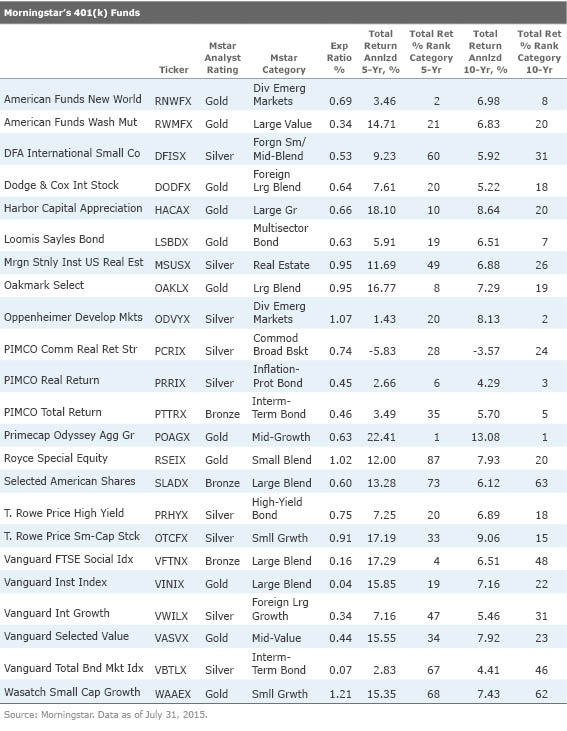

The Funds in Morningstar's 401(k)

It's a plan loaded with good long-term options.

A version of this article was published in the August 2015 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor here.

The funds in Morningstar's 401(k) are chosen for the long haul. Some of our employees may be here 30 years, and they might hold on to their 401(k) for 20 years after that. So, we look for funds that should stand the test of time. In fact, more than half have been in the plan for more than 10 years. Two of them even predate my start date at Morningstar 20 years ago.

We want funds that fit together well, though we do build in some redundancy in order to let employees make their own choices. It isn't designed for employees to own one of everything.

We look for the same things any long-term investor should: stable management, a sound strategy, low expense ratios, and strong stewardship. We also seek out funds that tend to be on the less risky side of their Morningstar Category. Even though a 401(k) is a long-term investment, experience shows that investors in 401(k)s have a hard time making the most of high-risk funds. They buy after the funds have gone up and sell at just the wrong time. And, of course, our 401(k) funds have to be Morningstar Medalists.

You'll notice that our fund selections are cheaper and from a wider array of fund companies than the typical plan. That's because Morningstar accepts most of the administrative costs rather than passing them along to employees. Typically 401(k) providers will charge the company or its employees less if they use funds from the plan provider and/or those funds charge 12b-1 fees that the provider collects as payment. So, we have some institutional funds you might not have access to, as well as some funds closed to new investors. However, many have near-equivalents that you can buy instead. I will list replacement suggestions if there is a close substitute.

I haven't listed any target-date funds. We have customized target-date funds designed specifically for Morningstar employees by Ibbotson Associates, which is part of the Morningstar Investment Management group. They also provide an individualized service that chooses funds for the lineup based on each individual's situation because, even for people at Morningstar, a 23-fund lineup can be daunting.

So, let's take a look:

American Funds New World RNWFX

This is a fund designed to make emerging markets more palatable to the average fund investor. It regularly has half emerging-markets equities and half developed-markets stocks. The premise is that the source of revenues matters more than the location of the stock exchange listing. Thus, the fund will buy companies domiciled in developed markets that still derive much of their business from emerging markets. It makes sense to me, and you get the added benefit of greater rule of law in most developed markets. The fund owns some companies from both groups as well as some emerging-markets debt. The effect mutes some of the extremes of emerging markets, and that makes it a very user-friendly fund. But perhaps more important is that American has great managers and analysts, and it charges just 0.69% for the R5 shares. The retail A shares' ticker is NEWFX.

