Women Are Scarce Among Fund Managers

A Morningstar study finds that less than 10% of fund managers are women.

More women in the United States are making their own investment decisions than ever before. In one recent study, 19% of women reported being a primary decision-maker for couples’ long-term retirement savings--a figure that has doubled since 2011.[1] The numbers of U.S. female financial advisors also are on the rise, with women now comprising more than a fourth of a growing profession.[2]

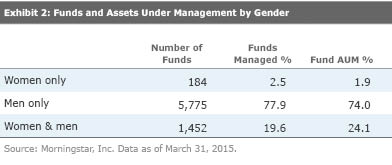

Yet the ranks of professional money managers who are women remain exceedingly small. We examined the gender of U.S. open-end fund managers in our database and found that only 9% are women. Women exclusively run only 2% of assets under management in the $12.6 trillion U.S. open-end mutual fund universe. The likelihood that a woman is managing a core multiasset allocation fund is even lower.

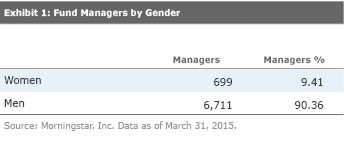

Fund Management by Gender Overall, about 7,700 individuals are named portfolio managers of U.S. open-end mutual funds as of March 31, 2015. This number includes portfolio managers who run funds exclusively and as members of teams. Of these, 9.4% are women. Women exclusively manage 184 funds, representing about 2% of the industry's funds and assets.

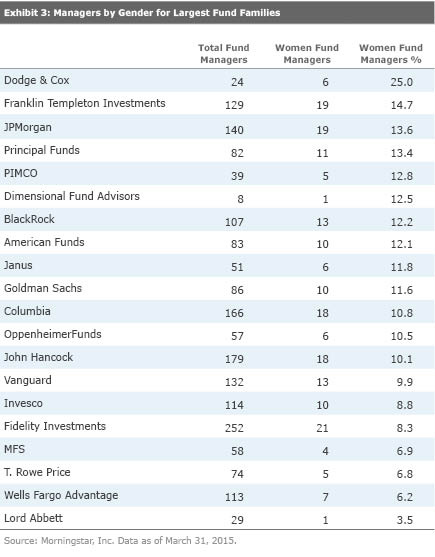

The largest fund companies, as measured by open-end fund assets under management, do a little better on gender diversity than the industry overall. Dodge & Cox leads the way, with 25% women managers. Franklin Templeton is next, at 14.7%, followed by JPMorgan at 13.6%. Vanguard, Fidelity, and T. Rowe Price are at or below average, and Lord Abbett comes in last among the industry’s largest firms, with just one woman manager.

Women are more likely to be managing a fund as part of a mixed-gender team than running a fund alone or with a team of women. Team-managed funds that have managers of both genders run 21% of the industry’s funds and more than a third of the industry’s allocation funds.

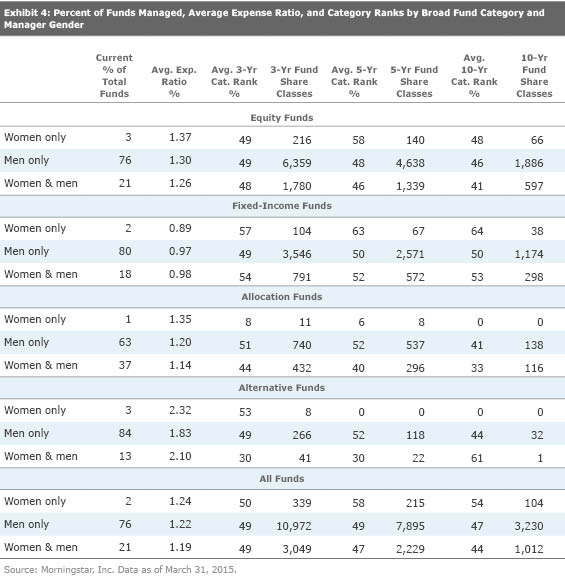

Though the sample is small, performance of funds run exclusively by women rivals that of funds run by men. Only 37 women have continuously run a mutual fund for at least a decade through March 31, 2015, and in several cases, those women comanaged with men for at least part of the decade. The women’s returns are similar to men’s even though women tend to manage pricier funds in niche areas, such as smaller-cap equity strategies and municipal bond funds.[3]

The average 10-year category rank for equity funds run by women is virtually the same as it is for men, even though the average annual expense ratio for women-run funds was 7 basis points higher. Women-run fixed-income funds lagged those run by men, but that is largely an artifact of one team of women running multiple municipal bond funds that underperformed over the past decade. The few women running their own allocation and alternatives funds held their own despite significantly higher costs among allocation funds (15 basis points higher) and alternative funds (49 basis points higher).

Interestingly, mixed-gender teams provided the best results, though the performance difference between all three groups is narrow. Overall, our data suggest that, from a performance standpoint, women are holding their own as fund managers, despite their small numbers and despite running more-expensive and noncore funds.

Notably, the fund industry’s leadership ranks are less-diversified than other comparable professions. A woman is less likely to be running a U.S. mutual fund than working as a doctor (37%), lawyer (33%), or accountant or auditor (63%).[4] Women are also better-represented in law leadership ranks: 20% of law-firm partners are women, while 24% of federal judges are women.[5] In accounting, 19% of partners in U.S. accounting firms are women.[6]

------------------------------------------

[1] Fidelity Investments. “2013 Couples Retirement Study Executive Summary.” May 2013.

[2] Bureau of Labor Statistics, U.S. Department of Labor. “Occupational Outlook Handbook.” May 2012.

[3] There are 46 fixed-income funds among the women-run funds with three-year records, 30 of which are municipal bond funds. Seven of the muni-bond funds have been managed by Stella Wong and Carrie Higgins of Franklin Templeton, so they represent 4% of the three-year sample and 16% of the funds with 10-year records. These strategies have very poor long-term records, due in part to Franklin Templeton’s firmwide decision to hold battered Puerto Rican bonds in its single-state and other muni-bond portfolios. When one excludes Wong and Higgins’ results from the women-run funds with 10-year records, the group’s average category rank rises to the 45th percentile, indicating most beat their typical peer for the period.

[4] Bureau of Labor Statistics, U.S. Department of Labor. “Labor Force Statistics from the Current Population Survey.” Feb. 12, 2015.

[5] American Bar Association. “A Current Glance at Women in the Law.” July 2014.

[6] Moore, S. 2013. “AICPA 2013 Trends in the Supply of Accounting Graduates and the Demand for Public Accounting Recruits.” American Institute of CPAs, July 26, 2013.

/s3.amazonaws.com/arc-authors/morningstar/895d7187-cd0c-437c-9fe4-63a22a4ba47c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/895d7187-cd0c-437c-9fe4-63a22a4ba47c.jpg)