Economic Outlook: Stuck in Neutral as We Cling to Cash

Corporations have become so focused on conserving capital that long-term growth prospects are diminished.

- The economy is still stuck in its 2.0%-2.5% growth rate.

- Easing manufacturing growth and a slow-to-recover housing industry are holding back economic growth.

- Corporations are merging and buying back stock--not investing--which is reducing growth prospects and amplifying the potential for inflation.

Despite a lot of ups and downs over the last three months, our full-year economic forecast remains relatively unchanged since our last report. Our full-year GDP growth forecast remains steady at 2.0%-2.5%, as it has for the last three years. We see nothing that would cause the economy to break sharply out of that channel.

Also, we are not changing our full-year forecast despite a first quarter that was disappointing to many. Weather and poorly constructed seasonal adjustment factors produced a decline, just as they did in 2014. The first quarter of 2015 also suffered further from labor actions at West Coast ports that shifted the flow of imports and, to a lesser degree, exports.

Just as in 2014, we expect unusually large growth rates in the back half of the year to make up for the shortfall in the first quarter. This implies that growth will need to average over 3% for the last three quarters of the year. That said, we don't expect the bounce to be quite as large as in 2014. The first-quarter inventory drawdown was not nearly as dire in 2015, which means the subsequent bounce-back can't be nearly as large, either.

Inflation is likely to run considerably higher in 2015 than either 2013 or 2014 on a fourth-quarter to fourth-quarter basis. Core inflation (excluding food and energy) will likely be around 1.7% for 2015, very similar to the last two years, but the ups and downs of energy prices will cause headline inflation to accelerate in 2015, especially if energy prices don't fall soon.

We are still scratching our heads over how employment growth in 2013 and 2014 accelerated so sharply even as GDP remained stuck in its same old rut. Our feeling is that the next set of economic revisions will likely bring these two metrics, GDP growth and employment growth, into closer alignment. Without those revisions, we surmise that employment almost has to slow in 2015 relative to 2014. Still, with a falling participation rate and retiring baby boomers, we suspect that the unemployment rate will continue to fall, perhaps as low as 5% by year end.

We suspect that overall employment growth will be modestly lower in 2015, which might not be an entirely bad thing given the labor market shortages that are brewing due to the retirement of the baby boomers. However, hourly wage growth, even adjusted for inflation, should more than offset stagnant employment growth rates and cause total wages paid to increase in 2015. That wage growth in turn should keep the overall consumption rate moving at a slightly better pace than in 2014--though, again, the acceleration isn't likely to be large.

We have continued to be too bullish on interest rates and bearish on the ownership of bonds. We have always felt that without Fed intervention, the 10-year bond should trade at some fixed spread above the inflation rate: perhaps a spread of 2.5% to 3% at high inflation rates and maybe between 1.5% and 2.0% at low inflation rates (the difference is at least partially related to the fact that inflation gains are fully taxed, requiring a higher spread to pay the taxes). If you take our year-end inflation forecast of around 2% and add 1.5% to that, you can see how we got to our U.S. 10-year bond rate forecast. As the Fed is still manipulating that rate some, we are allowing for a lower potential interest rate than our normal methodology might suggest.

We were feeling quite silly about our forecast in January and February when the 10-year rate got as low as 1.6%, driven not by fundamentals, but by quantitative easing programs in other countries. Money being the ultimate fungible commodity, some of the non-U.S. easing found its way back into the U.S. rate structure. As Europeans sensed an uptick in their economy and as speculators that had bid bond rates to a negative return came to their senses, German bond rates surged in the second quarter, with the German 10-year bond getting close to 1% at one point. This in turn caused U.S. 10-year rates to surge to a yield of over 2.4%. Now we don't feel quite as silly about our forecast, though we admit to being a little closer than we like to the lunatic fringe with our 3.0%-3.5% forecast for U.S 10-year rates.

