The Most Concentrated Stock Funds We Rate

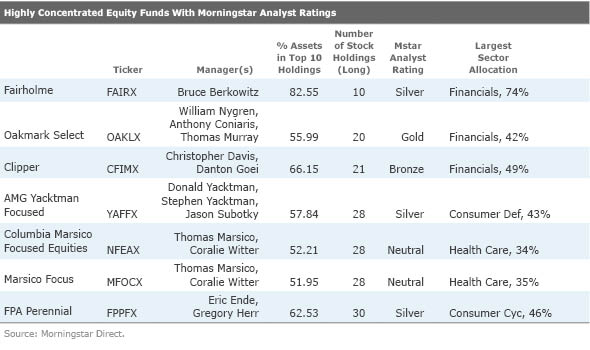

A look at the dispersion of Analyst Ratings for some of the most focused equity funds in Morningstar's coverage universe.

Be careful for what you ask for when looking for a concentrated equity fund--you might get exactly what you want. Funds that limit their holdings to those in which their managers have the highest conviction offer the promise of bigger returns, but also the risk of having too much in a particular stock or group of stocks at the wrong time. Morningstar analysts weigh these opportunities and pitfalls when rating funds run by high-conviction managers.

Here's a look at how the Morningstar Analyst Ratings shake out for the most focused of our rated funds, which for this article are defined as those with fewer than 30 holdings, significantly more money in their top holdings than their respective Morningstar Category average, and more than a third of their assets in at least one sector.

Most Concentrated Player

Silver-rated

Late in the Shot Clock

Disappointing performance since Davis Advisors took this fund over in 2006 and a comanager change in 2014 explains why

That's not good, which is reflected in the fund's Performance Pillar score of Negative. The shot clock, however, partially reset for this fund in the first month of 2014 after Davis Advisors fired Feinberg and replaced him with longtime analyst Danton Goei, who had posted strong results in his sleeve of the analyst-run

Transition Game

Streaky Shooter

High fees weigh on Silver-rated

Steady Floor Game

Contract Distractions

Neutral-rated

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)