While Greece Roils, U.S. Settles Into a Rut

Most reports this week showed an economy that continues to trudge along with no real acceleration or deceleration.

U.S. bond and stock markets were virtually unchanged on the week, which was really good news compared with the rest of the world. The whole Greek situation, which came to a head over the weekend, weighed much more heavily on markets outside of the United States. While the U.S. was also down a lot on Monday, many of the losses were recovered by the end of the week. European-related equity markets were down 3%-4% for the week while emerging markets were down just more than 1% and the S&P 500 was virtually unchanged. Commodities were slightly higher on the week.

It is still a little surprising to us that a country the size of Greece, which what one commentator mentioned was about the economic size of Alabama, was moving world markets this much. It does, however, say mountains about Europe's ability to cope with problems and that there are potentially serious problems with the structure of the eurozone. The short-term drama should settle down soon, but the longer-term structure of the European Union, with disparate countries with different growth rates tied to one rigid currency, could prove to be a real problem.

This week Morningstar Investment Management senior economist Francisco Torralba and corporate bond strategist Dave Sekera offered their take on the crisis and Sunday's referendum. For an interesting editorial on the longer-term context, we also think this editorial by Brett Arends of MarketWatch is worth a read.

There was a lot of economic news for the week, but none of the reports were really game-changers. Most of the reports showed a U.S. economy that continued to trudge along with no real acceleration or deceleration in growth. Everything continues to point to 2.0%-2.5% growth.

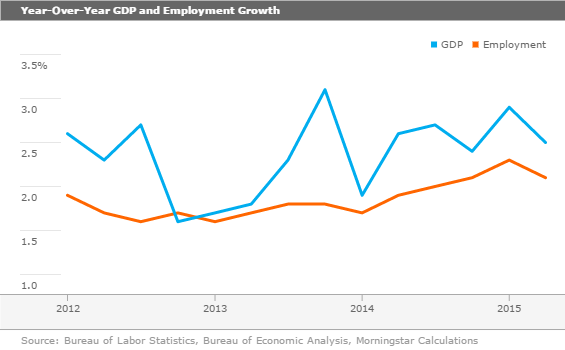

Another reason for the big yawn for this week's economic data is most economists were very close to the mark on a lot of indicators, which almost never happens. Auto sales hit 17.2 million units, exactly as analyst forecasts (which were down month to month and up year to year). Auto industry growth, while nice to have, wasn't nearly as strong as it was at the beginning of this recovery. Employment growth for June also matched the consensus forecast with 223,000 jobs added. Some previous months of employment data were also restated lower. All of this brings employment growth and GDP growth into closer alignment. We knew the relative growth rates (high employment growth, lower GDP growth) didn't make any sense at the beginning of the year. We expected a big blowout event to bring the numbers back in line. Instead, we got a slow, irregular drift back down combined with some minor revisions to the employment data. Monthly job growth will need to accelerate sharply in the back half of the year if there is to be any hope of adding as many jobs in 2015 as we did in 2014. Job growth would need to accelerate to something like 280,000 jobs per month, on average to get to the 2.9 million or so jobs added in 2014. At the moment, that looks like a bit of a stretch.

In other news, purchasing manager reports continued to support our thesis that the manufacturing sector is near a bottom. Additionally, the existing-home industry continued to pick up steam as indicated by yet another strong pending home sales report.

Job Growth Rates Return to Earth Headline job growth of 223,000 total jobs added was near consensus and our forecast but was viewed as a disappointment to many who had hoped for a much better number. The bulls had hung their hats on strong job openings, low initial unemployment claims, and the employment metrics of various manufacturing reports. The bears cited a slowing and low rate of GDP growth compared with unusually strong employment growth, especially at the end of 2014, as a reason for their pessimism. As it turns out, the final number came in between the two extremes. At 223,000 the June number came in below the 12-month average of 244,000 jobs added but above the six-month average of 208,000 jobs added.

