Is Your College-Savings Plan Charging a Fair Fee?

Morningstar's annual look at 529-plan fees finds costs are dropping.

One knock against 529 college-savings plans is their cost. The fees on 529 investment options tend to be higher than those charged by similar traditional mutual funds. But fortunately for college savers, the fee gap has narrowed, to about 18 basis points in 2014 from 40 basis points in 2010.

The trend--one of several identified in our annual study of 529 college-savings plans--stems from a number of factors, including a growing use of low-cost passive mutual funds in both advisor- and direct-sold plans. But several 529 plans and program managers have aggressively cut expenses across all of their portfolio offerings as well.

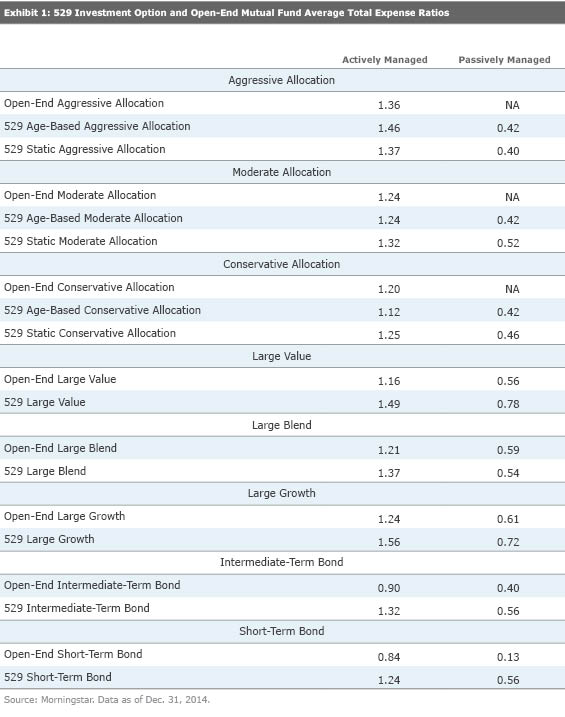

In fact, 40 of the 85 529 plans in Morningstar's database reduced fees in 2014, on average by 3.8 basis points. Fee reductions were more significant at the direct-sold plans, where the average expense ratio dropped by 1.6 basis points. In contrast, portfolio fees decreased by less than 0.1 basis point in advisor-sold plans. Exhibit 1 illustrates the gap that still generally exists between 529 portfolio fees and their open-end counterparts.

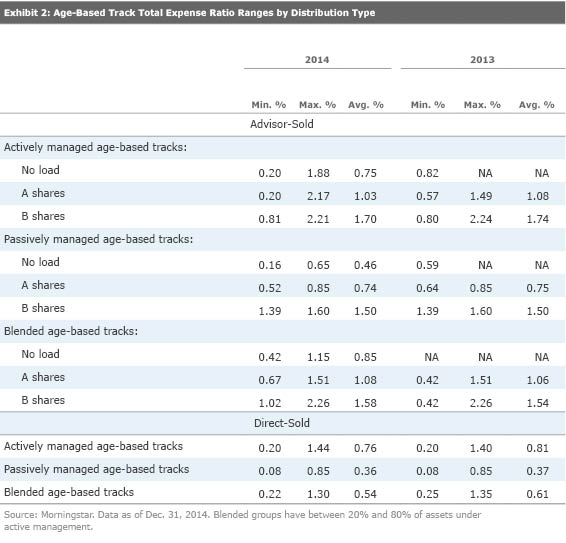

To better compare 529 expenses, we then divide the 529 age-based options--some of the most ubiquitous and widely used portfolios within 529 plans--into groups based on their distribution channel and underlying investment type. Exhibit 2 dices the numbers in a few different ways to show the nuances behind the fees: In addition to showing direct-sold versus advisor-sold portfolios, it shows the age-based portfolios by actively and passively managed strategies, as well as those that are a blend of the two. (We defined the "blend" group as having between 20% and 80% in active management.) We then found the average total expense ratio for each age-based track.

While overall expense ratios tend to be higher for advisor-sold age-based options, direct-sold passive options show the most variation. The cheapest direct-sold passive option charged 0.08% on average, while the most expensive charged a whopping 0.85%. Since the underlying fund expenses for index-based options tend to be low, the difference in price across plans frequently comes from program management fees. These fees typically cover administrative and marketing costs, and larger plans can benefit from economies of scale to negotiate lower program management fees.

For instance, the nationally direct-sold Vanguard 529 College Savings program has more than $10 billion in assets under management and charges between 0.11% and 0.27% for program management fees, resulting in all-in fees that range from 0.19% to 0.49%. In contrast, North Dakota's $380 million plan's program management charges range from 0.66% to 0.70%, bringing total fees for its all-index lineup to 0.85%. Still, Delaware's $615 million plan only charges 8 basis points for program management fees and has a total average expense ratio more than 50 basis points lower than North Dakota's.

Regardless of cause, higher expenses guarantee the extent to which indexed strategies will underperform their benchmarks, so it pays for investors to be especially price-sensitive for passively managed investments.

Want to find out how your 529 college-savings plan investments compare on cost? Visit the 529 Plan Center to locate your plan, and then click through until you see the Options tab. From there, you can locate the investment(s) you've chosen and compare their prices in the table above.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)