Discipline at the Core

A look at three funds that attempt to harness the underlying drivers of stock returns.

A version of this article was originally published on May 7, 2014.

Investing has always been part art and part science, but leaning more heavily on a scientific approach may help improve consistency. Through fundamental research, a manager may decide to purchase stocks with varying degrees of value, momentum, and market exposure--the elements that appear to drive stock returns. But without directly targeting these dimensions of return, a portfolio's risk and expected return relative to the market can change over time.

Investors can obtain more consistent exposure to these return drivers through rules-based funds that specifically target stocks with value, profitability, low volatility, or momentum characteristics. Each of these strategies has worked in most markets studied over long horizons, according to many independent studies. There are sensible explanations behind each strategy’s success, including compensation for bearing risk, behavioral biases, and borrowing constraints (in the case of the low volatility strategy).

Individually, these strategies are sensible, but they may work better together. For instance, according to a study by Robert Novy-Marx, a portfolio of cheap (value) and highly profitable U.S. stocks would have offered better returns than a portfolio of just cheap or just highly profitable stocks from 1963 through 2010. A profitability overlay may help investors avoid value traps, and a valuation discipline can reduce the likelihood of overpaying for profitability. Combining factors may also offer good diversification benefits. For example, value tends to outperform when momentum lags, and vice versa. Using these two strategies together may reduce the risk of underperforming for extended periods of time.

IShares Enhanced U.S. Large-Cap ETF It is structured as an exchange-traded fund, has a 0.18% expense ratio, and is available to all investors. In contrast, individual investors must generally gain access to the DFA and AQR funds through a financial advisor. The iShares fund targets stocks with quality, value, and smaller-cap characteristics. It anchors its sector weightings within 10 percentage points of the Russell 1000 Index and optimizes the portfolio to achieve 90%-95% of the volatility of the market.

It may seem a bit odd that a large-cap fund would introduce a small-cap tilt. By itself, size is not a great factor (see this article for a more in-depth discussion on this topic). Tilting toward the smaller end of the large-cap spectrum should theoretically have an even smaller effect than overweighting small-cap stocks. However, the advantage from tilting toward value stocks has tended to increase as market capitalization decreases. Therefore, combining value with a small-cap tilt is a reasonable strategy.

This fund measures value based on earnings yield and book/price. Individually, these metrics may not tell the whole story. For instance, a company with greater debt should offer a higher earnings yield, all else equal. Similarly, differences in the application of accounting rules and differences in asset requirements across industries may distort book/price comparisons across stocks. However, combining these two metrics can help paint a more complete picture.

The fund measures quality with earnings stability, low debt, and low accruals (high operating cash flows relative to net income). Accruals may be a good proxy for earnings quality because the cash component of earnings tends to be more persistent than accruals. High accruals may be a sign of earnings management. Earnings stability is also a reasonable measure of quality. However, in contrast to the DFA and AQR core equity funds, the iShares fund does not directly consider profitability.

Profitability is arguably one of the most important measures of quality because it reflects the productivity of a firm’s assets. Additionally, highly profitable firms often enjoy competitive advantages that can help keep competitors at bay. Profitability can even help explain returns as an independent factor. However, a healthy dose of skepticism is in order. While it is clear that quality and profitability are good things, it is less obvious why they should be associated with higher expected returns. There is a risk that the strategy could become less effective as more investors exploit it. But it may still help reduce volatility.

DFA US Core Equity This fund offers broader exposure to the U.S. stock market and has a 0.19% expense ratio. In fact, its portfolio represents more than 94% of the assets in Vanguard Total Stock Market ETF VTI. However, it adjusts its constituents' weightings to tilt the portfolio toward stocks with small market capitalization, high book/price (value), and high profitability. For example, a small-cap value stock with high profitability might receive twice its market-cap weight. Similarly, the fund gives an underweighting to large-cap growth stocks with weak profitability. However, it does not exclude these stocks.

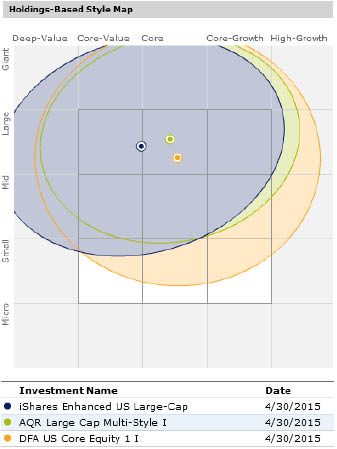

This broad approach introduces modest style tilts, as the style map below illustrates. The fund’s inclusion of profitability moderates its value tilt because more highly profitable stocks tend to carry higher valuations. However, it has the advantage of low turnover, which should help promote tax efficiency. Because it weights its holdings using market-cap multipliers, changes in market prices largely mirror the desired changes in the portfolio weightings. This mitigates the need to actively rebalance the portfolio.

