The Ultimate Stock-Pickers’ Top 10 Dividend Stocks

Top managers' focus on high-quality dividend-paying stocks should limit the negative impact of more volatile global equity markets.

Note: This article is part of Morningstar's November 2015 Income Investing Week special report. This article originally appeared Sept. 15, 2015.

By Greggory Warren | Senior Stock Analyst

The vast majority of our

have never been mistaken for dividend investors, but a handful of them--

As you may recall from our last dividend-themed article, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to hone in on the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of more than 500 different dividend-paying stocks held by our Ultimate Stock-Pickers, and focusing on firms that we think not only have competitive advantages that should allow them to generate the cash flows they'll need to maintain their dividends longer term, but be able to do so with far less uncertainty. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, represent firms with Wide or Narrow economic moats, and have uncertainty ratings of either Low or Medium.

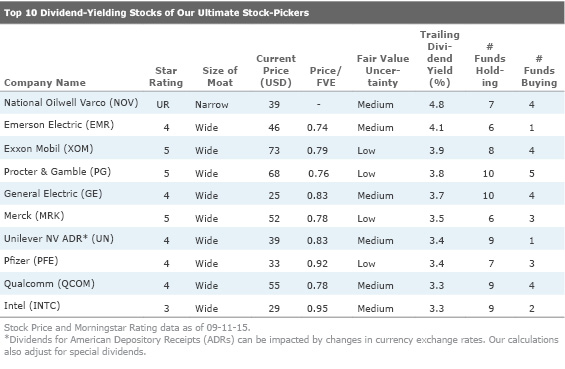

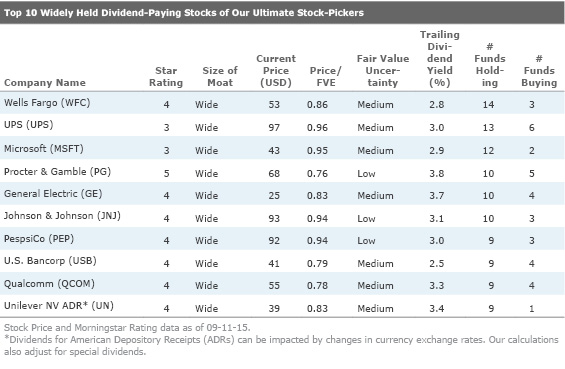

Once this is done, we put together two different tables, one reflecting the top 10 dividend-yielding stocks of our Ultimate Stock-Pickers, and the other representing stocks that are paying dividends in excess of the S&P 500 that are also widely held by our top managers. In our view, finding stocks that are yielding more than the benchmark index, but which operate in more stable industries, where there is less uncertainty surrounding their future cash flows, should offer some downside protection for investors (which seems to be a growing concern these days). We would also note that our dividend yield calculations in each of these tables is based on regular dividends that have been declared over the past 12 months, and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Top 10 Dividend-Yielding Stocks of Our Ultimate Stock-Pickers

While there have been some changes in the list of top 10 dividend-yielding stocks of our Ultimate Stock-Pickers since

, with

this time around. We should also note that National Oilwell Varco, General Electric, Merck and Intel were all new-money purchases for at least one of our top managers during the most recent period.

Looking more closely at the top 10 widely held securities that meet our criteria for dividend paying stocks, which has traditionally had very little overlap with our list of our Ultimate Stock-Pickers' top 10 dividend-yielding stocks, we see a similar level of diversity in the names, with three Consumer Defensive stocks, two names each from the Financial Services, Industrials and Technology sectors, and one Healthcare company included. As Consumer Defensive stocks like Procter & Gamble,

As for Industrials names like

for our Ultimate Stock-Pickers the past six and a half years. We've also seen

Widely Held Dividend-Paying Stocks of Our Ultimate Stock-Pickers

With valuation being a bigger concern for investors right now, we thought it best to try to hone in on the names on both lists that are trading at less than 85% of our analysts' fair value estimates, believing that there might be more value to be had in solid dividend payers offering investors a wider than average margin of safety. We've included a few of our observations below, starting with the three names that showed up on both of our lists:

