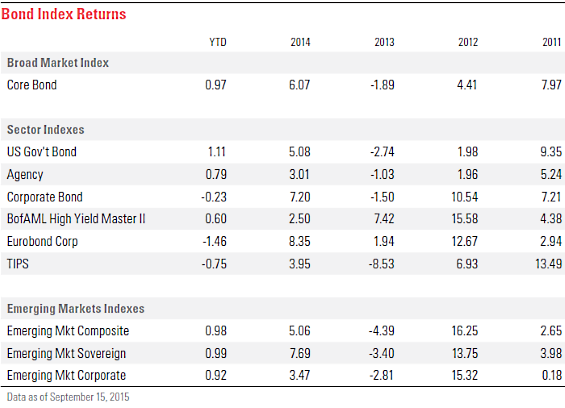

As credit spreads have widened, they have pushed down corporate bond prices to the point that losses on the bonds have overwhelmed the amount of yield carry that investment-grade bonds have earned this year, and in the case of high-yield have severely limited the year-to-date return. Through Sept. 15, the total return of the Morningstar Corporate Bond Index, which is our proxy for the investment-grade corporate bond market, has declined 0.23%, and the total return of the Bank of America Merrill Lynch High Yield Index has risen only 0.60%.

With risk aversion rising in the corporate bond market, many fixed-income investors have turned to the safety of the Treasury bond market. With the demand for Treasury bonds rising, the increase in Treasury bond prices has pushed the yield on long-term Treasuries, such as the 10-year bond, back down from where they ended last quarter to where they began the year. As such, the Morningstar US Government Bond Index has been one of the better-performing indexes this year and based on the yield carry earned thus far this year, has risen 1.11%.

Federal Reserve Holds Off, Yet Again, on Raising the Federal Funds Rate At the September meeting of the Federal Open Market Committee, or FOMC, the committee decided to hold the federal funds rate steady at its targeted range of zero percent to 0.25%. This December will be the seventh anniversary since the zero-interest-rate policy was put in place and a little over eight years since it began the current monetary easing cycle by lowering interest rates. The last time the Fed has begun a monetary policy tightening cycle was in June 2004, over 11 years ago, and the last time it raised the federal funds rate was in June 2006.

The Fed has long averred that its decision to begin raising interest rates and start normalizing monetary policy is "data dependent." Yet many of the Fed's governors have been intimating for much of this year that it was close to tightening monetary policy. Considering that recent U.S. economic data has been neither strong enough, nor weak enough, to indicate that the economy was on a strong, consistent expansionary trend, we thought that this meeting would be especially contentious. However, only one voting member (Jeffrey Lacker of the Federal Reserve Bank of Richmond) dissented on the action, preferring to have raised the federal funds rate by 25 basis points.

Telling of the wide dispersion of economic outlooks among the members, within the dot plots of the economic projections of the Fed's officials, one of the officials (our guess is Narayana Kocherlakota of the Federal Reserve Bank of Minneapolis, who has been particularly dovish) is now projecting that the federal funds rate will be cut to a negative interest rate by the end of this year and held through the end of next year.

The tone of the FOMC's statement was generally positive regarding the economic situation in the U.S. The FOMC opined that economic activity "is expanding at a moderate pace," highlighted that "household spending and business fixed investment have been increasing moderately" and "the housing sector has improved further." The Fed even said that the "labor market indicators show that underutilization of labor resources has diminished."

Inflation continues to run below the FOMC's target, but this is due to low energy prices and imports, which should equalize next year. It seems that the main development holding the FOMC back is economic weakness abroad: "Recent global and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term." In addition, it appears that the data-dependency of the FOMC now includes international fluctuations as it specifically states it "is monitoring developments abroad."

