A New Tool for Retirement Income

QLACs offer longevity insurance in IRAs and 401(k)s, but will they catch on?

Is there a QLAC in your future? Not disability insurance from that noisy duck of TV-ad fame, but a qualified longevity annuity contract.

QLACs are a new form of deferred income annuity (DIA) promoted by the Obama administration as a way to address longevity risk--the risk that you'll run out of money in retirement. The U.S. Treasury approved rules last year encouraging the use of QLACs in individual retirement accounts and 401(k) plans by waiving required minimum distributions (RMDs), which had been seen as a key barrier to adoption.

QLACs let buyers pay an initial premium or make a series of scheduled payments and set a future date to start receiving income.

DIAs can be purchased at or near your retirement age, typically age 70, with payouts starting much later, usually at 80 or 85. DIAs provide guaranteed regular income until death, and the deferred feature allows you to generate much more income per dollar invested.

For example, Principal Financial Group, which introduced a QLAC for individual retirement accounts earlier this year, says a $100,000 policy purchased at age 70 with a 10-year deferral (life with cash refund, single life) would generate $15,457 annually for a male buyer and $13,843 for a female. By contrast, an immediate annuity of the same value would provide $7,704 for the 70-year-old man and $7,272 for the woman, according to ImmediateAnnuities.com.

Despite the benefits, DIAs haven't generated much interest from retirement investors. Sales in the second quarter of 2015 totaled $551 million--23% lower than the year-earlier period and the lowest quarterly sales since the second quarter of 2013, according to the LIMRA Secure Retirement Institute. By contrast, $7.4 trillion is held in IRAs and $6.8 trillion in defined-contribution plans, according to the Investment Company Institute.

But DIAs have a champion at the White House--J. Mark Iwry, deputy assistant secretary of the U.S. Treasury for retirement and health policy. Iwry, a well-respected policy expert on retirement income, has been working on ideas for boosting guaranteed income since well before he joined the Obama administration in 2009, most notably the Retirement Security Project.

Iwry's theory is that more people will buy DIAs if they can be purchased and held inside tax-deferred IRAs and 401(k) plans. The problem there: required minimum distributions, which require 401(k) and IRA participants to start taking withdrawals at age 70 1/2. That requirement conflicts with the later payout dates of longevity annuities.

The QLAC rules state that if a longevity annuity meets certain requirements, the distribution requirement is waived on the contract value (which cannot exceed $125,000 or 25% of the buyer's account balance, whichever is less). That not only makes a deferred annuity possible inside a tax-deferred plan, it also can encourage their use for anyone interested in reducing the total amount of savings subject to mandatory distributions.

So far, most of the action has been in the IRA market. Sixteen insurance companies are now selling DIAs, and nine are offering QLACs. But only one insurance company--Metlife--has rolled out a product for 401(k)s.

Michael Finke, a professor in the personal-financial-planning program at Texas Tech University, argues that the RMD waiver feature of QLACs can provide substantial benefits. "If you put $125,000 in a QLAC inside an IRA, you won't have to take RMDs on that amount from age 70 1/2 to 85. Depending on your tax bracket, the income taxes on those withdrawals provide an appealing tax-deferral benefit that remains even after you pay tax on it eventually in the form of higher income later in life."

A forthcoming paper authored by Finke (and sponsored by Metlife) analyzes those tax benefits and argues that QLACs offer an extraordinarily cheap way to buy income. "A QLAC provides the same income from age 85 to 100 at about half the cost of an investment in a bond portfolio," he writes. "A retiree can achieve the same income goal with fewer assets through the use of a QLAC while simultaneously protecting against the risk of depleting assets over a long lifetime."

He adds: "Simulations in which retirees follow the 4% spending rule in retirement using current asset returns and the 2012 Society of Actuaries tables to predict longevity show that a retiree with a balanced portfolio can reduce the risk of shortfall by as much as 39% through the purchase of a QLAC. In addition to reducing the risk of depleting investment assets to fund retirement income, a QLAC also reduces the consequences of a shortfall by providing a higher income floor. These efficiency improvements are provided without any sacrifice in the size of a retiree's bequest."

The deferral feature of DIAs can be a tough concept for buyers to accept--handing over a large sum of dollars with a far-off, uncertain return. And, while the upfront investment is lower, you're still left with the challenge of managing your assets to generate sufficient income while waiting for the annuity income to start flowing at age 80 or 85.

For that reason, actuary and financial planner Joe Tomlinson prefers single premium income annuities (SPIAs). "This aspect of a deferred-annuity purchase is downplayed sometimes, unfortunately," he says. "What I always hear people say is that all you have to do is make your money last until you hit 85. That may sound easy, but it's not uncomplicated when you consider investment risk. If the market drops 50% and you have half of your money in stocks, your income base falls 25%--it's not a good situation."

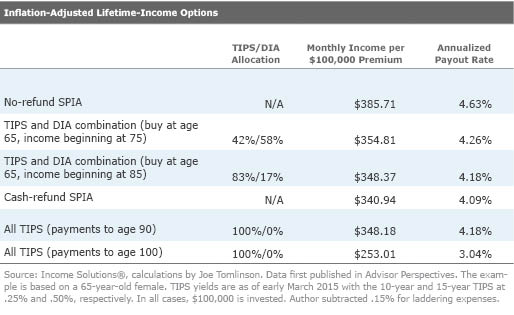

In an article earlier this year for Advisor Perspectives, Tomlinson ran a scenario comparing three strategies for providing longevity protection, using combinations of SPIAs and deferred annuities, and Treasury Inflation-Protected Securities (TIPS). The scenario was based on a 65-year-old female buyer.

Tomlinson found that a no-refund SPIA provided the highest income with inflation-adjusted payments similar to Social Security; the downside was lack of liquidity and remaining assets to pass along to heirs. The greatest liquidity came from a DIA purchased at age 65 with payments beginning at 85 and TIPS used to generate income prior to 85, but that cost the buyer 10% in income.

Tomlinson concluded that no product was clearly superior to another--it's a trade-off between liquidity and flexibility versus achieving higher income.

"The appealing feature of the QLAC is that you're setting aside less money at 65 than you are for a SPIA. But you'll need to dedicate significant savings to meet your living expenses until the QLAC payments begin, and the liquidity of those dedicated savings isn't worth all that much."

Mark Miller is a retirement columnist and author of The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work, and Living. The views expressed in this article do not necessarily reflect the views of Morningstar.com.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)