Puerto Rico Back in the Hot Seat

Investors should expect continued volatility.

The commonwealth of Puerto Rico and the municipal-bond mutual fund market were thrust back in the headlines in recent weeks as Gov. Alejandro Garcia Padilla warned that the U.S. territory couldn't pay its $72 billion of debt. In this article, we'll provide context around the announcement, review which mutual funds own significant amounts of Puerto Rico bonds, and discuss what investors can expect moving forward.

Key Takeaways

- The financial crisis of the commonwealth of Puerto Rico continues to worsen, creating heightened risk for investors in the island's $72 billion of debt.

- The commonwealth's municipal bonds have been attractive to many mutual funds thanks to their higher yields and "triple tax-exempt" benefits. Although investors might expect to find the highest concentrations of this debt in high-yield municipal funds, some of the largest allocations are in single-state funds.

- With those funds' higher yields comes a higher risk of potential losses. Though the funds with large stakes in Puerto Rico bonds have prospered until recently, many suffered meaningful losses in June.

- Puerto Rico is far from out of the woods. Investors should expect more volatility and haircuts to their original investments as the commonwealth tries to restructure its debt in the coming months and years.

What Happened On June 29, Puerto Rico Gov. Alejandro Garcia Padilla declared that the U.S. territory couldn't pay its $72 billion of debt. Although an initial debt payment was made directly after the announcement, various agencies of the commonwealth are widely expected to default on or restructure their upcoming obligations. Indeed, Puerto Rico's Public Finance Corporation is due to make a bond payment on Aug. 1; as of this writing, the commonwealth's legislature had thus far failed to appropriate the funds.

Exposure to Puerto Rico in Mutual Fund Portfolios As we've noted before, the financial woes of Puerto Rico affect millions of municipal-bond fund investors. Unlike bonds issued by the troubled city of Detroit (which were not widely held by most large muni funds during the city's historic bankruptcy), the commonwealth's municipal bonds have been favored historically by a meaningful number of mutual funds. According to Morningstar data, roughly half of U.S. open-end municipal-bond funds hold some exposure to debt of the commonwealth, ranging from less than 1% of assets to nearly 50% of assets. Including debt held by taxable funds, U.S. open-end bond mutual funds collectively own more than $11.4 billion of the island's debt, or just over 15% of its outstanding issuance.

A Closer Look at the Funds One might reasonably expect to find bigger helpings of Puerto Rico bonds in high-yield national muni funds, and to a certain extent that's true. But some of the largest concentrations of the island's debt are found in funds in Morningstar's single-state muni categories. Funds in these categories are set up to invest primarily in the debt of an investor's home state; as a result, the income paid by these funds is not subject to federal or state taxes (assuming that the state grants tax-free status to muni bonds issued by in-state municipalities, which most do). Puerto Rico and other territories, including Guam and the U.S. Virgin Islands, have "triple tax-exempt status," meaning bonds issued by municipalities in Puerto Rico aren't subject to federal, state, or local income taxes. This triple tax-exempt status--taken together with high yields--has made Puerto Rico a popular investment for many single-state muni funds. And because the names of the funds don't suggest the presence of such holdings, many investors might be caught off-guard.

Nearly 50 U.S. open-end municipal-bond funds representing $43 billion in assets have exposure of 5% or greater to Puerto Rico bonds. While 11 of those funds are categorized in the high-yield muni Morningstar Category, 35 are in one of the single-state muni categories. Many of those funds are comparatively small in terms of total assets, but 14 of them, listed in Exhibit 1, had assets of $1 billion or more each as of July 2015. None carried a Morningstar Analyst Rating.

