Tax Bills on the Rise for Fund Investors

A long-running bull market means great returns and a growing tax burden.

The downside to a seven-year bull market is taxes. Even if you don't sell your funds, you will be getting more capital gains distributions, which require you to pay taxes (unless your funds are in a tax-sheltered account).

We've seen the amount of capital gains steadily creep up in recent years, and that figures to continue as long as the stock market rally does.

Not only did the fund burn through its charge-offs, but it also suffered redemptions that spurred selling. Also, comanager Ken Feinberg's departure in early 2014 spurred management to clear out some of Feinberg's favorite picks. The fund and its sibling

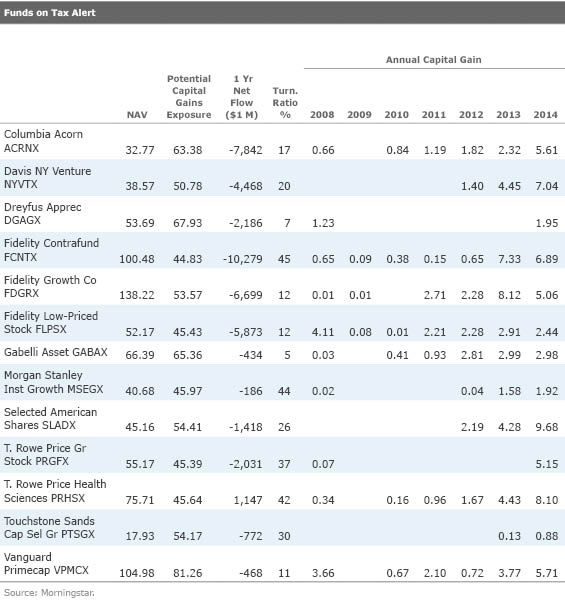

Potential capital gains exposure tells you roughly how much a fund would pay out if it turned over its entire portfolio. It's a useful measure in figuring out whether a fund is likely to make a distribution. Funds report this figure once a year, and Morningstar then adjusts it monthly to reflect appreciation or depreciation in the fund. You can find a fund's potential capital gains exposure on the tax tab of a fund's data pages. Here's an example.

I should note that all of this applies to stock funds only, because bond funds' returns come through chiefly as income, and there are no capital gains if they hold a bond to maturity unless it was bought below par. In addition, when funds replace maturing bonds with new bonds, that counts as turnover, yet it wouldn't spur capital gains distributions. In general, bond funds have very low capital gains payouts.

There's a little more information we need to see before we issue a tax warning. First, we want to see whether a fund has sizable redemptions. Say a fund sees 20% of its assets go out the door. That means it probably has to sell about 20% of the portfolio, unless it is sitting on a huge pile of cash. What's happening here is you have to go deeper into your pile of stocks held at a gain, and you are spreading those gains out over fewer and fewer shareholders. It's a little unusual to have redemptions in a fund that has had sizable gains, yet that's just what we are seeing in a lot of equity funds these days.

We also want to know a fund's turnover rate. Generally, a fund won't have huge, built-up capital gains if it has a high turnover rate, but you will see some with high potential capital gains exposure and a turnover rate above 40%. In such cases, it's a given that you will see some distributions. Let's first look at the funds with outflows and big potential capital gains exposures.

The Trouble With Outflows It isn't pretty. A fund underperforms, leading investors to bail, and those who stick around see their tax bills rise even as they are disappointed by performance. The Selected American example is just such a case. In fact, it may have more distributions to make. Selected American and Davis New York Venture both saw about 20% of assets flow out over the past 12 months, and they have potential capital gains exposures of 52% and 48%, respectively. Both funds have Morningstar Analyst Ratings of Bronze, so obviously we expect them to rebound, but it's worth knowing the price of that bet.

The situation is worse for

Higher-Turnover Funds The list of funds with large potential capital gains exposure has mostly very low-turnover funds, which are less likely to make big payouts. However, as you get above a turnover of 40% in a fund with a potential capital gains exposure above 40%, it's a virtual certainty they will make a sizable distribution. They'd have to have nearly all of the turnover just in the holdings not held at a gain or all of their gains in a small number of holdings in order to avoid a payout.

T. Rowe Price Health Sciences PRHSX has been making money like nobody's business thanks to its biotech exposure. Thus, it's probably not a surprise that it paid out about 12% of NAV in capital gains last year. With a 46% potential capital gains exposure and a turnover rate of 42%, I'd imagine those tax bills will continue. The fund is set to close to new investors on June 1.

I should note that all three Fidelity funds mentioned above are widely held in 401(k)s and other tax-sheltered accounts, so the managers have the difficult position of trying to maximize returns equally for tax-sheltered investors and those in taxable accounts. A trade might be advantageous on a pretax basis but not on an aftertax basis if the manager only expects modest improvement by switching to a new position from a current holding that has capital gains embedded. Yet with that shareholder base, they might be inclined to make the trade anyway.

Big Potential Capital Gains Exposure Only There are some funds that have big potential capital gains exposure but low turnover, plus stable flows and management. Even these funds will have to make payouts sometime, but I am less worried.

Gabelli Asset GABAX has a potential capital gains exposure of 65% but single-digit turnover.

What to Do About Capital Gains Payouts If you own a great fund, then you'd be hurting yourself if you sold it. But it might make sense to sell a mediocre fund that is set to make big payouts. Also, if you have automatic reinvesting for a taxable account that might make a big payout, simply turn it off.

The next obvious thing to do is look closely at the situation before buying in a taxable account. If two funds are otherwise equally attractive but one lacks the big tax overhang, go with that one.

Where to Find Tax-Efficient Funds Index funds are a good bet. They rarely make payouts and have low turnover. Vanguard is particularly good at managing the tax situation of its index funds.

You can search for stock funds that have no or low potential capital gains exposure. Today that would mostly involve new funds or funds with really bad track records, but don't settle for an inferior fund.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)