Among the Fed's 2015 projections, it increased its gross domestic product forecast to 2.1% from 1.9%, decreased its unemployment projection to 5.0% from 5.3%, and slightly raised its core personal consumption expenditure, or PCE, inflation to 1.4% from 1.3%. Bob Johnson, Morningstar's director of economic analysis, forecast that full-year 2015 GDP growth in the U.S. will range between 2.2% and 2.6%, and based on his current expectations, he is confident that GDP will most likely print at the high end of his range. Inflation will remain subdued through the rest of this year, but should begin to normalize and rise early in 2016 as the year-over-year comparisons lap when oil prices hit their lows earlier this year. While the core PCE will remain low over the next few months, inflation as measured by the core Consumer Price Index remains at 1.8%, not that far from the Fed's 2% target.

The original intent for the zero-interest-rate policy was to be an emergency measure to support the entire financial system in December 2008 and pump liquidity into the markets when the economy was in a free-fall, and that this policy would be kept in place only during the financial crisis and would normalize soon thereafter. With the credit crisis well behind us, unemployment declining to its long-run central tendency, and positive economic growth ahead of us, we expect this backdrop to be sufficient to encourage the Fed to begin raising short-term rates by the end of this year. Long-term interest rates should also begin to move higher as monetary policy normalizes. Historically, the yield of the 10-year Treasury bond has averaged more than 200 basis points over inflation, and with domestic economic growth expanding, albeit at a low-single-digit pace, the desire for the flight to safety of Treasury bonds should alleviate.

High-Yield Market Still Poised to Outperform Investment-Grade Market In our first-quarter outlook published late last year, we made our case for why we expected the high-yield market to outperform investment-grade in 2015. Our thesis was mainly centered on the greater credit spread afforded in the high-yield sector and its lower sensitivity to losses as interest rates rise.

Our expectation was that GDP growth in the low single digits would keep defaults at bay and that interest rates would rise once monetary policy began to normalize. In this scenario, low defaults allow investors to capture the benefit of wider credit spreads, and rising interest rates lead to greater losses in the investment-grade sector than high-yield.

While the tumultuous volatility in high-yield earlier in the third quarter has eroded some of the outperformance that the high-yield asset class registered over investment-grade earlier in the year, we continue to think that the high-yield asset class will outperform investment-grade for the remainder of the year.

From a technical perspective, the high-yield market has had to contend with a significant amount of outflows during the third quarter, which has weighed on credit spreads. Over the past 11 weeks through Sept. 16, there has been a total of $4.2 billion of funds withdrawn from high-yield open-end mutual funds and exchange-traded funds. Investors cited the uncertainty surrounding the impact of the Chinese devaluation of the renminbi, the decline of commodity prices to multiyear lows, lower-than-expected earnings from global industrial firms, and economic metrics that indicate that the Chinese economy is softening at an accelerating rate. More recently, over the past three weeks, outflows appear to have stabilized as the decline in commodity and oil prices have stabilized, and the wider credit spread has begun to attract investors back to the asset class.

While these investor concerns are pertinent, we maintain that the high-yield asset class should continue to outperform investment-grade for the remainder of this year. Johnson projects full-year 2015 GDP growth of 2.2%-2.6%, and based on his expectations, he is confident that GDP will most likely print at the high end of his range. While the depressed prices of commodities will impair the credit quality of the companies in those sectors, and lead to selected defaults later this year and in early 2016, this level of overall economic growth should be enough to hold down the total default rate, which with credit spreads at heightened levels will in turn support the high-yield market. In addition, much of the jump to default price risk in the energy and metals and mining sectors has been mitigated as the average price of the bonds in those sectors in the high-yield index are already trading below $0.80 on the dollar.

As discussed above, we do expect that long-term rates will gradually rise as the Fed begins to normalize monetary policy. Based on our expectation that default rates will remain low over the near term and interest rates appear poised to head higher, the high-yield sector, with its lower duration and higher credit spread, should outperform the investment-grade sector for the remainder of the year.

Chinese Equity Markets Falling, Despite Beijing's Best Efforts to Halt the Slide; Emerging-Market Fixed-Income Markets at Risk Emerging-market fixed-income indexes still register positive returns year to date, but in the third quarter they gave back some of the gains generated earlier this year. Quarter to date, the Morningstar Emerging Markets Composite Bond Index has declined 1.41%, erasing much of the gain generated earlier this year. Year to date, the Emerging Market Composite Index is now up only 0.98%.

