Do Tax Benefits Outweigh Higher Costs of 529 College-Savings Plans?

Morningstar finds federal tax savings give 529s an edge.

Morningstar has been a loud cheerleader for low-cost investing and has noted that 529 college-savings plans often aren't as cheap as traditional mutual funds. But a new study finds that 529 plans' federal tax benefits make them a better choice overall for college savers.

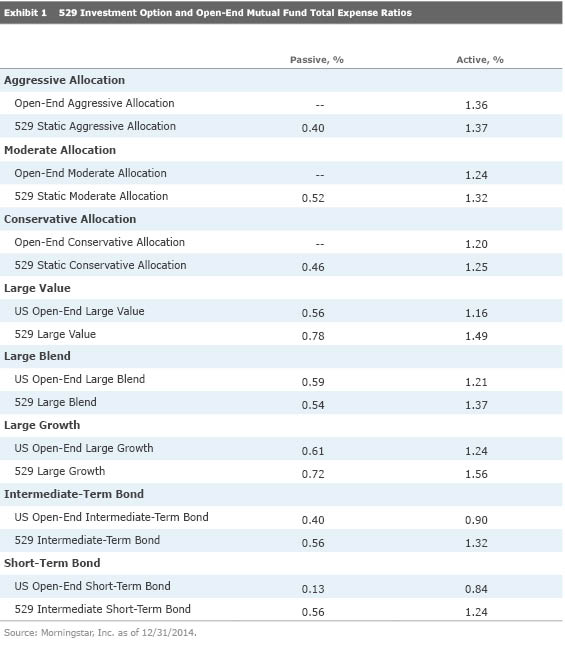

Historically, Morningstar has found that open-end funds have lower expense ratios than 529 investment options. Mutual funds on average cost 18 basis points less than comparable 529 investments. The difference in price owes largely to state-level administration and marketing costs incurred by 529 plans. And while investors can gain access to a wide range of topnotch asset managers through 529 plans, there is a wider selection of mutual funds enticing some savers. Exhibit 1 shows the fee differentials between open-end funds and 529 investments.

Meanwhile, 529 plans offer significant tax benefits, as investors escape capital gains taxes when monies are used to pay for higher-education expenses. Moreover, some states offer additional incentives, often allowing residents to deduct some or all of their 529 contributions from their taxable state income.

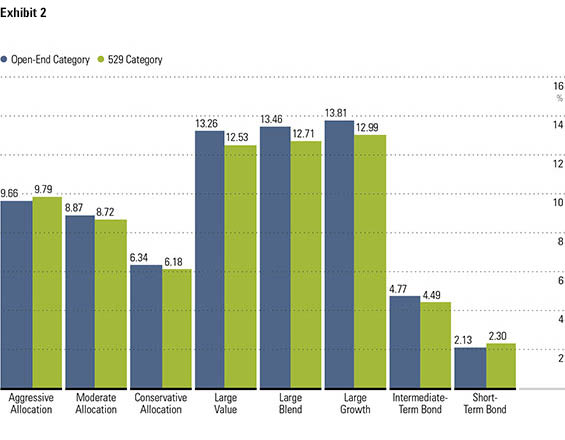

Exhibit 2 shows that, indeed, high fees have proved to be a tough hurdle for 529 investments to overcome: During the past five years through the end of 2014, six of eight 529 categories for static investment options lagged their analogous open-end rivals. The biggest gaps occurred in the large-growth, large-value, and large-blend Morningstar Categories, where the typical 529 investment trailed by 73-82 annualized basis points. Meanwhile, 529 options fared relatively well in the short-term bond category, outpacing the analogous mutual fund by 17 basis points on average.

Exhibit 2 doesn't account for the tax benefits associated with 529 investments, though. Morningstar ran a simulation to compare how the average investor in each vehicle would have fared on an aftertax basis during the same time period. It made the following assumptions:

· The college saver contributed $2,400 to the investment at the beginning of each of the past five years, starting in 2010. The investor then withdrew the entire balance on the first day of 2015 and used the funds for qualified higher-education expenses.

· Open-end funds distribute capital gains annually, but for simplicity’s sake, Morningstar assumed the investor realized all capital gains accumulated during the entire five-year period on the first day of 2015. (Capital gain equals ending portfolio value, less $12,000 in total contributions).

· The investor was subject to a 15% long-term capital gains tax (assumes the investor landed in the 25%-35% tax bracket: taxable income between $36,901-$405,750 for singles, $73,801-$457,600 for married filing jointly, and $49,401-$432,200 for heads of households.)

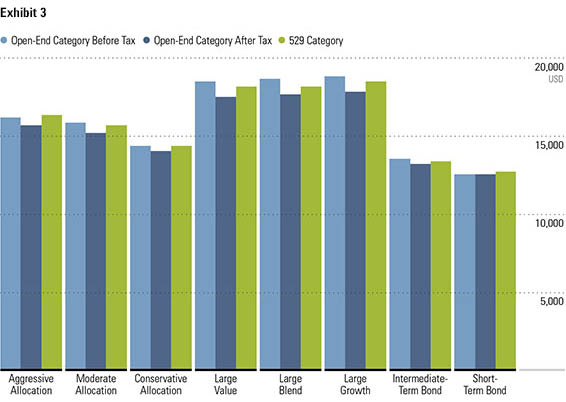

The study produced unanimous results: After subtracting the capital gains tax on open-end funds’ appreciation over the period, 529 investments fared better in all categories. For instance, in the large-growth category, the typical 529 investor would have $18,440 to use toward qualified expenses, compared with $17,801 for an open-end fund investor. Exhibit 3 shows the results of the study.

Notably, the chart above only accounts for federal tax benefits (that is, avoidance of capital gains tax). For savers residing in states that offer additional tax incentives, the case for 529 investing becomes even stronger. Some states sweeten the deal by offering savings matches, grants, or scholarships. Moreover, the study gives mutual fund investors an edge by assuming they defer capital gains tax for the entire five-year period; in reality, they would owe capital gains tax annually and their aftertax returns would be lower than shown in Exhibit 3.

True, the markets have rocketed since 2010, and investors should not expect gains of similar magnitude in most five-year periods. However, college savers would ideally contribute to a 529 plan over an 18-year time horizon, over which savers should realize substantial gains--and tax savings.

Keep in mind that Exhibit 3 specifically pertains to investors in the 25%-35% tax bracket. Those in the higher 39.6% bracket would enjoy even greater tax savings. Meanwhile, savers expected to land in the 15% or lower bracket at the beneficiary’s anticipated college enrollment date are exempt from capital gains tax and might be better served in open-end funds, as depicted by the leftmost column in each category. That’s especially true for residents of states providing no additional tax benefits.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)