Swatch’s Long-Run Advantages Remain

China Volatility and the strong franc are worries, but the Apple threat is distant as new product demand suggests rekindled interest in Swiss watches.

The Swiss franc’s strength versus multiple world currencies, as well as political and economic issues in Hong Kong and China, continues to weigh on

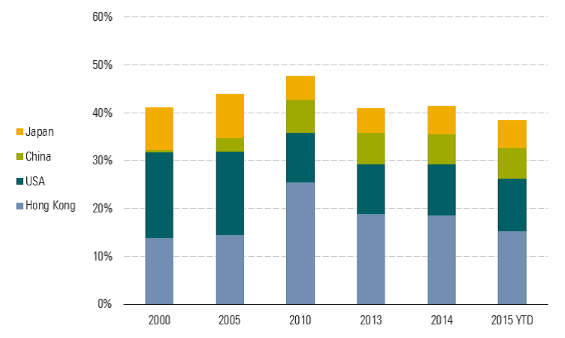

For more than a decade, Hong Kong has served as both an import gateway and a warehousing hub for the watch industry, in part due to low taxes, which can be significant when purchasing high-value goods such as a Swiss watch. As the luxury industry focused on tourist centers such as Hong Kong—and to a lesser extent Macau—the selection of goods and the number of vendors quickly increased. In the watch business, Hong Kong accounted for only 14% of the Swiss export market in 2000, but grew to 26% in 2010, while mainland China went from almost zero to 7% over the same period (see below). Year to date in 2015, retailers, wholesalers, and luxury tourists have continued to stay away from Hong Kong, or have cut high-end purchases there, reducing sales in the largest market for Swiss watch exports by value. We believe that both the current attractiveness of prices in Europe and the price changes (up and down) at many luxury brands are affecting purchase decisions. Over time, we expect sales to Hong Kong to normalize with exchange rates and price differentials.

- source: Swiss Watch Federation export data

Several luxury companies have noted that sales in mainland China have shown positive growth—Swatch disclosed its Swatch brand is positive—but Hong Kong and Macau are dragging down the Pacific region. While both areas have suffered a drop in tourist flows in 2015, Hong Kong’s number of visitors from China has slowed considerably but is still positive year to date, while Macau's has gone negative. In addition government scrutiny affecting both cities and China, we believe Hong Kong has an image problem—political tensions, and prices that are suddenly less attractive because of exchange rate volatility. We believe Macau’s issue is based more on the Chinese government’s antiextravagance campaign, although the price mix issue seems to be spread across China. Swatch management has noted that its midrange brands are selling better in Macau as more middle-class Chinese customers visit the city. We believe this supports our view that Swiss watches are still highly desired in Asia, and we think that the negative impact of the anticorruption campaigns by the Chinese government will continue to shift demand elsewhere. Ultimately, we do not think investors should conclude from the weakness in Hong Kong and Macau that Swiss watches have lost appeal.

Swiss Watch Export Data Showing Impact of Hong Kong Drop, but Gains in Europe The Swiss Watch Federation's year-to-date export figures show the impact of Hong Kong on the total Swiss watch industry. Export data suggest that although the U.S. has been strong, sales will be shifting elsewhere this summer as the tourist countries in Europe have accelerated over the past few months. On a growth percentage basis, Europe, including the weaker economies, appears to be attracting a greater percentage of Swiss watch exports, suggesting to us that tourist flows and Swiss watch sales are still very dynamic. We view these data as evidence that the long-run demand for Swiss watches is still solid.

Luxury Goods Companies Find Difficulties Changing Prices in the Short Run While multiple luxury companies have attempted to rectify global luxury product pricing imbalances caused by exchange rates, price changes can lead to a distortion of behaviors because of incentives for retail and wholesale buyers. In regions such as Europe and Eastern Europe, where various price increases have been taken (but not at the full pace and volatility of the euro/franc exchange rates), products have at times been cheaper in Paris than in London, or vice versa, and now are particularly cheap in Europe versus China. New York is again becoming expensive with the rise of the dollar, for example, and traveling luxury buyers who often visit multiple cities have become more adept at shifting purchases based on where prices in the traveler's home currency seem the most advantageous. We point out that most Asian and Chinese tourists' currencies are pegged to the dollar, or are dollar-related, so dollar strength influences the effective discount in Europe rather than effectively creating a price premium in the U.S. for a majority of luxury tourists. We believe these imbalances will normalize over time with stable exchange rates.

