Tech and Telecom: M&A Heats Up, and the Cloud Changes the Landscape

Mergers and acquisitions are ramping up (as are rumors), but with the sector slightly overvalued, we stick to fundamentals and seek firms with established economic moats.

- Foreign exchange will still have an impact on 2015 results, but we haven't seen it affect the tech spending environment all that much; the sector still looks 5% overvalued, and we'd be selective.

- We expect spending on cloud applications to grow nearly 20% annually to reach $62 billion by 2019. Improving sales and marketing efficiency will drive significant operating leverage at many software-as-a-service firms.

- The telecom market overseas is still consolidating; European activity is being led by convergence but still may slow following the appointment of its new antitrust chief.

Despite a modest increase for the S&P 500 through the first half of 2015, it hasn't been a particularly smooth ride for investors. Performance for the technology sector in aggregate has been slightly stronger, up around 3%, but there were notable areas of strength and weakness. Global currency movements over the past two quarters have resulted in slightly elevated volatility across both the technology and communications-services sectors, but the overall tone from management teams has been fairly positive in terms of the macro environment. In aggregate, we view the tech sector as slightly overvalued and remain selective in our picks.

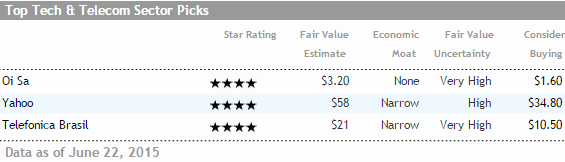

In the following table, we highlight a few companies in technology, media, and telecom that appear to be fundamentally undervalued. All three have significant international exposure in some form or another, a factor that investors will want to keep a close eye on since we don't explicitly offer currency forecasts, though they are baked into our uncertainty ratings.

Taking a step back, with these three subsectors trading above their respective fair values, we would prefer a wider margin of safety in most cases. We are quick to gravitate toward firms with established economic moats, those with strategic assets, and those that are well-positioned in key growth areas. We believe firms with this combination should be in a better relative position to withstand near-term revenue and operating margin volatility, while offering long-term free cash flow growth potential.

In our numerous discussions with clients about cloud-applications companies (also referred to as software-as-a-service, or SaaS, companies), we find a wide array of opinions about their long-term profit potential and ability to generate excess returns on capital. The lack of consensus is no surprise--current GAAP operating margins for many firms are extremely low or negative, especially compared with successful on-premises software firms. Blind faith (or its enemy, dogmatic skepticism) has driven the bull (and bear) case for legacy software firms facing the disruptive forces of cloud computing and pure-play cloud providers recording strong revenue growth but paltry profits. We expect spending on cloud applications to grow nearly 20% annually to reach $62 billion by 2019, paced by the customer relationship management segment, which should represent almost half of overall cloud spending.

Improving sales and marketing efficiency will drive significant operating leverage at many SaaS firms. Although they appear to be woeful on a GAAP basis, the cost of maintaining customers should be markedly cheaper than the cost of acquiring them. Even as growth has slowed, we anticipate that SaaS companies may be able to drive sales and marketing costs below 25% of sales in many instances. We also anticipate research and development leverage as products mature and cloud application companies realize the benefit of supporting only one version of each software product. These expenses are currently quite high, depressing cash flow and profitability, but growth in this expense category should slow as products mature and functionality becomes more fully featured. Similarly, SaaS providers with the highest switching costs are unlikely to suffer from price competition, and we expect pricing to increase, even when the industry matures. Currently, on-premises software firms have had the ability to increase pricing for maintenance and support services, and we expect cloud application pricing to follow a similar path. This pricing power is critical as we consider normalized financial models and returns on capital.

Semiconductor mergers and acquisitions are heating up, with high-profile deals at Intel and Broadcom. On June 1, Intel and

The Wall Street Journal

. We maintain our wide and narrow moat ratings for Intel and Altera, respectively, and expect the deal to clear regulatory hurdles after being approved by both companies' boards.

We view this deal as initially complementary from Intel's perspective. Altera's product portfolio of programmable logic devices is tailored to market segments where Intel does not have a significant presence, such as wireless and wireline communications infrastructure. In a declining personal computer industry, this acquisition provides Intel with additional areas in which to leverage its manufacturing leadership. Recently, Altera has been the main customer for Intel's foundry offerings in 14-nanometer process technology. We believe that by bringing Altera's business in-house, Intel can more optimally use its excess capacity and ultimately realize synergies in research and development that weren't plausible in the pre-existing foundry relationship.

On May 28, in conjunction with the release of its fiscal second-quarter results, Avago AVGO announced that it has entered into a definitive agreement to acquire Broadcom. Total implied consideration is set at $37 billion, consisting of $17 billion in cash and $20 billion in stock. Management from both companies highlighted areas for potential R&D collaboration that were a bit more optimistic than our expectations. Yet for Avago, we view the deal as much more attractive financially than strategically. Avago will diversify into new products and end markets like TV set-top box, broadband access, and wireless connectivity solutions, but more important is paying a reasonable price for such diversification. In networking, management touted cross-selling opportunities, but we still don't think Avago will unlock significant hidden value in Broadcom's industry-leading networking business. Ultimately, we think our viewpoint is embedded within Avago's long-term financial targets, as 5% average revenue growth doesn't point to extending Broadcom's reach, but a 40% adjusted operating margin target implies hefty cost-cutting (consistent with $750 million in operating expense synergies as announced) and cost savings thereafter.