Procter & Gamble Ticker: PG Current Yield: 3.8% Price/Fair Value: 0.76

Morningstar analyst Erin Lash reconfirmed her $90 per share fair value estimate for wide-moat-rated Procter & Gamble following the company's release of fourth-quarter earnings at the end of July. Despite the company posting only a low-single-digit year-over-year increase in sales, Lash believes that by rationalizing its brand portfolio and focusing on its highest-return opportunities, Procter & Gamble will return revenue growth to a mid-single-digit rate in the coming years. She believes that as the brand portfolio is condensed, Procter & Gamble should become a much more nimble operator in the consumer space, with a more profitable cadre of products in its stable. Combined with ongoing efforts to further slim its cost structure, Lash sees operating margins expanding at Procter & Gamble by up to 350 basis points over the next decade. This should generate more cash flow for the firm to reinvest back into the business and return to shareholders. Lash notes that Procter & Gamble views its dividend as a high priority, demonstrated by 125 consecutive years of dividend payments. She expects the company's annual payout (currently at $2.65 per share) to increase at a mid-to-high-single-digit rate over the next 10 years as margins and cash flow expand.

General Electric Ticker: GE Current Yield: 3.7%| Price/Fair Value: 0.83

Wide-moat rated General Electric, covered by Morningstar analyst Barbara Noverini, continues to remain focused on shrinking its volatile GE Capital segment while focusing on growing its well-established and dominant industrial business. Even after the sale of certain GE Capital assets such as

Unilever Ticker: UN/UL| Current Yield: 3.4% Price/Fair Value: 0.83

Morningstar analyst Erin Lash also covers wide-moat rated Unilever, which she thinks continues to leverage its global scale and brands to deal with increased competitive pressures. While investors seem concerned about the company's heavier exposure to emerging and developing markets, with its shares trading at 83% of Lash's fair value estimate, she notes that Unilever's portfolio of essential household products are more likely to be resilient during periods of economic distress. She believes that Unilever maintains a pulse on local consumer preferences and effectively spends behind its brands. She also notes that the firm continues to streamline its operations, attempting to better scale the company's IT systems, marketing efforts and the bulk purchasing that takes place across the organization. Lash thinks that Unilever’s strong 8% free cash flow yield should provide it with ample cash to distribute in the form of dividends. Absent a major acquisition, she believes the firm is likely to continue to pay out around 50% of annual earnings in the form of dividends, which would imply mid-to-high-single-digit dividend growth during the next decade for the company.

Looking more closely at the other stocks trading at less than 85% of our analysts' fair value estimates, we note the following:

Emerson Electric Ticker: EMR Current Yield: 4.1% Price/Fair Value: 0.74

Morningstar analyst Barbara Noverini also covers wide-moat rated Emerson Electric, which she thinks has developed competitive advantages from three main sources: customer switching costs, intangible assets, and cost advantage. Even with these advantages, markets sometimes work against a firm of Emerson Electric's size, scale and positioning, as near-term pressures from the slowdown in China, as well as in the oil and gas markets, have pressured the firm's revenue and profitability. Believing that it will now take longer for these key end markets to recover than she had originally anticipated, Noverini recently lowered her fair value estimate for Emerson Electric to $62 per share from $65. Even so, the stock continues to trade at 74% of her fair value estimate and yields nearly twice what the S&P 500 is currently offering. The biggest unknown is whether the pressures that have driven sales down the last several quarters will impact the company's ability to continue growing the dividend. Noverini believes that Emerson remains on solid financial footing, with quite a bit of cash on their balance sheet to meet near-term obligations. She also notes that Emerson Electric has historically had little issue passing on dividend increases, even during turbulent periods like the Great Recession.