American Funds Washington Mutual RWMFX

The fund has some strict rules to follow. It aims to beat the S&P 500's dividend yield, and 90% of the companies it owns must come from the S&P 500. All companies must meet the listing requirements of the New York Stock Exchange. It can't invest in companies deriving the majority of their revenues from tobacco or alcohol. The end result is a solid if unexciting portfolio of dividend-paying value stocks that has produced consistently solid returns. The fund is in the top quartile for the trailing five- and 10-year periods. The retail A shares' ticker is AWSHX.

DFA International Small Company DFISX

There aren't a lot of foreign small/mid-cap funds that are attractive and still open to new investors. With two large-cap foreign funds, we wanted a good diversifier that was predominantly small cap. This fund has one of the lower market caps and one of the lower expense ratios among the Medalists, so it was a natural choice. DFA runs a passive strategy that doesn't track an index. By doing this, it can secure better prices on stocks for shareholders. It can step in to buy when there's an eager seller and sell when there's an eager buyer. The fund still behaves like an index fund, only that trading flexibility helps it perform a little better.

Dodge & Cox International Stock DODFX

I'm glad the firm closed this fund to new investors as it's topping out at $70 billion these days. The strategy is a straightforward value process that leads management to buy good companies with falling valuations. What makes this a winner, though, is the depth of management and analysts. Many make a whole career of their time at Dodge, and thus their long-term interests are aligned with shareholders'. The fund also charges a very reasonable fee. The closest open equivalent is

Harbor Capital Appreciation HACAX

Jennison Associates may not be quite Dodge & Cox, but the experience and depth at this growth fund are still impressive. Although Sig Segalas is old enough to retire should he choose to do so, he has the support of comanagers Kathleen McCarragher plus three more comanagers with an average tenure of 25 years. The 11 analysts have an average tenure of 11 years. This is a growth fund that tends to do well in market rallies. With names like

Loomis Sayles Bond LSBDX

Dan Fuss isn't shy about taking on credit or currency risk, but he is quite savvy about finding good values before doing so. It's a wide-ranging fund that goes into high-yield and foreign-currency debt whenever it sees attractive bonds. As with Harbor, this is also a fund where a transition may be near. Fuss is also past the standard retirement age, but comanagers Matthew Eagan and Elaine Stokes are skilled investors who give us confidence that this fund will be worth owning even after Fuss retires. The fund has the support of a 40-member credit team as well as other groups at the firm. The Retail share class has the ticker LSBRX.

Morgan Stanley Institutional U.S. Real Estate MSUSX

Ted Bigman has run this fund since it was launched 20 years ago. He runs a somewhat cautious strategy that holds up well in downturns while still outperforming its peer group. Unfortunately, this fund is difficult for individual investors to gain access to outside of a 401(k).

Oakmark Select OAKLX

This fund is coming up on its 19th anniversary, and it has been in Morningstar's 401(k) for about 15 of those years. Bill Nygren is a big believer in the importance of good management, though he also wants to buy in at a modest price. He's done a remarkable job over 18 years. He said that he has shifted his views on closing the fund a bit, so that he now thinks it's better to keep a fund open and attract modest inflows than to close a fund. However, he acknowledges that a focused fund like this one does have some capacity limits.

Oppenheimer Developing Markets ODVYX

For those who prefer a pure emerging-markets play, our plan has Justin Leverenz's closed fund. Leverenz focuses on stock selection and pays little heed to benchmark sector and country weightings. Since taking over in 2007, Leverenz has more than doubled the returns of benchmark and peers alike.

PIMCO Commodity Real Return Strategy PCRIX

If inflation ever does come back, you'll be glad you owned this fund to offset bond losses. Until then, though, you'll probably regret it. The fund owns exposure to a broad array of commodities and throws in some inflation-protected securities to boot, so you have two forms of inflation protection. On the downside, this fund and nearly all of its competitors are in the red for the past five years as inflation has been tamer than tame. One can gain access to this fund through D shares PCRDX, or there is a near-clone in the form of

PIMCO Real Return PRRIX

Although PIMCO has had a shakeup, manager Mihir Worah has been at this fund since 2007, and he's done a fine job. He looks for the best inflation-protected securities out there among Treasury and non-Treasury issuers. The fund has done quite well over time, too. This fund has D shares PRRDX and also a near-clone in the form of