Emerging-market corporate bonds have taken the brunt of the losses as the Morningstar Emerging Market Corporate Bond Index has declined 2.39% in the third quarter and is now up only 0.92% for the year. The Morningstar Emerging Market Sovereign Bond Index has fared better, down only 0.05% for the quarter and up 0.99% year to date.

Last quarter, we highlighted that the bubble in the Chinese stock market appeared to just be beginning to pop and that contagion from declining prices in China would likely ripple throughout the emerging markets. Since then, the Shanghai Index has continued to drop and has fallen over 42% from its peak on June 12. Between lending enormous amounts to brokerage firms to purchase stock, restricting large and government-owned shareholders from selling positions, halting trading in many companies' stocks, and implementing other stimulus measures, the Chinese government has gone to great lengths to halt the slide. However, Chinese officials are getting a lesson in market dynamics: Once an asset bubble pops it is nearly impossible to halt the bleeding until valuations become cheap enough to entice new investors.

In the midst of this correction, the Chinese government further surprised the markets by letting the value of the renminbi decline against the dollar. Over the course of three days in mid-August, the People's Bank of China allowed the renminbi to depreciate by 4.5%. For the renminbi, this was a significant move as the change over these three days was greater than the total amount of change over the course of the prior four years.

Considering that currency devaluations have sparked a number of international financial crises in the past, this move caused considerable concern across all markets. While we do not think this move will cause a crisis, we would be concerned if the renminbi continued such a steep slide, as further devaluation could trigger competitive currency devaluations resulting in destabilizing capital flight.

While the devaluation will help make China's exports slightly cheaper at the margin, we do not think that was the main intent of the devaluation. In our view, the PBoC's intent is to "enhance the market-orientation" of the official fix. This was a first step in allowing the renminbi to move away from its peg with the U.S. dollar and qualify as a special drawing right currency at the International Monetary Fund. We think the goal of the PBoC is to position the renminbi in the international community to begin capturing a greater share of global trade settlements. Consequently, we do not foresee any further step-changes in the valuation of the currency, but expect a slow and steady decline from here.

In addition to the emerging markets in Asia, the economic slowdown in China has affected countries that have a significant export base to the Chinese economy. For example, Japan was recently downgraded by one notch to A+ by Standard & Poor's. Outside of Asia, as one of the largest commodity exporters in the world, Brazil has been disproportionately affected. Brazil has entered a recession as its GDP has slid into negative territory over the past two quarters, and the country's sovereign debt rating was recently downgraded to below investment-grade.

Between declining equity prices and weakening foreign exchange rates, capital has been exiting the emerging markets for the developed markets. As we warned previously, emerging market bonds are notorious for being an extremely volatile asset class in a "risk-off" scenario. For example, in 2013, the Morningstar Emerging Markets Composite Bond Index fell 4.43% as investors looked to repatriate cash during the "taper tantrum," when interest rates rose sharply as the market priced in the end of the Fed's asset purchase program. If our assertion that further devaluations of the renminbi will occur in a slow and steady state is wrong, or if investors believe that it will weaken significantly, then the capital flight out of the emerging markets would pick up pace and lead to further downside volatility.

More Quarter-End Insights

- Stock Market Outlook: Minor Correction Not Enough to Make Stocks Cheap

- Economic Outlook: As World Growth Falters, the U.S. Consumer Rolls Along

- Basic Materials: U.S. Construction Activity Provides Shelter From the Storm

- Consumer Cyclical: Near-Term Concerns Over China Create Buying Opportunities

- Consumer Defensive: Upside in Staples Companies With Long-Term Cost-Cutting Opportunities

- Energy: No Rapid Rebound for Oil Prices

- Financial Services: Re-Analyzing Banking Systems and Bank Moats

- Health Care: Recent Pullback Opens Door to More Compelling Valuations

- Industrials: High-Quality Industrials Are on Sale

- Real Estate: For the Strong Stomached, Commercial Real Estate Looking More Attractive

- Tech and Telecom: Still Watching Foreign Exchange Headwinds and the Cloud

- Utilities: Low Rates Keep the Sector's Lovefest Raging

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)