The 429,000 jobs added last November and the 329,000 jobs added in December continue to stick out like a pair of sore thumbs. Those really high numbers severely complicate analysis of a lot of the data. It made the end of 2014 look boom-like and has been followed by months of payback. Also, it is not entirely clear if the great numbers for those two months were due to faulty seasonal adjustment factors or if there just happened to be a perfect storm of good news events during those two months. The good news is that with this report GDP growth and employment growth have resumed their more normal relationship. We had suspected that either a couple of really horrific months or a restatement would have brought these two points back together. Instead, we have witnessed a slow, almost indiscernible, inching downward trend with good months and bad months. As of the second quarter, year-over-year nonfarm payroll growth is averaging around 2.1% and GDP growth over the same period is running around 2.5%.

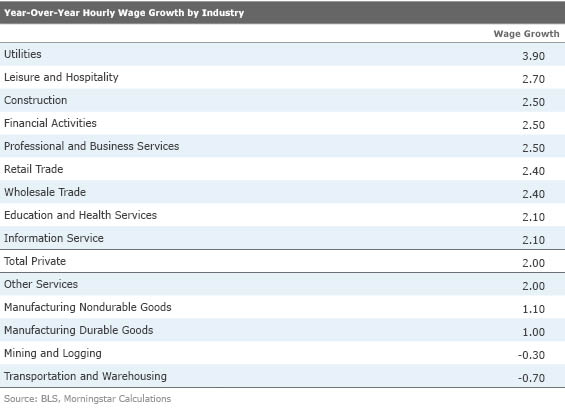

Not Much Hourly Wage Growth or Hours Worked Growth Month to Month With no hourly wage growth month to month and a modest slowing in the single-month year-over-year wage growth rate, a lot of economists were disappointed with the June data. We think the average measure has grown a bit confusing as it muddles together many industries and is strongly affected by mix issues and undue influence of some industries. The number is also prone to lumpiness with good months often followed by a series of months with no change. Being economists, we would all love to see five months of 0.2% monthly growth than one month of 1% growth and four months of no growth. Both ways get us to the same end, but it creates a lot of panic when we hit the slow spots. Also unusual in the year-over-year data are a lot of industries that are doing quite well and some that are not.

Surprisingly, there appears to be some convergence going on here, with some of the higher-paying sectors--manufacturing in particular--and mining (includes oil extraction) doing poorly and low-paying sectors such as leisure and hospitality doing better.

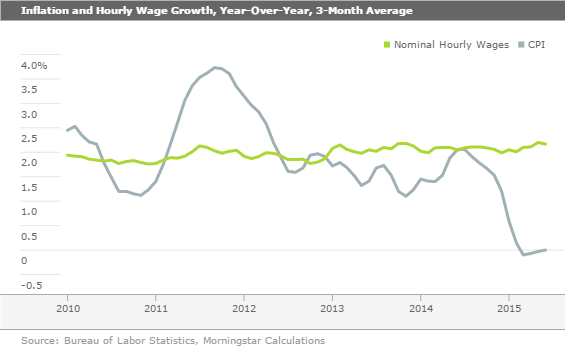

Overall Total Year-Over-Year Wage Growth Is Slowing Slightly Rolling together employment growth, hours worked growth, and the growth in the hourly wage rate, things still look pretty good but not stunning. Private sector employment growth is at its 12-month average and the hourly wage growth rate is just one tick above the average. Meanwhile, hours worked growth has seemingly come to an end, as it often does at this part of a recovery. Employers are opting for more employees and not working their current ones more hours. Putting it all altogether, total wage growth has been slowing since February and is down to 4.7% from a high of 5.4% and its 12-month average of 4.9%.

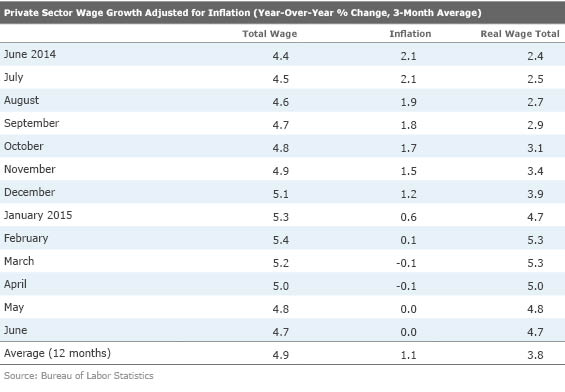

Inflation-Adjusted Data Trending Lower, Collapse Is on the Way Low year-over-year inflation rates, almost entirely due to low gasoline prices, have meant those dollars theoretically grow much faster. And the table below shows just that. Consumers have spent some of the extra inflation-related cash, but certainly not all of it, as savings rates have been increasing.

