Bond Market Midyear Review: The Calm Before the Storm?

The second half of the year is shaping up to be even more eventful than the first.

Bond-fund investors have had plenty to digest over the first half of 2015. Speculation on when the Federal Reserve will raise its benchmark interest rate, and by how much, remains at the top of this list given the broad ramifications that a change in U.S. interest rates would likely have on global asset prices.

A steady stream of headlines has also been coming out of Europe as Greece's debt crisis has mushroomed. There has also been a divergence in monetary policy among the world's major central banks as regions across the globe have been at different points in their economic cycles. As a result, relative currency valuations will continue to be crucial indicators.

Other major themes thus far in 2015 have included sharpened liquidity concerns in the otherwise rebounding domestic high-yield market, as well as volatility in the municipal market triggered by extra supply and fears around pockets of distressed credits.

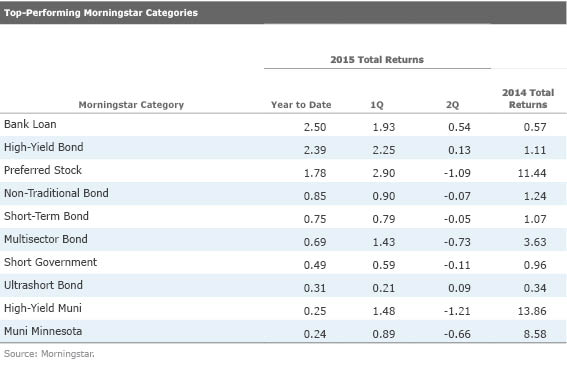

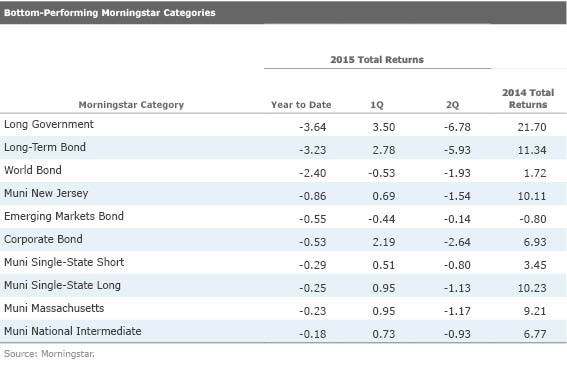

Against that backdrop, performance across the fixed-income Morningstar Categories has varied considerably. The following tables highlight the best- and worst-performing categories through the first six months of 2015.

Below, we recap several of the aforementioned themes from the first half of 2015. As these stories unfold in the coming months, the second half of the year is shaping up to be even more eventful than the first.

Watching the Fed Fixed-income investors continue to fret about the potential timing and magnitude of future rate hikes from the Federal Reserve. Coming into 2015, the general consensus was that the tightening cycle would begin in June, but after a round of economic data that was slightly weaker than anticipated, expectations shifted to a September rate hike or later. Taking action in September would allow the Fed to review the economic data from the second quarter and either confirm a stable and strengthening U.S. economy or hold off for further evidence before it decides to act.

Once the Fed lifts off, many market participants expect a very gradual move toward normalized interest rates. As of the June 17 meeting, the Federal Open Market Committee members--across the board--were anticipating that the Fed funds tightening cycle would be longer and slower than others had previously expected. At that point, the median projection for rates in 2016 by the 12 FOMC members declined compared with prior projections from March 2015 and December 2014, which suggests that we could see a more gradual and less aggressive rate-hike cycle.

It has been roughly nine years since the Fed last hiked its target short-term interest rate, so there is plenty of apprehension about how markets will respond when that eventually happens. In hopes of avoiding a repeat of 2013's "taper tantrum," the Fed has been trying to hold the market's hand in guiding it toward the first move. To that end, the Fed has been clear on its stance that economic data, which it continues to watch closely, is what will guide future policy decisions. In particular, the Fed has its eye on labor market data as well as inflation.

The U.S. economy appeared to be on solid footing at midyear, but other major developed economies, including those of Europe and Japan, still face challenges. That has led to a divergence in policies among the world’s major central banks, a key circumstance worth monitoring. While the Fed prepares to begin tightening, central banks across the eurozone and Japan continue to employ quantitative-easing programs in efforts to stimulate their respective economies.

Europe: Negative Yields on One Hand, Greece on the Other In fact, Europe has had an interesting ride so far in 2015, to say the least. Investors desperate for safe-haven assets amid negative sentiment across the eurozone drove bond yields into negative territory. As of February, sovereign bonds issued by several European countries were sporting negative nominal yields, including Germany, Switzerland, and Denmark. According to BlackRock, 25% of the European sovereign-bond market was trading with a negative nominal yield in April. The market was displaying its proverbial concern for the simple return of investment (principal) over the return on investment.

Then during the first week of June, following better-than-expected economic data for Europe and the United States, 10-year German bund yields spiked nearly 95 basis points from below 0.05% within a matter of weeks. That sparked a repricing of the entire European bond market, and Japanese government bonds sold off in tandem with bunds.

Midway through the year, the Greece story continued to drive volatility higher. Talks fell apart for a deal on June 18 when Greece's proposals were rejected. As of July 1, the nation had defaulted on a payment to the International Monetary Fund while waiting for results from a controversial Greek voter referendum on whether to accept the terms of EU proposals, which may no longer be on the table. A potential exit from the euro is looming for the ailing country, which finds itself under crushing pressure from both creditors and its own populace. The situation remains in flux and will likely remain critical through the back half of the year.

