Weighing in on PIMCO's Prospects

An update on the firm eight months after Bill Gross' departure.

Eight months after Bill Gross' abrupt departure from PIMCO on Sept. 26, 2014, the dust is finally starting to settle. Below, we provide an update on the firm, assess the impact of recent outflows, and recap the Morningstar Analyst Ratings on funds that we've been keeping a close eye on since Gross left.

PIMCO Is in Better Shape Than Expected

Reassuringly, fears that PIMCO would suffer mass defections following Gross' exit have not materialized. There have been a few notable departures, among them Saumil Parikh, who led

The firm has continued to invest in its research effort. The addition of several high-profile advisors and consultants--including former Federal Reserve chairman Ben Bernanke, former White House advisor Gene Sperling, and Nobel laureate Michael Spence--provides added heft to the firm's macro research effort, while former Morgan Stanley chief economist Joachim Fels joined the firm as global economic advisor. Meanwhile, chief investment officer Dan Ivascyn has shored up the teams supporting Mihir Worah and Mark Kiesel, both of whom took on an expanded role as comanagers on

The return of several high-level investment staff in the months after Gross' departure is also a positive signal that the firm's culture has improved in the post-Gross era. These include Chris Dialynas, an Investment Committee member and longtime PIMCO generalist portfolio manager, and Marc Seidner, who serves as CIO for nontraditional strategies; heads up the firm's New York office; leads PIMCO Unconstrained Bond; and serves as a full-time member of the firm's Investment Committee. Jeremie Banet's return in late 2014 provides additional support to Worah on the firm's real-return strategies, while David Hammer rejoined PIMCO's municipal-bond effort in New York in March.

It's clear that Ivascyn is placing an emphasis on increasing communication within and across investment teams and making sure that conflicting views are heard. He has succeeded in bringing a broader range of voices to the table, which informs vigorous debate around the key macro views that are ultimately formulated within the Investment Committee and then expressed across the PIMCO portfolios

Finally, the May 2015 announcement that PIMCO will shutter several of its equity funds and that equity CIO Virginie Maisonneuve would be leaving the firm is not a red flag in terms of the broader investment team's stability. Three dividend-oriented funds under Brad Kinkelaar and PIMCO's global long-short strategy under Geoffrey Johnson remain intact. Going forward, PIMCO will focus its $50 billion equity business on physical stock versions of the RAFI-index-related strategic-beta offerings crafted by Research Affiliates under Rob Arnott and on its "portable alpha" capabilities (

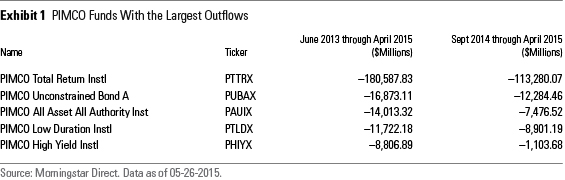

Outflows, While Lessening, Remain a Concern

Outflows following Gross' departure have been staggering. PIMCO Total Return alone shed an estimated $180 billion in net assets between mid-2013 and May 2015, with the bulk of redemptions coming since September 2014. Those redemptions, taken together with other hard-hit strategies, including PIMCO Unconstrained Bond,

Outflows from PIMCO Total Return have finally started to slow, dropping to approximately $2.7 billion in May 2015. There are reasons to believe that outflows might continue to decline, barring a major departure from the investment team or a period of significant underperformance. According to PIMCO's management, the firm has seen more stability in its business outside of the United States, where assets were less concentrated in Gross-run strategies. Even in the U.S. there have been several strategies enjoying sizable inflows, including

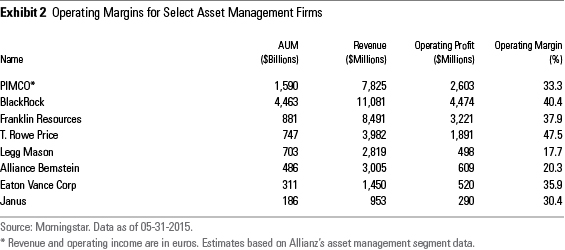

In November 2014, we estimated that PIMCO could take a roughly $300 billion to $350 billion hit to its $1.88 trillion assets under management over a three-year period before suffering an impact on its profit margins sufficient enough to affect its ability to invest in its business. From 2013 to 2014, PIMCO's operating margins fell from an estimated 37% to 33%, worse than we expected, but even with the decline, its profitability is still within a range of other well-run asset managers of comparable size. Exhibit 2 highlights the estimated operating margins for PIMCO and other select asset management firms:

PIMCO's long-standing and supportive relationship with its corporate parent Allianz should buy it time to withstand outflows. Allianz recently raised its dividend to shareholders, which increases pressure on the firm to maintain its profitability, but has thus far been supportive of PIMCO's decisions to continue to invest in its business. That said, continued outflows and their potential impact on the firm's ability to attract and retain investment staff remain the biggest unknowns for the firm as it emerges into the post-Gross world.