Even the way the fund measures value (book/price) helps keep turnover low. Book value tends to be more stable than alternative value metrics, such as earnings and cash flow. But it is not always comparable across firms. While book value is not a perfect measure of value, it is the metric that academic researchers most often use to study the value effect.

DFA measures profitability as operating income before depreciation and amortization minus interest expense, over book value. This is a reasonable approach because it includes most relevant expenses but strips out income that is not relevant to the core business. It also removes depreciation and amortization, which are often difficult to compare across firms. Accounting earnings are more susceptible to smoothing and may be less representative of a firm's effective profitability.

AQR Large Cap Multi-Style Similar to the DFA fund, AQR Large Cap Multi-Style (0.54% expense ratio) targets stocks with attractive value and profitability characteristics, but it also incorporates momentum. Because there has been more research on value and momentum, the fund gives greater weight to these characteristics than to profitability. Based on these attributes, the fund assigns composite scores to each large-cap U.S. stock and targets the fourth with the highest scores. It weights its holdings according to both the strength of their style characteristics and market capitalization. In order to smooth out changes, the fund updates a different portion of its portfolio each month.

Momentum historically has been a much stronger effect than size and likely will continue to offer better performance, at least on paper. However, it requires high turnover, which can create high transaction costs and reduce tax efficiency. In order to mitigate these costs, the fund may deviate from its target portfolio if the estimated cost of trading a security outweighs the benefits of buying or selling it.

Momentum isn't the fund's only distinguishing feature. It also measures value more holistically than its peers. In addition to book/price and earnings yields, the fund also incorporates sales- and cash flow/enterprise value ratios, which strip out differences that are due to leverage. Together, these metrics may tell a more complete story. In contrast to DFA, the fund measures profitability using gross profits (sales minus cost of goods sold) scaled by assets and sales, and free cash flow. Gross profitability may not be the best way to measure profitability because it excludes economically relevant selling, general, and administrative expenses. However, it is consistent with how Novy-Marx measured the profitability effect in his seminal paper.

Which Fund Is Best? That depends on the investor. Despite its higher expense ratio, AQR Core Equity will likely offer the highest pretax returns because it makes the boldest style bets and harnesses momentum. However, this unconstrained fund can make large sector bets, which can increase volatility. It will also likely be less tax-efficient than the other two funds, which have much lower turnover.

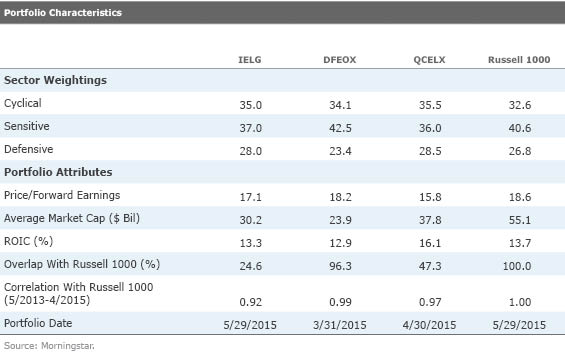

DFA US Core Equity may be more appealing to investors who want less tracking error relative to a broad market-cap-weighted benchmark. Of the three funds, it exhibited the highest correlation with the Russell 1000 Index over the past two years, as illustrated in the table below, owing to its broad market coverage and relatively small sector tilts.

Risk-averse investors might find iShares Enhanced U.S. Large-Cap most appealing because it explicitly attempts to limit its volatility relative to the market. This may help it weather market downturns better than the other two funds. While this fund constrains its sector weightings, it also has the narrowest portfolio. Consequently, its performance may deviate the most from the market's, as its correlation with the Russell 1000 Index over the past two years demonstrates.

One to Watch Over the past year, fund companies have launched more than 20 multifactor strategy ETFs, including iShares FactorSelect MSCI USA LRGF (0.35% expense ratio). This fund has less than $3 million in assets and is very thinly traded, so it may be best to wait until it attracts more assets before pursuing it. But it is worth putting on the radar. This fund tracks an index that targets stocks with attractive momentum, value, quality, and smaller market-cap characteristics. It keeps sector weightings within 5 percentage points of the market-cap-weighted MSCI USA Index and attempts to offer a comparable risk profile to this parent index.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)