PIMCO Total Return PTTRX

This fund is in good hands despite all the drama around Bill Gross' exit. It's run by Scott Mather, Mihir Worah, and Mark Kiesel. All three are proven managers with strong track records. The fund has outperformed its benchmark and peers modestly since Gross left. More important, a tidal wave of outflows hasn't interfered with the smooth running of the fund, and we expect good things in the future. This fund has D shares PTTDX and a near-clone in the form of

Primecap Odyssey Aggressive Growth POAGX

This closed fund has been downright remarkable since it was launched in 2004. Managers Theo Kolokotrones and Joel Fried along with the rest of the team have done a brilliant job of finding great biotech and tech names at reasonable prices and holding on until they trade at unreasonable prices. The closest open substitute would be the large-cap

Royce Special Equity RSEIX

Charlie Dreifus is one of the best and most original value investors out there. A disciple of accounting guru Abe Briloff, Dreifus puts a company's earnings and balance sheet under the microscope to ferret out corner-cutting and even outright fraud. It's a good fund to own when bad news starts spreading on Wall Street. This fund is closed, but Dreifus runs an excellent all-cap fund called Royce Special Equity Multi-Cap Service RSEMX.

Selected American Shares SLADX

Can Chris Davis right the ship here? In 2014, Davis changed comanagers when he replaced Ken Feinberg with Danton Goei. The two have trimmed the portfolio a bit while adding health-care and tech stocks. Otherwise, the fund still runs a Warren Buffett-influenced strategy of looking for good companies trading below their estimate of "owner earnings." The fees and stewardship are strong here. Performance is strong over Davis' entire tenure, but the fund has been in a prolonged slump.

T. Rowe Price High Yield PRHYX

Mark Vaselkiv has been at the helm for 19 years, and he's done a remarkable job. He focuses on issue selection, and in high yield that's a very hands-on process because you have to dig deep to understand the likelihood that a company will default on its debt. The fund has posted top-quartile returns for the trailing five-, 10-, and 15-year periods. Like many of the best high-yield funds, however, it's closed to new investors.

T. Rowe Price Small-Cap Stock OTCFX

This $9 billion closed fund is a bit of a dullard, but that's a good thing in a 401(k). In his 22nd year at the fund, Greg McCrickard has a diffuse 300-stock portfolio with no more than 2% of assets in the top name. The fund has provided a nice smooth ride for investors, and its strong relative performances in down markets make it a welcome holding in the worst of times.

Vanguard FTSE Social Index VFTNX

Performance has improved at this fund since it switched to the FTSE4Good US Select Index in December 2005. The fund has beaten its average peer while lagging the S&P 500 by a modest amount. The fund charges a mere 0.16%, so it's a pretty good bet.

Vanguard Institutional Index VINIX

This is the institutional version of

Vanguard International Growth VWILX

Steady rather than exciting, this fund makes a fine core holding. Vanguard divvies assets among three subadvisors: Baillie Gifford, Schroder, and M&G Investment. That means you get a blend of three different growth strategies. For the most part that smooths out performance, though they tend to all favor emerging markets, so the fund's short-term performance relative to peers can often be chalked up to how emerging markets do versus developed foreign markets. With a fee of just 0.34%, the fund shows you don't need to pay up for foreign exposure.

Vanguard Selected Value VASVX

Vanguard's active funds are pretty cheap, too. This one charges just 0.41% for the services of three solid value managers. It's run by Barrow Hanley, Donald Smith & Co., and Pzena, each of whom has a slightly different value strategy. The fund has top-quartile returns over the trailing 10- and 15-year periods.

Vanguard Total Bond Market Index VBTLX

Along with PIMCO Total Return, this fund makes two funds in the intermediate-bond category. Why two? The index is heavily weighted to U.S. government securities, whereas PIMCO Total Return invests in government bonds as well as high-yield, foreign debt, and currency plays. Thus, we provide two very different paths for employees to select.

Wasatch Small Cap Growth WAAEX

Jeff Cardon has the longest tenure of any of the managers in our 401(k). He's been running this closed fund since 1986. He uses the same flexible small-cap-growth strategy that he's used all along. However, over the years Wasatch has built up its analyst staff so that he receives more support than he did early on.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)