Opportunity in the High-Yield Bond Market?

Three options for a measured approach to junk bonds.

The past year has been a rough one for the high-yield bond Morningstar Category. Even before this month’s rocky credit and equity markets took a toll their toll on the sector, junk bonds had suffered through a volatile 12 months. Those that invested in the high-yield market after looking at the asset class’ post-crisis gains and strong income generation have likely been disappointed by recent returns. That said, the category’s sell-off over the past year has made the asset class more attractive based on valuations; the high-yield market might be presenting an opportunity for contrarian investors. To offset the risks inherent in the asset class, we think it’s important for investors to treat high yield as a long-term strategic investment within portfolios rather than a vehicle for market-timing and trading.

Here we provide an update on the high-yield market’s year-to-date performance, current valuations, and risks and highlight several more-conservative options in the category.

Energy Troubles Continue to Dominate As we explained earlier this year, the energy sector drove returns for the high-yield category in 2014, and, as we expected, that sector's fortunes have continued to drive returns in 2015. That (admittedly not very earth-shattering) prediction came true, as shown in the table below.

The average open-end high-yield bond fund declined 4% over the past 12 months. Much of that pain has been driven by sharp declines in the energy sector, which has lost close to 10% for the year to date and an eye-popping 22% over the past year against the backdrop of a plunge in oil prices. The energy sector remains the largest constituent of the high-yield market, making up 13% of the Bank of America Merrill Lynch High Yield Master II Index. The metals and mining sector makes up a much smaller 3% of the high-yield market but is facing similar commodity price pressure to energy firms and has also experienced a painful sell-off in recent months.

Looking at recent results from a credit quality perspective, the CCC rated portion of the high-yield market has also done poorly, as reflected by a 12.3% decline over the past 12 months. Aside from energy, which is about 10% of the CCC portion of the high-yield bond market, many other sectors also contributed to these disappointing results, including machinery (perhaps a knock-on effect from the commodities sell-off), cable and satellite firms, and media firms. The poor results have also resulted in five-year returns for CCC bonds that are about in line with the broad high-yield category. Generally speaking, investors that stretched for yield by dipping into the lower-credit-quality tiers have not been rewarded for the extra credit risk they took on over the period.

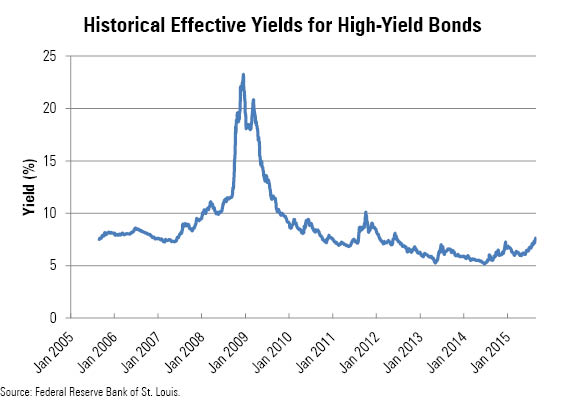

Outlook One positive from this poor performance is that valuations for high-yield bonds now appear much more reasonable, creating a potentially attractive entry point for investors. As shown in the chart below, spreads and yields are now at multiyear highs. The current effective yield of 7.5% is the highest since June 2012. Excluding the battered energy sector, where yields have approached 12%, yields for the broad high-yield market still clock in at a respectable 7%.

The risks for the energy sector suggested by these plump yields are very real. Many firms, especially exploration and production companies, borrowed heavily during the past five years based on the assumption that oil prices would remain high. We spoke to several high-yield managers as oil prices started their decline in summer 2014, and many indicated that these firms could survive with oil north of $75 but that defaults would be likely if oil dropped below $60. With a barrel of oil now trading below $40, we’ve only just begun to see the extent to which defaults will plague the sector. For that reason, we think high-yield investors need to remain cautious when it comes to this troubled sector.

However, risks across the nonenergy portions of the high-yield market are less apparent. There is potential for the troubles in the energy sector to spread to other areas of the economy. More recently, concerns around a slowdown in China, and increased borrowing to fund merger and acquisition activity and share buybacks, could all spell trouble for high-yield investors. Still, aside from the energy sector, the broad U.S. economy still seems to be chugging along just fine.

Another concern is how high-yield bond funds will perform during rising-rate environments. Common wisdom suggests that high-yield bonds are driven more by defaults and corporate fundamentals and less by interest rate movements. More recently, however, the Fed’s zero-interest-rate policy has forced many bond investors to move further out on the risk spectrum away from traditional interest-rate-sensitive bonds (such as Treasuries) and toward more credit-sensitive securities like high-yield bonds. For that reason, it’s possible (if not likely) that high-yield bonds could sell off if and when rates rise.

Given what we’ve discussed above, investors may be well-suited to avoid bond fund managers that have stretched for yield by investing in lower-quality bonds or those that have heavy exposure to the dicier parts of the energy sector. Below are several Morningstar Medalists that either explicitly, or implicitly through bottom-up security selection, focus on the higher-quality tiers of the market and have managed to sidestep the worst of the energy meltdown.

Vanguard High-Yield Corporate VWEHX: Silver

By design, this fund lands at the conservative end of the junk-bond group when it comes to credit risk. The fund's investment philosophy is informed by the asymmetrical risk/reward profile of the high-yield bond market: Investors can lose all or a significant portion of their investment when a company goes belly-up, but upside is limited, especially for a bond purchased at par. Unlike many of its competitors in the high-yield category, the fund’s team has kept the bulk of its assets in BB rated fare since 2010, and the fund remains lighter than category rivals when it comes to bonds rated B and below. The fund was underweight the energy sector in 2014 as oil prices declined and its exposure was focused on midstream pipeline firms. The fund's moderate streak shows in its long-term record. It tends to lag peers during strong credit markets--think 2009 and 2010--but stays ahead when concerns about economic growth and credit quality take their toll on bond markets. Add in super-low expenses and this fund is a strong choice.

PIMCO High Yield PHIYX: Bronze

This fund’s focus on bonds rated BB and its Bank of America Merrill Lynch U.S. High Yield BB-B Rated Constrained Index benchmark gives this fund a more-conservative look than many of its high-yield rivals. Indeed, management treads more lightly in junkier bonds rated B and below. The fund will invest significantly in non-U.S. issuers (18% as of August 2014), including emerging-markets-domiciled issuers (2%). That leaves the fund with a slight overweighting in non-U.S. names relative to its benchmark. Manager Andrew Jessop invests mainly in cash bonds and uses smaller doses of credit default swaps to gain market exposure, particularly in the face of strong cash flows. PIMCO’s credit team was early in moving away from the bonds of hard-hit exploration and production firms, as Jessop indicated the heavy debt issuance by these firms was reminiscent of the telecom industry during the tech bubble. Most of this fund’s energy exposure was limited to pipeline firms, which are less exposed to commodity prices.

Janus High-Yield JAHYX: Bronze

Gibson Smith and Darrell Watters apply a moderate approach to managing high-yield bonds. The fund avoids distressed securities and those with declining fundamentals, instead focusing on cash flow generation and management intentions. They look for management teams that have incentives to use cash to pay down debt rather than make acquisitions or return cash to shareholders. The strategy also focuses on sector and credit quality rotation: paring back risk when the team grows more concerned with the macro environment and selectively adding back risk when fundamentals begin to improve. This fund held a considerable energy stake during 2014 but has since reduced its exposure and astutely increased its cash holdings, which has allowed it to outperform most of its peers for the year to date.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)