Do You Need a Bear-Market Fund?

These funds were among the best performers during the recent stock-market plunge--but there are other ways to play defense.

After six years of positive market returns, investors are getting a refresher course in what a market sell-off feels like. During a sizable market correction such as the one we've seen, it's natural for investors to wonder if they should be doing more to play defense in a downturn.

Some may even be wondering if they should allocate a portion of their portfolio to an investment type that is designed to profit from market downturns: bear-market funds.

The short answer: For the vast majority of investors, bear-market funds just don't make sense. "These types of tactical funds might be useful to a sophisticated few," said analyst Josh Charney, who covers alternative strategies for Morningstar. "But selling a portion of your portfolio and allocating it to a bear-market fund is beyond hitting the panic button; it's selling a piece of your portfolio and then betting against your portfolio."

What Are Bear-Market Funds?

Bear-market funds are designed to profit during market sell-offs. They use a variety of different methods to do so. Most of them are passive funds that use derivatives to get the inverse return of a certain market index (over certain short periods--often a single day), such as

As you can see from the graph below, bear-market funds do, in fact, gain when the market loses:

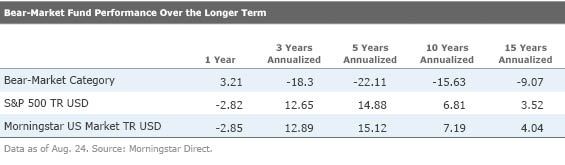

But these funds only outperform when the market is in the dumps. If you had a crystal ball and could reliably predict when the market will sell off, a bear-market fund could work. But your timing has to be spot-on, because if you hold these while the market is gaining--as it has for most of the longer-term trailing periods--you will lose money. "We've always taken the view that market-timing is extremely difficult," said Charney. "Portfolio managers often get it wrong, so there's a good chance individuals won't get it right either." As you can see from the data below, bear-market funds just don't make sense for long-term, buy-and-hold investors. For one, over the long term, the stock market goes up more than it goes down, so the risk/reward trade-off on bear-market funds just isn't that great. To illustrate, take a look at the bear-market category relative to the same benchmarks over longer-term periods.

On top of that, the expenses on these types of funds are typically high (the median expense ratio among actively managed funds in the bear-market category is 1.78%). Although passive funds are typically cheaper than actively managed mutual funds that follow bear-market approaches, they are not the perfect solution either. For one, many ETFs that employ inverse strategies are not designed to deliver the inverse return of the index for periods longer than one day due to the impact of compound interest. These discrepancies can be large and can be particularly magnified during volatile markets, and they were big in 2011, said analyst Michael Rawson. (In fact, the SEC and FINRA issued an alert cautioning investors about the risks of leveraged and inverse exchange-traded funds and clarifying their performance objectives; for more on that, click here.) Rawson, who covers two such ETFs--ProShares Short S&P500 and ProShares UlraShort S&P500--notes that the funds carry significant risk and are by no means a long-term, buy-and-hold investment.

What Are Some Other Alternatives? Cash If you want to reduce your portfolio's exposure to equities, you may be better off assessing your asset allocations than holding a bear-market fund. For example, carving out a portion of your portfolio to be held in liquid assets (one year or more of living expenses, depending on your needs and risk tolerance) is the linchpin of Morningstar director of personal finance Christine Benz's bucket portfolio approach. Though cash yields are close to zero, Benz notes that "the goal of this portfolio sleeve is to stabilize principal to meet income needs not covered by other income sources."

Bonds Another option is to check your bond allocations. As Benz notes in her recent article "The Best Diversifier Has Been the Simplest", despite the proliferation of instruments designed to provide diversification in recent years, high-quality bonds have proved to be the best foil to equities during the past decade. Looking at the long-term correlations among various asset classes, Benz noted that the open-end long-term government-bond category is the only category with a strong negative correlation to both the large-cap blend and foreign large-cap blend categories. And in fact, amid recent market turbulence, the long-term government category has been in the black, gaining 1.3% for the week and 3.3% for the month through Aug. 24, according to Morningstar Direct.

Market-Neutral Funds

If the appeal of a bear-market fund for you is the low correlation with the stock market (bear-market funds have a beta relative to the S&P 500 of around negative 1.3 to 1.5 over all long-term trailing periods), market-neutral funds could be a better alternative. Market-neutral funds aim to generate a positive absolute return by taking little or no market risk (very low beta). In order to achieve this, managers employ a variety of means, including going long and short simultaneously and in equal proportion, stock-picking, and quant strategies. Among the funds we like in this space are two with Morningstar Analyst Ratings of Silver,

Stay the Course But if you can handle the market volatility and have a long time horizon, generally it is not necessary to tinker with your portfolio unless your targeted allocations drift far off-course. "Volatile markets can be a breeding ground for knee-jerk investment decisions motivated by emotions more than fundamentals; undertaking a major portfolio renovation in such trying times is usually not a good idea," said Benz. Also, keep in mind that whether you are an investor looking for opportunities to scoop up high-quality stocks on sale or a long-term investor dollar-cost averaging into a fund, when many people in the market are sellers, it can be a great time to be a buyer. "[Stay] attuned to potential bargains that can crop up when market participants overshoot on the downside," adds Benz. "(And they reliably do.)"

Have a personal finance question you'd like answered? Send it to TheShortAnswer@morningstar.com.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)