While the top end of our housing price forecast range hasn't changed for 2015, we keep chopping numbers off the bottom range. Although we still have a 5% to 6% housing price increase estimate (which at one point was a range of 4% to 6%), it is looking more and more like we will hit the upper end of that range. Demand seems somewhat better, but on the supply side, housing starts still look pretty anemic and inventories of existing homes still aren't really moving up, which is keeping continued pressure on prices.

Housing Not as Strong as Hoped Speaking of housing, it may not be a big adder to the economy in 2015 and may not even meet our more modest expectations. We had been hoping housing starts might make it as high as 1.15 million units in a range of 1.1 million units to 1.15 million starts; it now looks like 1.1 million units might be the best case and not the worst case. Don't get us wrong; that is still a 9% gain, but not nearly as large as the 12% guess that we started the year with. Our existing home sales forecast remains intact at 5.3 million units with a slight bias to the upside.

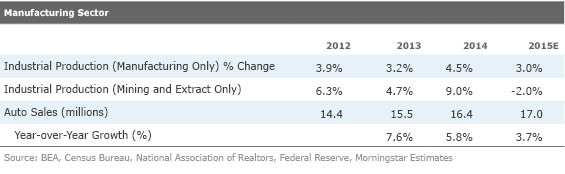

For most of the last six months, we have been more negative on the economy than the consensus (although now we are at about consensus), largely due to worries about the manufacturing sector. Unfortunately many of those worries have come true.

The manufacturing economy, along with the auto industry and the oil and gas industries, have been the unsung heroes of this recovery. Manufacturing overall probably accounts for 15% of U.S. GDP (including mining and extraction and the auto sector) and housing for 3%. The trends in these key sectors were not good going into the year with the exception of maybe housing. Now all four are looking a bit underwhelming.

Note, we aren't forecasting any kind of disaster for these groups or the economy. We are just recognizing some key economic drivers aren't growing as fast as they were--and that will keep the economy from rebounding as much as many had hoped. Those 3%-4% GDP growth forecasts for 2015 (or even 2016 for that matter) are looking a little silly.

Demographics will also hold back the overall growth rates for some time to come. Low population growth (0.7% now, instead of 1.8% in the 1960s) is likely to keep the economy from growing any faster than our 2.0%-2.5% forecast, versus the average GDP growth rate over the last 50 years of around 3.1%. In addition, it isn't helping that the fastest-growing age group in the U.S. economy is the miserly 65 and over crowd, while the absolute number of free-spending, high-income 50 year olds will be in a pattern of decline over the next five to 10 years.

Corporations Adapt for Slower Growth While Equity Markets Expect an Expansion High valuations cited by our analysts in our sector outlook reports, as well as sector performance over the last several quarters, suggest that investors are expecting the economy to shift back into high-growth mode. Meanwhile corporations seem more focused on making the most of what they view as a limited opportunity set.

First the investor point of view: In general valuations remain high, with our coverage universe trading modestly over fair value on average, as it has for most of the past several years. The sector performance data show investors continuing to favor growthier areas and shunning slower-growth sectors. For example, utilities were by far the worst performers, down in both the quarter and year to date. This drop has been sharp enough to push this sector off of the list of grossly overvalued stocks. Meanwhile, health care and technology have both been big movers on the upside, along with consumer cyclicals. By size, geography, or style, there was no discernible difference in performance data for the latest three months (and little change in quarterly prices); year-to-date performance shows a huge bias toward growth stocks and non-U.S. markets.

Corporations Merging and Buying Back Stock, Not Investing

Meanwhile corporations continue to collectively sit on their hands and their piles of cash. In reading through our analysts' individual sector reports, it's hard not to notice that firms are on a merger-and-acquisition binge, with secondary interest in stock buybacks (most likely buybacks will set another record in 2015). Even technology powerhouse

We are particularly sickened by the drug industry where, instead of innovation, the latest trend seems to be purchasing companies that are underpricing their drugs or services and then immediately jacking up prices while cutting any new research on those same activities. (In fairness, some of the higher prices could eventually lead to more capacity increases to eliminate some of the current bottlenecks in drug production. Capacity constraints and plant failures have led to an unusually large number of shortages of literally hundreds of decades-old drugs.) Even on the innovation side, the drug companies seem to be focusing on specialty niche products that have limited competition and that can generate huge revenues per dose. There just doesn't seem to be much talk of new mass-market drugs.