Perhaps the biggest boost to Broadcom's underlying business from the deal (and, similarly, the biggest source of value unlocked by Avago for buying the firm) is the reduction of Broadcom's customer concentration risk as part of a combined company (which will be named Broadcom Limited, even though Avago is the acquirer in the deal). As part of a combined company with greater size and scale, Broadcom Limited will be better able to weather the storm if its connectivity or broadband segments underperform. Similarly, Avago's purchase premium for Broadcom could look even more attractive, in our view, if the combined firm can mitigate these concentration risks over time.

Consolidation, regulatory policy, and technology themes continue to converge in the U.S. telecom industry. The Federal Communications Commission remains active across the industry, recently adopting new regulation intended to ensure an open Internet. These rules, which more stringently regulate Internet access services, are unlikely to radically reshape the economics of the U.S. telecom industry. We caution investors, however, that regulatory risk is nearly always present with the telecom sector given the view among many regulators and politicians that Internet access and phone services constitute essential public goods. In addition, regulators continue to consider the implications of significantly greater media concentration that the proposed acquisitions of

The conclusion of the AWS-3 wireless spectrum auction also promises to remake the telecom landscape. The auction garnered $45 billion in gross winning bids, far more than we had expected. We believe

Consolidation is occurring in Europe, within countries and across national borders.

), the largest cable operator in France, has acquired SFR, the country's second-largest phone company. European Union regulators approved

's (

) purchase of

's (

) German subsidiary E-Plus, and this deal has now closed. Recently announced deals include

One of the drivers of European M&A is the movement to converged services of fixed-line telecom, broadband, and pay television with wireless telephony. We believe convergence will be a major theme going forward and will enable the lead operators to increase margins and free cash flow. In anticipation of these expected improvements, we've increased our moat trend for Telefonica to positive and for Orange and Numericable-SFR to stable from negative.

In general, however, we anticipate global mergers and acquisitions across the telecom industry to continue, which is reflected in higher stock prices in many cases. There are still pockets of value across the global telecom space, but most come with baggage in the form of lagging sales growth, higher legacy costs, or poor macroeconomic conditions, so we encourage investors to be highly selective.

Oi SA

OIBR

In Brazil, Oi now has nearly 18 million lines in service, making it the country's largest fixed-line provider. Its wireless operation, Oi Movel, controls more than 50 million wireless customers and is Brazil's fourth-largest cellular provider, with 18% market share. The firm has roughly 75 million revenue-generating units, or RGUs, among its corporate, telephony, broadband, and television subscribers. The 2014 merger with PT adds an extra 27 million RGUs, bringing the total for the combined entity to more than 101 million. The company carries a lot of risk owing to its leverage, but the firm still has a few things going for it. Industry consolidation in whatever form should help all the players, plus data and converged services are beginning to take off and provide significant long-term growth opportunities for Oi.

Yahoo

YHOO

Yahoo is one of the most heavily visited collection of websites on the Internet. Some of its more trafficked websites include Yahoo Search, Yahoo Mail, and Yahoo News. The company has undertaken significant effort to offload nonstrategic businesses and outsource the underlying search algorithm and operations to

Telefonica Brasil SA

VIV

Telefonica Brasil provides fixed-line services in Sao Paulo and mobile service throughout the entire country. On the fixed-line side, the firm provides international long-distance services. As of the end of 2014, its telephone network included 10.7 million fixed lines in service, 3.9 million broadband clients, and more than 771,000 pay-TV clients. On the mobile side, Vivo was created by merging five independently operating subsidiaries that were all using the Vivo brand. It now has more than 77 million subscribers. Ultimately, merging the fixed and mobile units should create a more economically efficient entity. That, coupled with a robust dividend and a strong balance sheet, makes Telefonica Brasil an attractive defensive bet on an emerging market.

More Quarter-End Insights

- Stock Market Outlook: Pick Your Spots Carefully

- Economic Outlook: Stuck in Neutral as We Cling to Cash

- Credit Markets: Investment Grade Struggles, While High Yield Outperforms

- Basic Materials: China Slowdown Weighs on Commodities (With One Exception)

- Consumer Cyclical: Assessing Disruptions in Restaurant, Retail, and Travel

- Consumer Defensive: Top-Shelf Picks for a Cautious Spending Environment

- Energy: No Rapid Rebound for Oil Prices

- Financial Services: A Favorable Outlook for Insurance

- Health Care: A Few Stocks Still Offer Upside

- Industrials: Stronger U.S. Dollar, Weaker Energy Activity Weigh

- Real Estate: Rising Interest Rates Wreak Havoc on REITs

- Utilities: Starting to Look Attractive After a Woeful 2015 Start

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2M6HBDLIZD3RLWRUR7IPUIVIU.jpg)