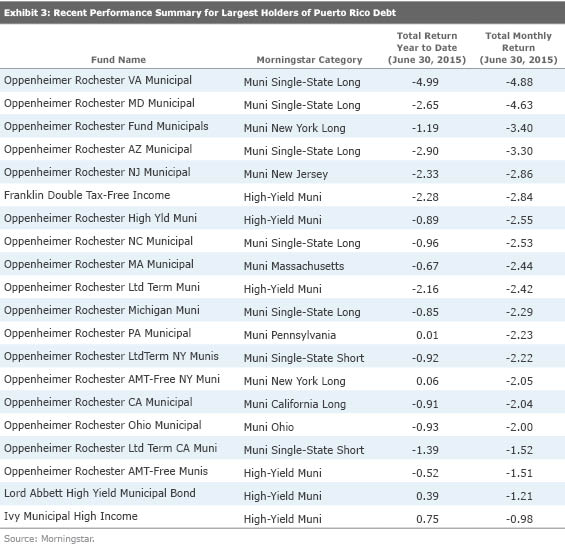

OppenheimerFunds and Franklin Templeton Investments are two of the largest holders of the commonwealth's debt with some of the largest concentrations in single-state funds. The Oppenheimer funds hold some of the heaviest weightings to the commonwealth's debt. Based on their latest portfolios, 19 of the 20 Oppenheimer Rochester funds had some exposure to Puerto Rico, and 17 had weightings in the double digits ranging from just over 10% of assets to nearly 50% of assets. Allocations in the Franklin funds, while still meaningful, tended to be smaller. Of the 32 funds in the Franklin municipal-fund complex, 26 funds listed some exposure to Puerto Rico bonds in their most recent portfolios; six funds had exposures of between 5% and 8% of assets. The exception here is Franklin Double Tax-Free Income FPRTX, which holds over 50% of assets in Puerto Rico debt as of June 30. In contrast, the largest national muni funds had small weightings to Puerto Rico debt, usually less than 2% of assets.

Noticeably absent from the list of large investors in the island's debt are some of the larger players in the municipal-bond space. The fixed-income teams at Fidelity and PIMCO haven't held large stakes in Puerto Rico for some time, and recent portfolios show no exposure. Exposure to Puerto Rico in other firms with significant muni-fund assets, such as Vanguard, BlackRock, and T. Rowe Price, were also relatively modest.

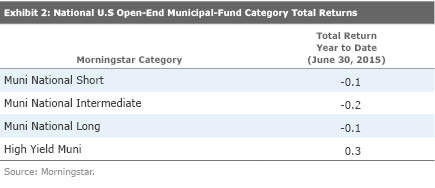

How They've Fared Thus far, Puerto Rico's troubles haven't led to significant trouble in Morningstar's muni categories; indeed, the relatively meager year-to-date returns are more attributable to a combination of increased muni bond supply in 2015, higher yields across the market, and general concern over rising rates, which have reduced demand and resulted in weaker performance among muni funds. All in all, average returns in Morningstar's muni national categories were collectively flat through June 30.

However, funds with more exposure to Puerto Rico have struggled relative to their peers in 2015 and significantly underperformed in June. Although other factors beyond Puerto Rico exposure may be affecting those portfolios--including a rise in muni yields--it's worth noting most of these funds have ranked near the bottom of their respective Morningstar Categories for the year to date. Exhibit 3 details the largest losses in funds with 5% or more in Puerto Rico for the year to date and for June.

What Does This All Mean for Fund Investors? For many investors, including those in large funds run by Fidelity, PIMCO, Vanguard, and T. Rowe Price, Puerto Rico exposure is small to nonexistent. Others, most notably investors in several Oppenheimer-run mutual funds, have more at stake. Although their higher weightings in Puerto Rico bonds have contributed to gains in recent years as investors reached for yield in the muni market, many of those Oppenheimer and Franklin funds experienced meaningful outflows over the past 36 months. Should outflows continue, they could pose another risk to investors as funds, especially those with the largest stakes, could be forced to sell at bargain basement prices in order to satisfy redemptions. And those buyers might be increasingly hard to come by--there's been a retreat from the broad muni market in the past several weeks, as investors are also growing wary that interest rates could rise and hurt their bond portfolios. Puerto Rico's new splash of negative headlines could spook some even further from muni funds.

With that, why certain firms have stuck with or increased their Puerto Rico exposure is a question advisors and investors using the funds listed in the exhibits above should be asking those managers. It's likely that some continue to be attracted to the hefty yields of the commonwealth's bonds and are willing to ride out their mounting risk, arguing that the debt's legal security pledge and/or insurance policies will ultimately shield bondholders from losses. Relying on dedicated analyst teams and tools, some believe that the commonwealth can afford to pay its debt back in full, regardless of the recent assertions by government officials to the contrary. Still others may be banking on a federal government bailout for the island and its investors. Finally, it's possible that some bought the debt at deep discounts and believe that they'll ultimately turn a profit on the deal when all is said and done. However, it's clear that this is setting up to be a long and complicated ride.

Editor’s note: The data provided in the following article includes the most recently available portfolio data provided to Morningstar as of July 2, 2015. Certain portfolio weights may have changed in portfolios made available to Morningstar after July.

/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)