Tallying Up the Cost of Short Interest Expenses

The costs of shorting aren't always visible, but they can exact a price.

A common source of confusion--both from fund companies and investors--concerns how Morningstar treats short interest and dividend expenses in our published expense ratios. This is particularly relevant to alternative mutual funds, because shorting is a commonly used technique in alternative strategies. Short interest and dividend expenses drive large differences between how Morningstar and fund companies report expenses for funds--for example, Bronze-rated

To begin, let's review what short interest borrowing charges and remittances on dividends paid actually mean and where they come from. Shorting (or short-selling) a stock involves borrowing shares of that stock and then selling them on the market, with the expectation of repurchasing those shares at a lower price and thus turning a profit on the difference. Managers of alternative funds may use shorting as a way of generating alpha or as part of a broader hedging strategy designed to reduce market exposure.

The short interest and dividend expenses derive from the fact that the investor has borrowed the shares of a stock and does not actually own them. As with loaning money, the institution facilitating the loaning of shares--the brokerage--will usually charge an interest expense. That charge will vary based on prevailing interest rates as well as the availability and liquidity of the stock shares being shorted. (What's known as a "short interest rebate" can occur if the rate a fund earns on its collateral exceeds what it pays out on the borrowing costs--not a typical occurrence in the current interest-rate environment). The investment universe on which a manager focuses can lead to significant differences in these costs.

The remittance paid on dividends of securities sold short is a bit different. When one purchases a stock, if the company issues a dividend, the owner of record receives the dividend payment. If one is short a stock, however, the opposite situation prevails: The borrower of the stock must pay the dividend to the party that lent it. That payment gets recorded as an expense. (It's also worth noting that this remittance does not affect the value of the fund because the stock drops in price when the company goes ex-dividend, causing the short to gain in value, leading to a net wash.)

To Exclude or Not to Exclude Fund companies generally report short interest and dividend expenses as a line item within the fund operation expense breakdown in their prospectus and (ideally) annual report. Morningstar does not include those expenses in the most commonly used calculated expense ratios, however. I'll walk through a couple of specific fund examples to help unpack where some of the confusion may lie and how investors can best interpret the data.

Vanguard Market Neutral uses a quantitative-based approach that neutralizes market exposure by balancing long and short exposures across a highly diversified stock portfolio, then seeking to generate alpha through its systematic ranking models. It's also one of the cheapest funds in the alternatives universe. Yet if you go to the Vanguard website overview page for the fund, you'll see the expense ratio listed at 1.64%. If you go to expense tab for the fund on Morningstar.com, by contrast, you'll see the expense ratio listed as 0.25%. Quite a large difference! What accounts for this gap? Does one of the firms have the data wrong?

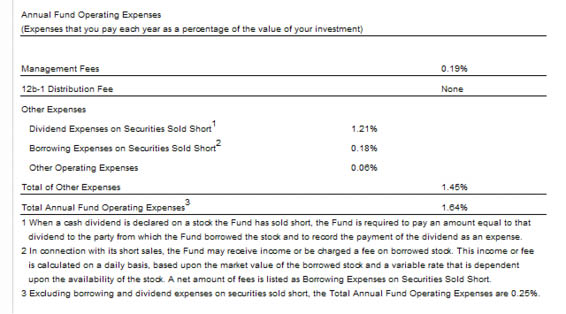

By this point, it will come as no surprise to hear that the difference comes down to the treatment of short interest and dividend expenses. Morningstar backs those expenses out of its published ratios, while Vanguard chooses to include them. This breakdown of operating expenses from the fund's prospectus spells out the details.

Vanguard tallies a rather small annual borrowing expense cost of 0.18%, and a somewhat larger dividend expense of 1.21% (the fund holds a fair number of large-cap funds that pay dividends). When you add those two costs to the 19-basis-point management fee and an additional 6 basis points of "other operating expenses," you get the 1.64% expense ratio published by Vanguard. To find the 0.25% expense ratio listed by Morningstar for both the prospectus and annual report expense ratios, you need to drop your eyes to footnote 3, where Vanguard notes that the 0.25% fee excludes "borrowing and dividend expenses on securities sold short." (Vanguard deserves credit for having some of the most explanatory footnotes around.)

Why does Morningstar exclude those costs, seemingly underreporting the true expenses of the fund? Philosophically, we view the short interest and dividend expenses as trading costs that are intrinsic to the fund's strategy. For the same reason, Morningstar excludes brokerage costs from the annual report and prospectus expense ratios of all funds. Vanguard appears to want to give investors a complete picture of the expenses charged by the fund, which we applaud. However, since different shorting approaches lead to different borrowing costs, cutting them out arguably leads to a more equitable comparison of fund expenses, because you are left with management fees and operating expenses. Regardless, in order to succeed, an alternative fund manager will have to outperform those shorting costs, and the proof will be reflected in the fund's returns, which are net of all expenses.

Not every alternative fund gets by with shorting expenses as low as Vanguard Market Neutral's. Take Silver-rated

Once again, Morningstar excludes those expenses from the annual report (2.02%) and prospectus (1.99%) expense ratios listed on our website. On its own website, TFS lists a gross expense ratio of 8.4%, a net expense ratio of 8.4%, and an "adjusted net expense ratio" of 1.89%. That last ratio is closest to the expense ratios published by Morningstar, but it excludes 10 basis points of acquired fund fees. The fund has also instituted a waiver to cap expenses at 1.90%.

Still, it's clear that the expenses involved with shorting create a higher hurdle for the fund, a hurdle the fund has cleared over the long term--management has generated alpha at an impressive rate--but has proved troublesome more recently. Indeed, a footnote in the Oct. 31, 2014, annual report mentions that "a significant portion of the Fund's underperformance can be attributed to the Fund's investments in short positions of companies with high rebate/borrowing costs." One might gasp at an 8.4% gross expense ratio and imagine that a fund should be dismissed out of hand, but remember that it's through the process of shorting (incurring those expenses) that the fund generates its returns. TFS Market Neutral's 4.15% return for calendar year 2014 ranked in the top 20% of the market-neutral Morningstar Category.

Painting the Full Picture Even though shorting expenses aren't baked into Morningstar's annual report and prospectus expense ratios, Morningstar analysts still pay attention to the underlying expense breakdowns in order to gain a full picture of a fund's strategy and the frictions its trading costs may create, as well as how those compare with peers. A Morningstar.com reader who did want to see the explicit costs of shorting broken out could dig into the prospectus or annual report under the Filings tab on the fund page. In other Morningstar products, such as Morningstar Direct, interest costs are available as a distinct data point, while the "gross expense ratio" data point adds back in those additional expenses. As noted above, some version of the gross expense ratio is also often available on the fund company's website.

In the end, the differences between various expense ratios come down to semantics, since the fund's net returns will reflect all of the operational costs. Moreover, there are other crucial aspects to short-selling strategies beyond their frictional costs, such as the risks of getting caught in a short squeeze and the benefits of protection in a market downturn. Annual report and prospectus net expense ratios are a perfectly adequate starting point, but any time a manager uses complex strategies like shorting, it behooves an investor to dig deeper.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)