Be Cautious With Commodity Exchange-Traded Products

Before speculating with futures-based ETPs, take a moment to look under the hood.

Academic research suggests that commodities can play a role in a balanced asset allocation. A track record of providing uncorrelated returns has won the commodities Morningstar Category a place in many portfolios as an attractive diversifier in a mix of stocks, bonds, and cash.

Exchange-traded funds have made a category that was once the realm of large institutional investors accessible to the masses. But, as with everything, investors should be aware of what they are actually buying when they go shopping for a commodity-focused exchange-traded product. A look behind these funds' labels will show that they are often not what they seem.

Odds Are It's Not Spot Spot prices are the stuff of commodity headlines--the numbers called out every day in the financial media--and represent the prices for immediate payment and delivery on everything from natural gas to zinc. Many investors are under the impression that commodity ETPs will offer them exposure to changes in the spot market prices of copper, corn, oil, wheat, and so on. In the vast majority of cases, this simply isn't so.

Unless you are buying a fund that takes physical possession of the underlying commodity, you are not receiving direct exposure to spot market prices. There are currently ETPs tracking gold, silver, platinum, and palladium that directly hold their reference metals. Given that these metals are fairly simple to standardize and inexpensive to store (because of their high value/weight ratio) they lend themselves well to a physical holding structure. Also, you don't have to worry about gold bullion spoiling the way you do soft commodities like wheat or corn.

Most commodity ETPs provide exposure to movements in the prices of futures contracts on a single commodity (oil, natural gas, copper, and so on) or an index composed of single-commodity futures (Bloomberg Commodity Index, S&P GSCI Agriculture Index, and so on). Futures contracts represent an agreement to buy or sell a commodity at a predetermined date at a predetermined price.

Futures prices will differ from spot prices based on a number of different factors including storage costs (paying for oil tankers, grain silos, and so on) and seasonal demand patterns (natural gas futures might rise above spot prices in anticipation of a cold winter) among others. As such, the returns on ETPs investing in commodity futures will typically differ from the spot price returns of the underlying commodity or basket of commodities.

Roll Returns Further distorting the performance of futures-based commodity funds relative to spot price movements is the fact that the funds must periodically roll into new futures contracts as the existing contracts expire. This results in what is known as roll returns or roll yield.

This is the source of the majority of the difference between spot price returns and the returns experienced by investors in commodity futures. Roll return can be attributed to the price difference between the current period's futures contracts and the price of the subsequent periods' contracts into which the fund or index is to be rolled. Roll returns can be either positive or negative, depending on the slope of the futures curve for the commodity or index in question. If the futures curve is upward sloping--where each subsequent month's futures price is progressively higher (known as contango)--this will result in a negative roll yield.

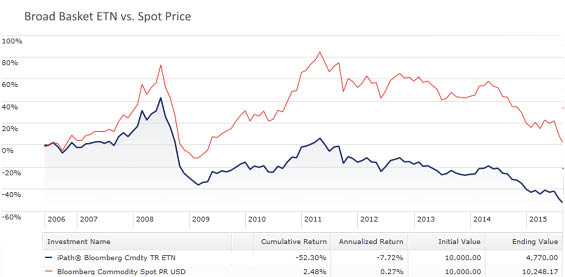

How does this work? Each period the fund will sell relatively low-priced contracts and buy higher-priced contracts further out on the futures curve. This phenomenon has been prevalent of late, as many commodities futures markets have been in contango for the past few years. The devastating effects can be seen in the graph below, which illustrates the return disparity between an index that measures the spot prices of a basket of commodities--Bloomberg Commodity Spot Index--and an exchange-traded note that tracks that same index by rolling futures contracts--iPath Bloomberg Commodity Index TR ETN DJP.

On the other hand, if the futures curve slopes downward--what is known as backwardation--the result is a positive roll yield, where each period the fund will sell higher-priced contracts and buy lower-priced ones. Historically (prior to 2004), most commodity markets sat in backwardation. However, increased participation in commodities markets by nonproducers in recent years may have altered the dynamics of these markets for good.

What Are the Implications of Roll Yield?

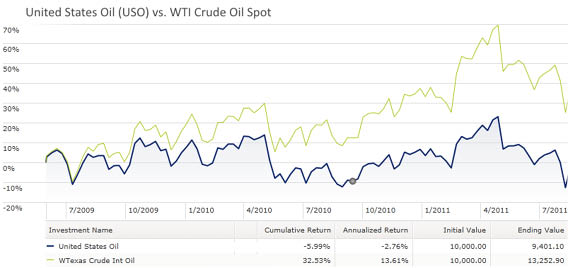

Roll yield will lead the returns of commodity futures indexes and funds to diverge from commodities' spot price performance. As demonstrated in the graph below, while West Texas Intermediate crude oil prices rallied more than 32% in the back half of 2009 and into 2011, the futures-based

However, this is not attributable to a flaw in the fund's design. It performed exactly as advertised. The wide divergence in returns here is due to the fact that the WTI crude oil futures curve had a relatively steep upward slope over that time period, resulting in negative roll returns that weighed heavily on the fund's performance. With WTI crude oil futures currently in contango, this is a particularly relevant example for those looking to speculate or find a bottom in oil prices today using an ETP like USO. Such products can be effective tools for capturing short-term price movements; however, as shown in the above example, if they are held for extended periods the results may be disappointing.

How Do You Deal With Roll Yield? Creating a better way to replicate the spot price performance of a broader swath of commodities is the Holy Grail for commodity fund providers. Given the costs of storage, a physical replication fund for oil, natural gas, or agricultural products is an unlikely solution. However, there are a few unique choices on the menu that seek to tackle some of the challenges associated with investing in commodities through futures markets.

The first fix is to simply invest in futures that are further out (say 12 months) on the curve. Investing in longer-dated futures contracts can do a bit to mute the effects of regular rolling, which are typically most pronounced in front-month futures. However, this strategy isn't foolproof, and real results are mixed at best. For example, during the same time period shown in the graph above, United States 12 Month Oil USL posted a cumulative return of 10.5% compared with the 32.5% advance in spot prices. Since the front end of the futures curve (near spot) is much steeper than the back end (further-out months), USO took it on the chin a bit more than its cousin USL, which dabbles in longer-dated futures contracts.

There are also more advanced strategies available that actively seek to minimize roll losses when futures markets are in contango and maximize roll gains when they are in backwardation. One such example is

" methodology that dynamically invest in crude-oil futures contracts with expiration dates as far out as 13 months. Despite the additional flexibility, there's no guarantee that dynamic or optimized strategies will outperform. In the same two-year period as the above example, DBO returned 4% cumulatively--better than being in the red but still a far cry from the spot price performance.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)