That is probably a really good thing as employers have been doling out 2% raises on average, no matter what the gyrations are in the inflation rate. Both employers and employees have been acting rationally, responding only to what they believe are changes in long-term inflation rates and not temporary blips in commodity prices. While total wages are up around 5% year over year during the past six months, consumption growth has been stuck at around 3%. That's a very good thing because without a total collapse in gasoline prices in the near term, year-over-year inflation could begin to approach 2% by December. If hourly wage growth doesn't accelerate (which could be given our labor shortage thesis), there won't be any wage income growth per individual and total wages will only increase to the extent of the percentage growth of the number of people employed. Because consumers have been cautious about spending their income gains, the impact on the economy might not be large. Still, those forecasting a sharply accelerating economy and reaching some type of escape velocity are likely to be disappointed yet again.

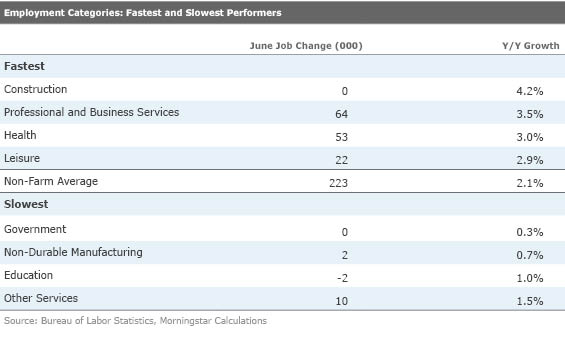

Employment Sector Data Shows It May Be Hard to Accelerate Job Growth Unfortunately, the number of job sectors that are doing really well are quite limited and some of the poorer-performing sectors don't have a lot of hope for doing much better. Too, some of the better performing sectors have slowed up, especially those related to manufacturing. The table below shows particularly good and bad performers over the past 12 months and their job additions in June alone.

Construction, a great performer year over year, had a rough June and we are hoping for some help from the sector, especially the residential market, by the end of the year. Business and professional, a high-paying, long-hours sector in general, did great on both a year-over-year and a month-to-month basis. The same can be said for health care, which has been gaining some momentum. The leisure category, led by restaurants, has had a good year but has been losing some momentum.

On the slow side, the budget agreement is keeping a lid on federal spending; soft tax collections and pension payments are holding back state government, and local government continues to feel the pain of a slow housing market. The government numbers have looked terrible for four years. The best thing that can be said about government is that it isn't getting any worse. At 15% of all jobs, the impact of slow government spending on employment growth often goes unnoticed. Nondurable goods have been soft for a while and education employment has been sliding downhill because of government actions against proprietary schools with poor graduation rates and an improving economy.

Auto Sales Drop Back but Still Elevated

As we have mentioned many times, May was an unusually good month for auto sales because of some very favorable adjustment factors. Indeed, June sales did drop back from 17.8 million (seasonally adjusted annual rate) to 17.2 million units in May. That drop was in line with expectations and about 2% higher than a year ago. It is a little higher than we had estimated immediately after the May blowout (we originally thought sales could drop back into the high 16s). The June numbers could have been slightly higher if

