The Problem With Alternative Investing

The funds are misused.

Good Intentions, But a Very Warm Path Alternative investments make much sense in theory, but the practice is wanting.

Finance classes teach about the vendor who brings umbrellas to her lemonade stand. If the weather is fair, she sells drinks; if not, she hawks umbrellas. Either way, she does business. (If the vendor lived in Chicago, she would offer gloves as a third asset, to sell on the cold, clear days, but, as she resides on a desert island, the two items suffice.)

The better parable, however, is yin and yang. The concept of yin and yang suggests the duo’s completeness, as between conventional and alternative investments the full investment universe is described. The concept also conveys the interdependence of the relationship. Unlike with lemonade and umbrellas, conventional and alternative investments are each defined by the other. Without alternatives, the notion of a "conventional" investment would not exist. And without conventional investments, alternatives would no longer be alternative.

Few investors, however, view the matter so holistically.

The proof lies in the asset flows. By and large, stock-fund shareholders have learned to live with market losses. While U.S. equity mutual funds did have net outflows following 2008’s plummet, the redemptions were moderate, never amounting to more than 3% of the industry’s assets during any calendar year. As a result, stock-fund investors were well positioned to catch the ensuing rebound. Steady asset bases mean that shareholders experience the good along with the bad.

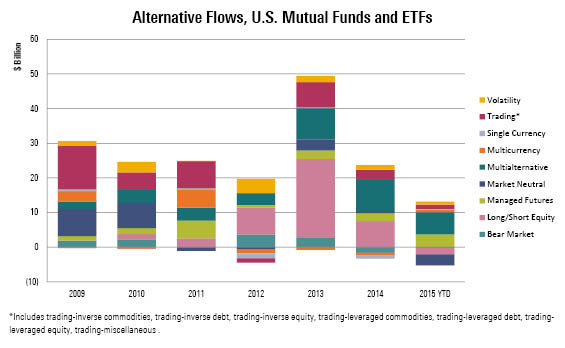

In contrast, alternatives investors lack patience. The chart below depicts the annual net flows of several alternatives investment categories. The red bar of trading strategies (that is, leveraged market-index funds) came, went, came again, and went. The blue bar of market-neutral funds was seen in the first two years, then disappeared. The pink bar of long-short equity suddenly burst to prominence, then turned negative. The orange bar of multicurrency appeared in two of the first three years, then vanished.

- source: Morningstar Analysts

That is the color of failure. The bars show fund investors chasing the hot investment categories, always arriving after the good news. That chart looks much like a diagram of sector-fund flows--which is no compliment. Sector funds are an ongoing fund-industry failure, continually tempting investors to yield to their worst instincts by buying high and selling low. So, too, have alternatives funds.

And for the same reason. If fund investors truly viewed alternatives as a necessary part of the portfolio, as the yang to conventional funds’ yin, they would accept their performance downturns as patiently as they accept stock market declines. But investors don’t. They think of alternatives as another flavor of sector fund--an optional slice that makes the owner (or the advisor who made the recommendation) look smarter than the everyday rabble if the fund performs well. If the fund does not perform well, then it’s off to Plan B. Or Plan C.

As usual, financial writer (and advisor) Bill Bernstein gets at the heart of the issue. When asked by ETF.com about the currently popular tactic of currency hedging, Bill responded, "It's performance chasing, closing the barn door after the horses have escaped. There's nothing wrong with hedging your equity exposure. But you have to have a consistent strategy. If you're going to hedge your currency exposure, then you should do it 100% of the time. Starting to hedge after a period of high hedging returns is a bad idea."

Exactly. If investors are to own alternatives, then they need to own that particular mix of funds 100% of the time. Flitting from one type to another is taking the road to investment hell.

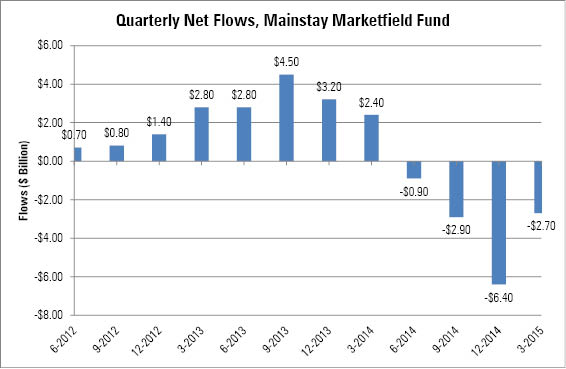

Consider the rise and fall of

(Marketfield also serves as a shining example of the dangers of relative unpredictability, discussed in last week's column. Marketfield dropped but 12% last year and has been abandoned by most of its owners. In contrast, stock market index funds fell 37% in 2008 and suffered at most only modest redemptions and at best enjoyed net new sales. Marketfield's sin was not the size of its loss but that the loss came unexpectedly.)

Buy high, sell low. It’s the alternatives way.

- source: Morningstar Analysts

The Fix If alternatives are to succeed in actual portfolios, as opposed to on paper, they will need to cultivate a much steadier shareholder base. That will be a difficult task for most existing alternatives funds, which follow a single strategy. Just as few investors own a wide range of sector funds, preferring instead to hold one or two favorites, so, too, do they cherry-pick with single-strategy alternatives funds. That habit is unlikely to change.

For me, the fix is simple: solution funds. If investors won’t treat alternatives as yang, but instead as tools for speculation, then create the yang for them. Offer them a so-called solution fund that bundles together all the necessary alternatives strategies so that an investor who owns a solution fund will have the complete yang package. As such, a fund will be very broadly diversified; it will likely have muted, dull returns that will discourage performance chasing. It will play its role quietly, as bond funds generally do.

Happily, things seem to be moving in that direction. The industry already offers such packaged funds, called "multialternative" funds by Morningstar and shown with a dark green bar in the first chart. After a slow start, sales have improved such that multialternative funds were the best-selling alt-fund category last year and again so far this year. Perhaps investors and the advisors who serve them are realizing the best way to trade alternatives funds is not to trade at all. And the best way not to trade is to buy the existing solution of a multialternative fund rather than dabble with single-strategy funds.

Moving to solution funds won’t solve the other big problem with alternatives funds: high costs. But that’s a topic for another occasion.

Blackhawks Not Down Yesterday, I should have been at my eighth-floor window, watching the Chicago Blackhawks parade. However, because of Washington Street construction, the march was re-routed and did not pass along the Morningstar office. Well, there's always next year. That's a phrase that means something quite different when said about the Blackhawks than when said about the Chicago Cubs.

Edit: When writing this column, I had forgotten what I was once told--Morningstar provides the underlying index for a multialternative exchange-traded fund offered by ProShares. I intended (and intend) no endorsement of that fund.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)