Currency Matters Fluctuating foreign exchange rates have been a big influence on both developed- and emerging-markets bond returns thus far in 2015, as well. The U.S. dollar strengthened, for example, climbing 3.8% against a trade-weighted basket of major currencies through June 26.

The yen, which showed some strength in March, was down 3.0% through June 26 relative to the U.S. dollar, while the euro shed 7.2% against the greenback. In early 2015, the Bank of Japan indicated that it may need to pull back on its stimulus because it could cause the yen to fall too far. It has played out accordingly: So far in 2015, losses versus the dollar have been more subdued compared with the 2012-14 period.

Turmoil Amid Emerging Markets For the most part, dollar-denominated debt has been the place to be among emerging-markets bonds. The JP Morgan Emerging Market Bond Index, which tracks U.S. dollar-denominated debt, for example, was up 1.4% for the year-to-date period through June 30. Over the same stretch, the JP Morgan Government Bond Index-Emerging Markets, which tracks local-currency debt, declined by more than 4.5% (in unhedged U.S. dollars). My colleague Karin Anderson recently wrote an article that takes an in-depth look at emerging-markets bond funds.

Bucking the trends, currency gains for the Russian ruble versus the U.S. dollar have helped lead a rebound there, with hard-currency Russian debt up 16.6% for the year through June 30 and local-currency Russian debt up 28.9%. Another oil exporter, Venezuela, has also shown a sign of recovery, with its hard-currency debt up 7.5% so far in 2015.

Ukraine hard-currency debt has recovered a bit lately as well, but it is still down 8.8% for the year to date, making it the poorest performer in the JPM EMBI Index. A group of creditors led by Franklin Templeton is still in negotiations over the terms of the debt and is pushing primarily for maturity extensions. The Ukrainian hryvnia has been the weakest currency versus the dollar in 2015, shedding 24.7% through June 30. The Brazilian real and Turkish lira were the next biggest losers relative to the greenback, with losses of 14.3% and 12.7%, respectively.

Junk Bonds Rebound High-yield bonds mounted a comeback in 2015, after being savaged in the second half of 2014. That period's collapse in oil prices caused widespread anxiety for those with exposure to high-yield bonds issued by energy companies. In particular, concern surrounded the fate of shale-oil firms, which in recent years have leveraged up their balance sheets by financing their expansions with corporate debt. Plunging oil prices along with the high cost of extraction rendered many of these firms unprofitable, which raised the prospect for an uptick in defaults down the road. Overall, the energy sector represents about 13% of the domestic high-yield market. Back in February, my colleague Sumit Desai covered the impact of energy prices on high-yield bond funds in detail.

Approximately one year ago (June 23, 2014), just prior to the oil-price swoon, the BofAML HY Master option-adjusted credit spread dipped as low as 3.35%. Fast forward to a year later, when the credit spread (as of June 26, 2015) stood at 4.65%. High-yield credit spreads actually contracted over the first half of the year, as coming into the year, the spread clocked in at 5.08%. This spread compression helped drive the bank-loan and high-yield bond categories' claim to the top two spots among all fixed-income categories at the midpoint of 2015, with category average returns of 2.5% and 2.4%, respectively.

Despite topping the list of year-to-date performers, asset flows into these below-investment-grade categories have been volatile. Given the significant growth of these comparatively illiquid categories over the past several years, market participants have raised concerns over a potential liquidity crunch if investors rush to redeem high-yield fund assets en masse as rates march higher. It remains to be seen if the market will be able to unwind in an orderly fashion if there is in fact a rush to unload high-yield credits.

Several Morningstar Medalist funds in the high-yield bond category posted impressive performance relative to the benchmark and category average for the first half of the year. For the year through June 30, 2015, the average high-yield bond fund was up 2.39% and the BofA Merrill Lynch High Yield Master II Index rose 2.50%.

Choppiness in Muni Bonds as New Supply Comes to Market Muni-bond market volatility has been more prominent in recent months, though, resulting in some weak performance among muni funds. Supply in the muni market has also been more robust this year, driven largely by issuers advance-refunding outstanding debt to take advantage of lower rates before the expected Federal Reserve rate hikes. That surge, combined with rising-rate fears, have been a lot for the muni-bond market to absorb. Yet, thanks to a strong start of the year, most of the muni-fund categories are still showing moderate asset inflows so far in 2015.

However, demand has waned recently, with most of the national muni categories experiencing outflows in May amid tight valuations. This was especially the case in the high-yield muni market, where credit concerns regarding large stressed issuers such as Chicago, the State of Illinois, and Puerto Rico have caused apprehension among investors. Looking ahead, muni headlines to watch through the balance of the year include upcoming budget seasons for states, the pension crisis in Illinois, and the increasing credit stress in Puerto Rico debt.

Long-Term Bonds Take It on the Chin The most volatile fixed-income categories over the past year were emerging-markets bond, long-term bond, and long government. The two long-term categories were at the extreme end of the performance spectrum, topping the list of worst-performing fixed-income sectors for the year-to-date period through June 30.

As expected, yields at the longer end of the curve started to inch higher in anticipation of Fed action later this year. After starting off the year at 2.18% (as of Jan. 2), the 10-year U.S. Treasury yield had fallen to 1.68% by Jan. 30 before climbing back to 2.40% as of June 26. The 30-year U.S. Treasury yield saw an even more pronounced rise through the first half of 2015. After touching a low of 2.25% at the end of January, the yield on 30-year Treasuries had climbed steadily to 3.16% as of June 26.

Of course, with a Fed rate hike presumably around the corner, investors have been eager to shed the duration risk of long-maturity bonds.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)