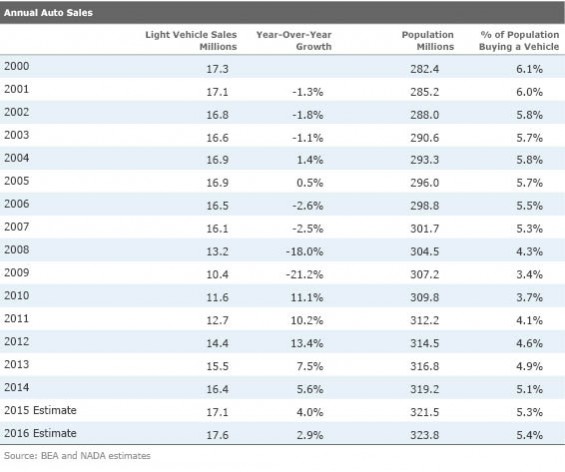

At the halfway mark for 2015, unit sales amounted to 8.5 million units or 17.0 million units on an annualized basis, up about 4% from the year-earlier period. Though the data for June wasn't much different than forecast, a lot of forecasters jiggled their full-year vehicle sales estimates. Notably, the National Association of Auto Dealers boosted its 2015 sales estimate from 16.9 million units to 17.2 million units. The association also set an initial estimate for 2016 of 17.6 million units. On a full-year basis, the all-time record high for auto sales was 17.4 million units in 2000. Unit auto sales got as low as 10.4 million units in 2009.

The infighting about whether current market conditions are better or worse than previous high-water marks remains intense. The bulls cite fewer incentives, greater industry profitability, and fewer workers. They also note that subprime auto loans are currently running at 11% of sales versus close to 20% in the mid-2000s. The bears note that while auto sales are near previous highs, adjusting for a much higher population per capita auto sales are still down about 14% from the level reached in 2000. The bears also note that the term of auto loans continues to lengthen, with many loans now exceeding seven years and some even more than eight years.

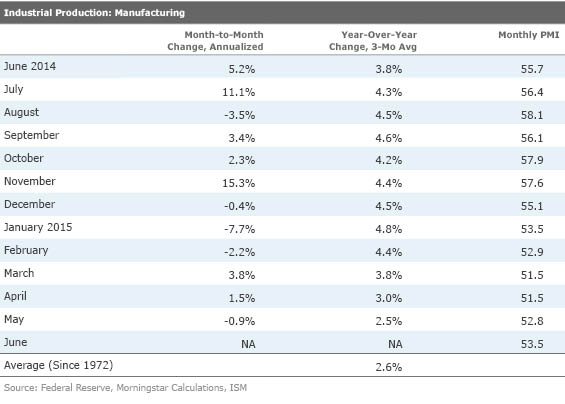

Purchasing Manager Data Suggest a Bottom for Manufacturing Manufacturing has had a tough year in 2015 with slowing exports, declining auto sales growth, and a soft energy patch weighing on the sector only for some time. Even employment in this sector is beginning to get hurt as there was no job growth whatsoever in June for manufacturing. Some of the reports on manufacturing seem to be showing some signs of bottoming and this month's purchasing managers' survey from the ISM showed the same thing, a bottoming but no boom.

The PMI index was flat in April and has now increased in both May and June, but is still well below the highs of last summer. New orders, the most forward-looking of the report subcomponents, also managed a nice month, with that part of the index increasing from 55.8 to 56. Overall 11 of 18 sectors were still in growth mode, too. It's always good to see growth distributed across many sectors and not limited to one or two great performers. Employment prospects also picked up, which came as a bit of a surprise, improving from 51.7 to 55.5. However, exports continue to be an issue as that index dropped below 50 to 49.5 in June, indicating a contraction in the export market.

At 10%-12% of the economy, the U.S. can't really afford to see more erosion in the manufacturing sector. Our best guess is that manufacturing could improve slowly from here. It's still too early to see any benefits from the investments in the petrochemical industry that aren't likely to show up until 2017 or 2018, when a couple of billion-dollar plants come on line. The short-term driver for manufacturing is likely to be an improving housing market that demands a wide variety of manufactured goods to build and even more items when consumers furnish those new homes.