PIMCO Fund Ratings Recap

Following Bill Gross' September 2014 departure, we updated the Morningstar Analyst Ratings on all PIMCO funds under coverage. Since the beginning of 2015, we have revisited our ratings on a number of funds, and all ratings reflect our cautious optimism on the firm's prospects. Our highest ratings go to funds we've long thought highly of and whose management teams and strategies have remained consistent since Gross' departure, including PIMCO Income (run by Dan Ivascyn and Alfred Murata),

We summarize our view on several strategies with recently revised ratings below.

PIMCO Total Return and PIMCO Low Duration In April 2015, we reaffirmed our Bronze ratings on PIMCO Total Return and PIMCO Low Duration. While it will take time to see how the three new portfolio managers on PIMCO Total Return settle into their new roles, and flows remain a concern, the ratings reflect our conviction in the strength and depth of PIMCO's investment team. Scott Mather, who previously headed up the fund's global portfolio management group and has taken the lead at both funds, is supported by Jerome Schneider (head of PIMCO's short-term desk) at PIMCO Low Duration and Kiesel (CIO global credit) and Worah (CIO asset allocation and real return) at PIMCO Total Return.

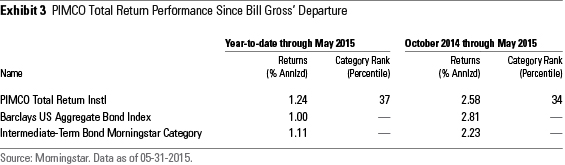

Both funds' heavy outflows do not appear to have significantly affected their performance. PIMCO Total Return, in particular, has benefited from recent portfolio positioning, including a significant bet on the strength of the U.S. dollar against the yen and the euro in late 2014 and early 2015, as well as allocations to high yield so far in 2015. Exhibit 3 shows the performance of PIMCO Total Return:

There is still a risk that performance for PIMCO Total Return could be negatively affected should outflows pick up significantly because of additional management departures or underperformance, or should the bond markets face a liquidity crunch.

PIMCO Unconstrained Bond When Marc Seidner then took over lead portfolio responsibilities upon Saumil Parikh's January 2015 departure, he became the fourth manager to run the fund in less than 18 months. PIMCO certainly has the resources to make good use of this fund's broad mandate, and Seidner has an impressive resume. He's also backed by an experienced team, with Ivascyn paying particularly close attention to this fund as a named comanager. However, the number of changes to the fund's investment team and questions regarding the fund's implementation of an unconstrained mandate support its Neutral rating.

PIMCO Global, Foreign, and Emerging-Markets Bond Funds We recently reaffirmed these funds' Bronze ratings. The global-bond fund under Andrew Balls appears solid and has experienced little turnover during the past several years. Although his responsibilities have increased considerably, the additions of comanagers Sachin Gupta and Lorenzo Pagani should help to alleviate the workload. The trio is also backed by nearly 50 developed- and emerging-markets managers in several locations worldwide. One area we'll continue to watch is the funds' exposure to emerging-markets debt. Balls recently acknowledged that the fund may own more emerging-markets debt over time. This bears further monitoring, as the funds' stakes have climbed as high as 30% to 40% of assets as recently as of late 2014.

Meanwhile, we downgraded the Analyst Ratings on

PIMCO Real Return Funds and PIMCO Global Multi-Asset

In 2014, we became concerned that PIMCO's real-return head Worah was becoming spread thin. Upon Mohamed El-Erian's January 2014 decision to leave PIMCO, Worah was named a co-CIO, assumed leadership of PIMCO's multiasset funds, and began to build out a dedicated multiasset team to run strategies including

As of June 2015, the picture for the real-return and multiasset teams is brighter than expected. Banet returned to the fold shortly after Gross left. Banet, Nic Johnson, and Greg Sharenow have been named comanagers on the real-return and commodities funds, in part to recognize their past contributions but also to signal they've taken on more explicit leadership of those funds. PIMCO Real Return,

PIMCO Global Multi-Asset, too, is on more solid ground, following the early-2015 arrival of emerging-markets and equities specialist Geraldine Sundstrom. Although not formally named as a portfolio manager on the fund, Sundstrom is playing a key role at PIMCO Global Multi-Asset together with Rahul Devgon (formerly of Moore Capital) and Worah. While that fund's rating remains Neutral because of the team's relatively short tenure plying its revamped approach, the team has scored multiple successes with long and short positions across asset classes and currencies since January 2014, and it may be beginning to hit its stride.

/s3.amazonaws.com/arc-authors/morningstar/bc7d88a3-8cc9-454a-994a-b769dee12e69.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/bc7d88a3-8cc9-454a-994a-b769dee12e69.jpg)