The food industry has been equally as guilty with their latest "innovation," exemplified by a major spice company that has kept its product containers the very same size while filling each container with less product and charging the same price. Shrinking the sizes of things has been standard operating procedure for years, but putting a smaller amount in the very same-sized package takes the game to a new, even more disgraceful level.

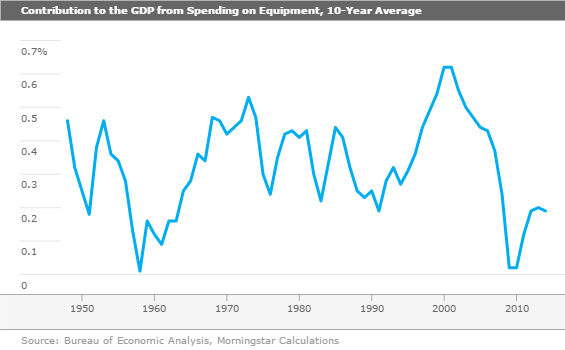

By at Least One Metric, Corporate Spending Isn't What It Used to Be Although there are probably a million different ways to look at capital spending data, it is clear that corporate spending, at least on any type of equipment, just isn't what it used to be. Below is a graph of corporate equipment spending's contribution to GDP growth since the 1940s on a 10-year averaged basis. The U.S. economy is clearly closer to record lows than record highs on a 10-year averaged basis.

By the way, one other data point to consider is that the stocks of capital goods producers have done worse than the market as a whole over the past year. Taking a longer view, the economy has gone from investing, expanding, and growing at any cost in the 1950s and 1960s (which created its own set of wastefulness and economic booms and busts) to being so focused on conserving capital that long-term growth prospects are diminished.

Lack of Capital Spending Combined With Labor Market Shortages Increases Inflation Risks We might add that labor market shortages combined with limited spending on capital goods is not a good combination for the longer-term inflation outlook. Old plants can be chicken-wired together only for so long. Even modest growth could create shortages and higher prices.

Reading some of the details of recent mergers in the food industry, I was shocked to find that many of the U.S. food production lines are over 50 years old. Elsewhere, the housing industry could find it exceptionally difficult to get anywhere near its old production highs, given the capital, labor, and equipment that have been taken off line. I suspect that even the auto industry, which is notorious for its expansion binges, is nearing some types of capacity constraints.

But the U.S. Has Been in This Bind Before, and Eventually Thrived

We could have said a lot of these same things about corporate spending five or 10 years ago, but we have indeed more than muddled through. New oil and gas drilling technologies were truly game-changers, dramatically reversing a 30-year downtrend in U.S. oil production, which was thought to be irreversible. Plus, the innovations, investments, and growth at

More Quarter-End Insights

- Stock Market Outlook: Pick Your Spots Carefully

- Credit Markets: Investment Grade Struggles, While High Yield Outperforms

- Basic Materials: China Slowdown Weighs on Commodities (With One Exception)

- Consumer Cyclical: Assessing Disruptions in Restaurant, Retail, and Travel

- Consumer Defensive: Top-Shelf Picks for a Cautious Spending Environment

- Energy: No Rapid Rebound for Oil Prices

- Financial Services: A Favorable Outlook for Insurance

- Health Care: A Few Stocks Still Offer Upside

- Industrials: Stronger U.S. Dollar, Weaker Energy Activity Weigh

- Real Estate: Rising Interest Rates Wreak Havoc on REITs

- Tech & Telecom: M&A Heats Up, and the Cloud Changes the Landscape

- Utilities: Starting to Look Attractive After a Woeful 2015 Start

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)