Merck Ticker: MRK Current Yield: 3.5% Price/Fair Value: 0.78

Morningstar analysts Damien Conover believes that wide-moat rated Merck remains an attractive option within the Healthcare sector, which has typically been a more defensive industry. He notes that the company is past the worst part of its patent cliff, with important new drugs in the pipeline. Merck has seen several new drugs--Januvia for diabetes, Isentress for HIV, and the Gardasil vaccine for human papillomavirus--go on to be key blockbusters the last couple of years. Despite a number of setbacks in cardiovascular drug development, as well as a couple of other fields, Conover sees strong potential for the firm as it pivots toward drug development in areas of unmet medical needs. This is a turnaround for a company that had fairly mixed results with past research and development, having spent heavily on new drug development the past decade. Conover also notes that Merck has been proactive about cutting costs, which should help to keep free cash flows up in coming years. In terms of dividend reliability, Conover believes that Merck’s strong cash flows, as well as its $30 billion cash pile on its balance sheet, should provide ample support for ongoing dividend payouts. Tellingly, Merck made it through the 2008 financial crisis without having to cut its dividend.

Qualcomm Ticker: QCOM Current Yield: 3.3% Price/Fair Value: 0.78

Wide-moat rated Qualcomm remains well positioned to continue attracting substantial licensing income from handsets that rely on access to 3G and 4G networks in the coming years. Morningstar analyst Brian Colello believes that with more 3G- and 4G-capable smartphones hitting the market, and carriers expanding their 3G and 4G wireless networks as a result, that Qualcomm is poised for strong licensing revenue growth the next few years. While he notes that the firm doesn't have the same dominant IP portfolio in 4G technologies like LTE, it has generated more than enough essential patents to enable it to strike new deals with many large handset makers at fairly similar royalty rates. More importantly, he notes that for at least the next decade, the overwhelming majority of 4G handsets will likely be backward-compatible with 3G technologies, allowing the firm collect higher 3G royalty rates. Although most technology companies tend to avoid paying dividends, Qualcomm’s strong and consistent licensing income has allowed the firm to focus distribute around 75% of annual free cash flow to shareholders through dividends and share repurchases, and has been good about raising its dividend in recent years.

U.S. Bancorp Ticker: USB Current Yield: 2.5% Price/Fair Value: 0.79

Wide-moat rated U.S. Bancorp remains a top pick in the Financial Services sector, trading at a more than 20% discount to our $52 per share fair value estimate for the firm. Morningstar analyst Dan Werner believes that U.S. Bancorp is one of the highest-quality banks we cover, deriving its wide economic moat from low credit and funding costs that only help to strengthen the switching cost advantage it has with its retail and commercial customers. He notes that the bank's payments processing and wealth management businesses generate a consistent flow of fees that not only account for more than 40% of annual revenue but have dampened the impact of low interest rates in the post financial crisis market. Werner expects higher interest rates to be a net benefit for U.S. Bancorp as well, given that its balance sheet is asset-sensitive with little pressure to keep funding costs higher, which should lead to net interest margin expansion in a rising interest rate environment that will lift both earnings and returns for the bank. Werner expects U.S. Bancorp to consistently return 60% to 80% of its annual net income to shareholders through buybacks and dividends, with the company's dividend payout ratio at around 30%.

Exxon Mobil Ticker: XOM Current Yield: 3.9% Price/Fair Value: 0.79

Morningstar analyst Allen Good believes that Exxon Mobil has developed a wide economic moat around its operations by integrating a low-cost upstream and downstream business to capture economic rents along the oil and gas value chain. He notes that while the company's peers operate a similar business model with the same goal, they fail to do so as successfully, as evidenced in the lower margins and returns they generate compared with Exxon Mobil. While the drop in oil prices over the last year is expected to continue to stress revenue and profitability in the near term, he expects to see things start to normalize in 2017. That said, an extended period of low oil prices would force Exxon Mobil to increase its debt load in order to avoid reducing share repurchases further (as the company has already trimmed its quarterly share repurchases to $500 million from $1 billion) or slow the growth of its dividend. Despite the poor outlook for returns, Good believes that a combination of higher cash margins and lower capital spending will result in a significant step up in free cash flow by 2018, and that the firm should be able to adequately cover its dividend and repurchase program beyond 2015.

If you're interested in receiving email alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Greggory Warren own no shares of any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)