How the Pros Manage Assets for Retirees

Investors can glean asset-allocation pointers from target-date funds.

In late May, Christine Benz, Morningstar's director of personal finance, discussed what in-retirement mutual funds can teach investors. Investors can learn similar lessons from Morningstar Medalist target-date funds.

To be sure, target-date funds may not address investors' unique retirement circumstances, but do-it-yourself investors may learn a thing or two by studying the moves of professionals. Target-date fund managers are tasked with designing a single, diversified strategy for investors who do not wish to make asset-allocation decisions. The managers proactively shift a fund's asset mix over time to address different phases of an investor's life cycle, including the retirement phase.

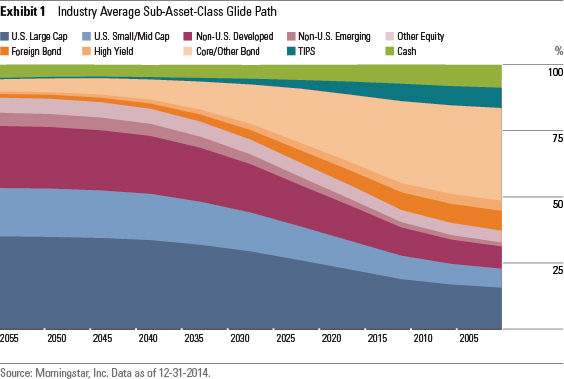

Target-Date Managers' Approach to Retirement Earlier this year, we unveiled the Industry Average Sub-Asset-Class Glide Path (Exhibit 1) in our 2015 Target-Date Fund Landscape report. We constructed this glide path by peering into the holdings of 48 target-date series. Each series has 11 observations for 10 distinct subasset classes, spanning funds designed for savers planning to retire between 2055 and 2005. If a series did not have a 2010 or 2005 fund because assets merged into a retirement-income fund at the target date, we substituted that series' retirement-income fund for those vintages.

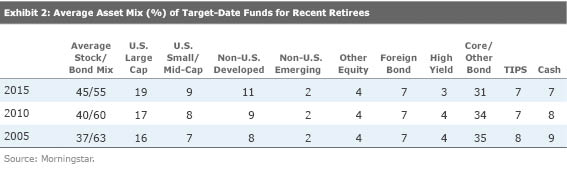

Let's focus on the asset mix of the target-date funds designed for retirees. Exhibit 2 shows the figures for the Industry Average Sub-Asset-Class Glide Path's 2015, 2010, 2005 funds. Assuming a retirement age of 65, which is the common assumption among target-date managers, these three funds are currently tailored to 65-, 70-, and 75-year-old investors, respectively.

And the Consensus Says … The Industry Average Sub-Asset-Class Glide Path imparts, at a minimum, the following five general asset-allocation guidelines for do-it-yourself investors:

1) Invest amply in bonds.

Exhibit 2 indicates that target-date funds in retirement, on average, hold more bonds than stocks. Bonds, including cash, make up 55% to 63% of the typical target-date portfolio for 65- to 75-year-old investors. The allocation to the Core/Other Bond subasset class handily tops all others, accounting for roughly a third of assets. This position serves to protect investors' assets in the event of a sharp stock market decline. In that scenario, retirees' income withdrawals amplify stock market losses as the withdrawals shrink the asset base, digging a deeper hole for assets to recover. Some target-date series tilt toward bonds more than others. For instance,

2) Consider holding some cash.

Staying with the concern of preserving capital, target-date managers typically keep some cash on hand for retirees. A 65-year-old target-date investor holds a 7% cash stake on average. Silver-rated

3) Don't abandon stocks.

Volatility accompanies the expected higher returns of stocks, but target-date managers generally believe stocks play a valuable role in a retirement portfolio. According to the Industry Average Sub-Asset-Class Glide Path, a 65-year-old investor would still have 45% of his/her portfolio in stocks. Notably, some managers hold even more equities based on concerns that longer life expectancy increases investors' probability of outliving their retirement assets.

4) Prepare for inflation.

Target-date managers often address inflation risk directly because of inflation's potential to ravage the purchasing power of retirees' assets. Treasury Inflation-Protected Securities (TIPS) have become prevalent within target-date series, and the average allocation to that asset class ramps up in the retirement phase, peaking at 8%, on average, for a 75-year-old investor. Vanguard introduces short-term TIPS into Gold-rated

5) Stay diversified. What may be the biggest--and most indisputable--takeaway from the Industry Average Sub-Asset-Class Glide Path is that investors should continue to hold a diversified portfolio throughout retirement. This applies to both the stock and bond allocations. Although U.S. stocks have surged higher than their international counterparts coming out of the financial crisis, non-U.S. stocks, including a sliver in emerging markets, still represent roughly 30% of the typical target-date glide path's overall equity exposure throughout the retirement phase. Some target-date series, including Vanguard Target Retirement, American Century One Choice, and PIMCO RealPath, have even increased their international-equity exposure in 2015. Similarly, the typical retirement portfolio has a noteworthy, albeit smaller, stake in foreign bonds within the fixed-income allocation.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)