Vanguard Broadens Four International Equity Index Funds

Emerging-markets index fund will now hold China A-shares.

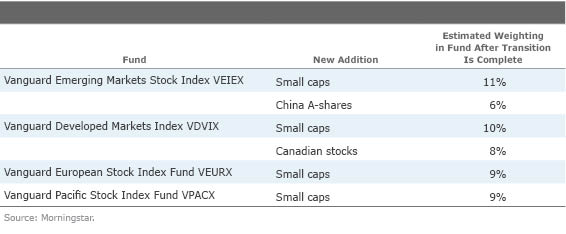

Vanguard will further diversify four international equity index funds--

Vanguard Developed Markets Index

VDVIX,

Vanguard European Stock Index

VEURX,

Vanguard Pacific Stock Index

VPACX, and

Vanguard Emerging Markets Stock Index

VEIEX--by changing their respective benchmarks from large- and mid-cap indexes to all-cap indexes. In addition, Vanguard Developed Markets Stock Index will now include Canadian stocks, which will account for around 10% of the fund. Vanguard Emerging Markets Stock Index will now include onshore China A-shares, which will initially comprise around 6% of the fund’s assets. Vanguard will implement these changes toward the end of the year. The transition periods will vary, ranging from about a month for the Europe and Pacific funds to around a year for the emerging-markets fund. All four funds have mutual fund and ETF share classes, and Vanguard plans to maintain their current expense ratios.

Vanguard Emerging Markets Stock Index is the first emerging-markets fund to announce that it will be integrating China A-shares into its portfolio. That fund’s existing 29% allocation in Chinese stocks comprises Chinese firms listed on the Hong Kong Stock Exchange, which is accessible to foreign investors. The addition of A-shares will bring this fund’s allocation to Chinese stocks to around 35% of its portfolio. Many emerging-markets fund managers have said they are monitoring the development of the A-share market and remain concerned about the evolving and uncertain regulatory landscape, as well as market accessibility. China A-shares are stocks listed on the Shanghai and Shenzhen stock exchanges; historically, foreign investors have not have access to them. Over the past few years, the Chinese government has taken steps to allow access by issuing quotas (or allotments) to approved foreign investors. In late 2014, a program called Shanghai-Hong Kong Connect launched, which allows foreign investors with a Hong Kong-based brokerage account to trade onshore-listed shares. Chinese authorities are also trying to improve liquidity in the onshore markets; over the past year they have loosened requirements for margin trading for domestic investors. The combination of these initiatives has helped drive a 130%-plus return in the CSI 300 (the A-share benchmark) over the past 12 months.

Vanguard Emerging Markets Stock Index tracks a FTSE index, but most emerging-markets funds are benchmarked to the MSCI Emerging Markets Index. MSCI will announce on June 9 its decision on whether or not to partially include China A-shares in the MSCI Emerging Markets Index. If MSCI decides to include China A-shares, it will have an impact on funds such as

-

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)