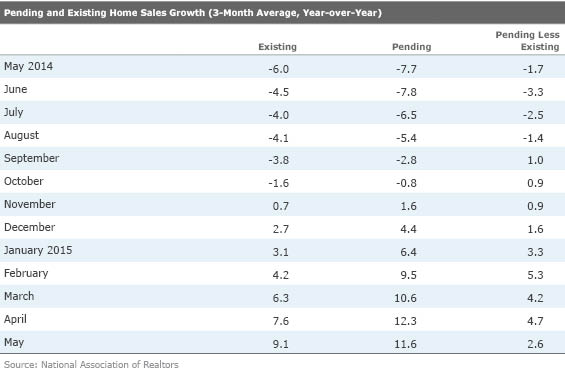

Hot Streak Continues for Pending Home Sales (by Roland Czerniawski) The volume of pending home sales advanced 0.9% in May, marking a fifth consecutive increase since the beginning of the year. With five out of six months of data now available, it is safe to say that housing made a comeback during the first half of 2015. Better weather and pent-up demand, coupled with consumers getting spooked by the prospect of rising interest rates, probably all contributed to the strong run so far this year. That being said, Lawrence Yun, NAR's chief economist, noticed something we've been talking about for the past few months. Home price growth has accelerated because of higher demand and relatively flat supply levels compared with last year, pressuring housing affordability and potentially crippling further advances. Home price growth now stands around 4 times the pace of wage growth, Yun notes, a level that doesn't promote a sustainable buyers' market.

Nonetheless, pendings are up 10% so far this year, and on a year-over-year three-month-average basis, pending home sales are up by double-digit amounts for the third consecutive month. Regionally, growth rates are strong across all census areas, with the West leading the pack at 13% year-over-year growth. The Midwest is the only region with single-digit year-over-year growth at 7.8%. Those are all solid results. If that pending homes contract activity through May translates into similar existing-home sales growth rates, as they usually do, we are on track to potentially one of best recovery years for the housing industry. Affordability will be a key factor going forward, and it should ultimately determine how successful this housing run will be.

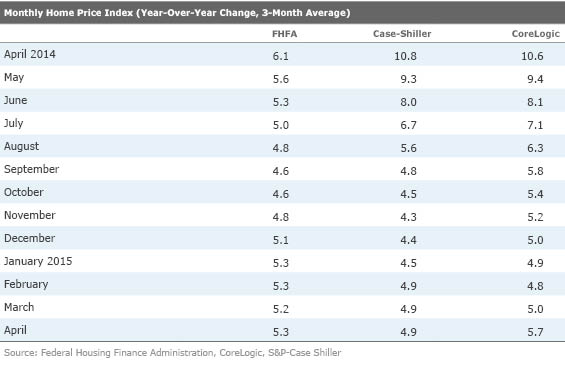

Data Suggests More Price Growth Acceleration Could Be Around the Corner (by Roland Czerniawski)

We've mentioned previously that the supply levels of existing homes are still emerging out of the winter slump, and are now similar to the levels we've seen a year ago. At the same time, it seems that demand has picked up more rapidly, putting an upward pressure on prices. After a meaningful moderation throughout the second half of 2014, home price growth has accelerated again. We predicted earlier this year that home prices would advance 4.0%–6.0% this year, and it is possible that the upper range of this forecast might be met or even exceeded. Neither FHFA nor this week's Case-Shiller showed a significant pickup in year-over-year price growth. Both metrics recorded a monthly gain of only 0.3% in April.

Trade, Job Openings, and CoreLogic Home Prices on Tap for Next Week We don't necessarily view the trade report as terribly important as it remains in a relatively narrow channel and exports comprise just 13% or so of GDP. That doesn't prevent violent quarter-to-quarter swings. Those wild moves are the biggest impediment, with the possible exception of inventories, to forecasting quarterly GDP. Combined imports and exports took a full 2% off of first-quarter GDP growth. The best guess right now is that trade will have no impact on the second quarter. At this moment that is just a guess, presuming that the horrible slippage in the first quarter was almost entirely due to West Coast port labor actions that will reverse out in the second quarter. April trade data supported that case and now the question is, will the May data continue the trend? For now, the consensus is for a modest worsening of the trade deficit in May from April's improved $40.9 billion. If that proves to be correct, the trade deficit for the second quarter could be a slight negative for the second quarter instead of completely neutral.

With the employment data relatively soft, the job openings report is likely to get a fair amount of attention next week. The data for April showed record openings that didn't really translate into strong jobs growth. With job gains relatively sparse in May and June, openings could remain above the 5 million level. If openings stay sky-high, it would suggest that job growth is not being limited by employers' desire to hire but by the lack of employees with the proper skills, which is an entirely different problem from the Fed is trying to fight with their policies.

With affordability issues heating up, as noted above, we will be watching the CoreLogic home prices indexes with a more careful eye. These reports have showed stronger price growth than either the FHFA or the Case-Shiller data, as noted earlier. It will be very interesting to see how these data sets converge over the next month.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)