Tax-Deferred Retirement-Bucket Portfolios for Fidelity Investors

These portfolios are composed exclusively of funds on offer from the Boston giant.

Many investors would prefer to deal with as few investment providers as possible. Of course, most of the big providers allow investors to buy funds from other firms on their platforms without paying any additional transaction fees, but those No Transaction Fee fund menus don’t include everything. A Vanguard investor will pay a transaction fee to buy a Fidelity fund, for example, and T. Rowe Price investors will have to pay transaction fees to buy Vanguard funds on the T. Rowe platform.

In recognition of the fact that some investors would prefer to do business with a single fund family and stick with the “house brand” of mutual funds, I’ve created fund-family-specific model portfolios. These portfolios—geared toward retirees with varying time horizons/life expectancies—are best for investors in tax-deferred accounts such as IRAs. These tax-deferred “bucket” portfolios are geared toward retirees who are actively drawing their cash flow needs from their portfolios and consist exclusively of Fidelity funds.

About the Portfolios

These portfolios employ a Bucket strategy, pioneered by financial-planning guru Harold Evensky. The central premise is that the retiree holds a cash bucket (Bucket 1) alongside his or her long-term assets, both stocks and bonds. If the long-term components of the portfolio, especially stocks, hit a rough patch, the cash bucket ensures that the retiree has enough liquid assets to use for living expenses. Bucket 2 covers another eight years’ worth of cash flow needs. It’s designed to deliver slightly more income than Bucket 1, as well as a dash of inflation protection and capital appreciation; thus, it consists mainly of high-quality short- and intermediate-term bonds. Bucket 3 is the growth engine of each of the portfolios, geared toward years 11 and beyond of retirement.

The portfolios are designed to be strategic—that is, they’re meant to be bought, held, and rebalanced—rather than tactical. I’ll make changes only when there’s a meaningful negative development in one of our holdings, or if another investment that I like better becomes available. In short, I expect to make very few changes to these portfolios over time, because many retirees don’t want to have to make frequent trades in their portfolios, either.

How to Use Them

The goal of the portfolios isn’t to outperform every other retirement portfolio or strategy ever devised. Rather, the objective is to illustrate sound portfolio-construction and cash-flow-generation principles. Nor do retirees need to completely upend their portfolios in order to implement a similar bucket strategy. Assuming they have solid core building blocks—both stock and bond holdings—they have most of the raw ingredients needed for a Bucket portfolio.

Investors should take care to customize their portfolios to suit their own situations—risk tolerance and capacity, of course, but also planned spending. An investor’s own cash bucket, and in turn the allocations to the other two buckets, will depend on his or her portfolio spending rate. If an investor is using a lower starting withdrawal rate—say, 3% in the first years of retirement—Bucket 1 would accordingly be smaller (6% versus 8% in my Aggressive portfolio).