Swiss Watches Enjoy a Price Premium, but Sellers Can't Raise Prices Indiscriminately We believe that the Swiss watch industry does enjoy pricing power given that its products sell for more than double the price of non-Swiss competitors, but if prices rise or seem too high consumers may delay purchasing a Swiss timepiece despite its prestige. The problem is worse if the price rise appears temporary or if prices decline because savings could be had by waiting. Swatch Group has said that it has raised prices by 5%-10% in Europe, but also commented that the price increases are on a case-by-case basis, decided brand by brand and country by country. Swatch has also increased component prices in Switzerland by roughly 10%.

Apple Watch Hype Fades; but Long-run Growth in Wearables Likely Positive for Swatch On the eve of the launch of the Apple Watch, a number of observers made bold predictions foretelling trouble for the Swiss watch industry. Now, as the first round of Apple Watches is in the market, we have become even more convinced that the whole watch category will benefit from the interest in wrist-based technologies. We haven't been been overly worried by the current state of the Apple Watch product as a competitor to Swiss luxury watches, many tech analysts, including Morningstar's own Brian Colello, have pointed out that Apple has had some slow starts to new products in the past.

Investing in Capacity for Sistem51 Is an Indicator of Positive Demand We believe press reports that Swatch plans to build a second automated production line for the Sistem51 are valid, although management would not confirm this. To us, this indicates both that demand is solid and that production difficulties in the full automation of the assembly process are now being put to rest. Although we believe initial quantities were limited and production volumes are not disclosed, we estimate that each line should be producing roughly 2 million units per year when fully operational, which could still be more than a year away. Since almost all the Sistem51 product will be sold in Swatch-owned boutiques, at an average selling price of CHF 150 or $150, we estimate a best case of only an additional CHF 300 million in sales in 2017. We do believe that some percentage of total Sistem51 sales (possibly more than 50%) would not be incremental to total Swatch Group sales, as the customer may be attracted to the Sistem51 at the expense of foregoing a purchase of a quartz movement Swatch brand watch. Given that each CHF 100 million in sales would represent roughly just over 1% of total revenue (CHF 9.2 billion gross sales in 2014), the Sistem51 is having an impact but in the current years it is still relatively small.

However, we believe that introducing a new generation of mechanical watches and incorporating an automated production mechanical movement to both the Swatch brand and to the mechanical watch segment are very important to the future and vibrancy of the Swiss watch industry.

Swiss Franc's Impact Should Soften Over Time Although Swatch Group has both the manufacturing of components and movements and its watch assembly in Switzerland, the company's trade-weighted exposure of both revenue and (to a lesser extent) costs has moved increasingly toward the U.S. dollar and related currencies in recent years. In addition, the shift to greater owned retail penetration and the acquisition of Harry Winston have increased the percentage of total overhead costs related to the U.S. dollar, while the high cost of the Swiss franc has caused tourists to prefer to shift an increasing proportion of sales to regions where the exchange rates are more favorable (currently Europe). According to preliminary financial figures from the first half of 2015, Swatch's European sales were up nearly 20% in local currency, but off slightly when measured in the highly valued Swiss franc.

Shift to Retail Supports Revenue and Profit Growth; Retail Sales Still Below Industry Averages Swatch Group management has said that although it is cautious when signing leases and analyzing returns on capital, it believes many of its brands would benefit from dedicated retail penetration with owned stores. We remind investors that Swatch owns 20 watch brands, many over 100 years old. We agree with Swatch's assessment that in some countries, many of the brands have yet to be discovered, and that the company is proportionately underpenetrated in retail versus other luxury goods companies. We believe the Sistem51 and new smart technology watches will lift unit volumes and average price, as the new products are at above average price. We also believe that in the U.S. market, the average price is artificially low due to lower-end brand presentations offered in many department stores, and the reluctance to take on expensive inventory.

The result, in our view, supports our forecast that Swatch should see growth in revenue and margins above the luxury industry average. This forecast assumes most of the new technologies that Swatch is investing in drive incremental consumers to Swatch brands, and that they are increasingly captured in Swatch Group owned retail stores.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)