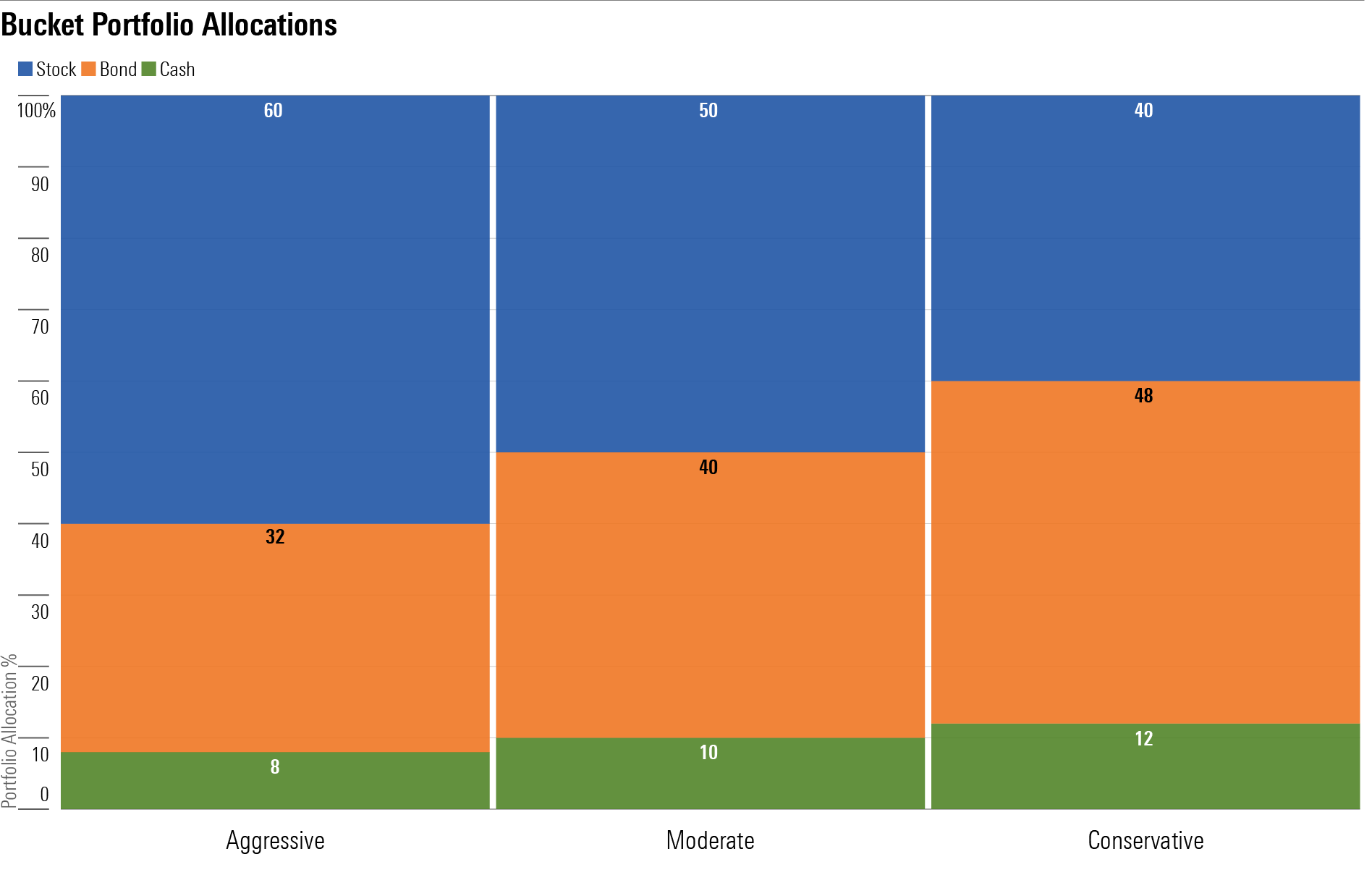

Bucket Portfolio Allocations

Aggressive Tax-Deferred Retirement-Bucket Portfolio for Fidelity Investors

Anticipated Time Horizon in Retirement: 25-plus years

Risk Tolerance/Capacity: High

Target Stock/Bond/Cash Mix: 60/32/8

Bucket 1: Years 1-2

- 8%: Cash

Bucket 2: Years 3-10

- 8%: Fidelity Short-Term Bond FSHBX

- 7%: Fidelity Inflation-Protected Bond Index FIPDX

- 10%: Fidelity Total Bond FTBFX

- 7%: Fidelity Strategic Income FADMX

Bucket 3: Years 11 and Beyond

- 25%: Fidelity Large Cap Stock FLCSX

- 15%: Fidelity Total Market Index FSKAX

- 20%: Fidelity International Discovery FIGRX

Moderate Tax-Deferred Retirement-Bucket Portfolio for Fidelity Investors

Anticipated Time Horizon in Retirement: 15-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond/Cash Mix: 50/40/10

Bucket 1: Years 1-2

- 10%: Cash

Bucket 2: Years 3-10

- 10%: Fidelity Short-Term Bond FSHBX

- 10%: Fidelity Inflation-Protected Bond Index FIPDX

- 12%: Fidelity Total Bond FTBFX

- 8%: Fidelity Strategic Income FADMX

Bucket 3: Years 11 and Beyond

- 25%: Fidelity Large Cap Stock FLCSX

- 10%: Fidelity Total Market Index FSKAX

- 15%: Fidelity International Discovery FIGRX

Conservative Tax-Deferred Retirement-Bucket Portfolio for Fidelity Investors

Anticipated Time Horizon in Retirement: Less than 15 years

Risk Tolerance/Capacity: Low

Target Stock/Bond/Cash Mix: 40/48/12

Bucket 1: Years 1-2

- 12%: Cash

Bucket 2: Years 3-10

- 10%: Fidelity Short-Term Bond FSHBX

- 10%: Fidelity Inflation-Protected Bond Index FIPDX

- 20%: Fidelity Total Bond FTBFX

- 8%: Fidelity Strategic Income FADMX

Bucket 3: Years 11 and Beyond

- 20%: Fidelity Large Cap Stock FLCSX

- 8%: Fidelity Total Market Index FSKAX

- 12%: Fidelity International Discovery FIGRX

A version of this article was published on Sept. 5, 2018.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)