Emerging-Markets Bond Funds: A Look Under the Hood

A growing but still risky group.

Improving country fundamentals, strong long-term performance, higher yields, and diversification benefits have made the emerging-markets bond Morningstar Category one of the fastest-growing categories that Morningstar tracks. Popular as the category has become, investors often don't fully grasp key differences among emerging-markets bond funds. Indeed, such funds tend to follow one of four investment approaches--hard currency (U.S.-dollar denominated), local currency (local-currency denominated), corporate, or some combination of the three.

Below, we examine these four approaches more closely, raise a few points to consider for investors thinking of purchasing an emerging-markets bond fund, and highlight some of our favorite funds in the category.

Emerging-Markets Bond Fund Approaches: A Primer Hard Currency: Today one fifth of funds in the emerging-markets bond category focus on hard-currency debt. These funds offer higher yields than U.S. Treasuries in exchange for emerging-markets country risk, and investors are shielded from foreign-currency risk. Most funds use the J.P. Morgan Emerging Market Bond Index Global Diversified (EMBI-GD) as a benchmark. That index includes more than 50 sovereign credits and quasi-sovereigns and many lower-rated countries such as Venezuela and Ukraine.

Local Currency: During the 2000s, many emerging-markets countries saw improvements in their fundamentals and stronger legal rights for borrowers and lenders, which led to improved credit ratings. As a result, several of these countries were able to issue debt in local currency. Today, local currency is the deepest segment of the market, and about one quarter of funds in the category are dedicated to this area. In addition to being exposed to interest-rate and credit risk, U.S. investors in this segment are also exposed to currency fluctuations. The J.P. Morgan Government Bond Index Emerging Markets (GBI-EM) tracks this market, and most of its constituents are rated investment-grade.

Corporate: As emerging-markets corporate issuance picked up, the first fund dedicated to that part of the asset class popped up in 2007. The J.P. Morgan Corporate Emerging Market Bond Index (CEMBI) contains exposure to issues from about 40 countries but is far more concentrated than U.S. corporate indexes on a sector basis. Investors here are taking on credit risks at both the company and country level, but currency risk is limited. Corporate emerging-markets debt is primarily denominated in U.S. dollars because of legal restrictions and poor custody arrangements in the local markets. This is the smallest subset of the category at about 13%.

Blended: The fourth type of fund invests in a mix of hard-currency, local-currency, and corporate debt. These types of funds account for 40% of the category.

Allocation Considerations We think emerging-markets bonds make sense for their return and diversification potential. However, investors should approach these funds with caution given that they carry considerable risk--currency, geopolitical, and credit/default risk in particular.

Currency: Emerging-markets currency exposure is the most significant risk to consider and affects local-currency and blended funds. To illustrate, weakening emerging-markets currencies drove negative returns for the J.P. Morgan GBI-EM in 2008, 2011, and 2014. We believe the choice between hard- and local-currency funds, whether focused on income or total return, depends on an investor's risk tolerance. That said, local-currency funds, which hold appeal for their long-term diversification potential, are not a good fit for investors who need access to their portfolio principal in the near term as currency volatility can wipe away the yield advantage.

Geopolitical: Emerging-markets country fundamentals can change quickly with changes in political regimes or geopolitical risk, affecting all types of emerging-markets bond funds. For instance, the amalgam of troubles currently facing Ukraine and Russia has sent their bond prices and currencies plummeting since the fall of 2014.

Credit/Default: Commodity price swings pose another risk, and the recent oil price plunge has been difficult on exporting nations including Venezuela, Russia, Chile, South Africa, and Nigeria. Country and corporate defaults are another consideration. Investors in higher-yielding emerging-markets corporates are exposed to differences in bankruptcy laws, which could lead to a poor recovery in the event of a default.

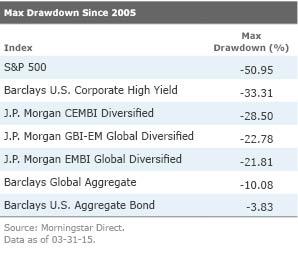

These risks, in addition to the illiquidity of certain segments of this market, make emerging-markets bond funds subject to swift sell-offs. To illustrate, the following table compares the maximum drawdown (peak-to-trough loss) of emerging-markets bond indexes to other major indexes during the past decade through March 2015.

Morningstar's data suggest that this volatility has made it more difficult for investors to use emerging-markets debt funds effectively. When comparing the funds' total returns and their Investor Returns (a measure of the return on the average dollar invested in a fund, accounting for cash flows into and out of the fund during the period) over the trailing 10-year period through March 2015, on average, investors have missed out on roughly 33% of the funds' total returns during the past decade because they bought or sold the funds at inopportune times. As a result, we urge investors to use emerging-markets bond funds as a part of a strategic allocation rather than a tactical play to boost yield or total return.

We'd also encourage investors considering an allocation to a dedicated emerging-markets bond fund to first closely examine their existing bond holdings to ensure they don't already have emerging-markets exposure. Global bond indexes have allocated increasingly more to emerging-markets debt during the past several years--for example, the Barclays Global Aggregate Index had a 16% emerging-markets bond stake as of March 2015. Today, most world-bond funds invest at least 10% of assets in emerging-markets bonds, and some have 40%-50% stakes. These securities have also become commonplace in wide-ranging multisector bond funds and have even popped up in some U.S. "core" bond offerings.

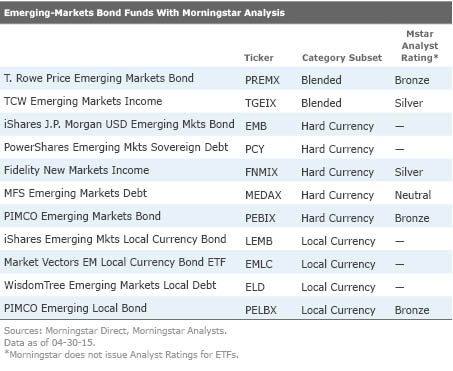

Emerging-Markets Bond Funds With Morningstar Analysis We cover six actively managed emerging-markets debt funds that use hard-currency, local-currency, and blended approaches, as well as five passive funds that track hard-currency and local-currency benchmarks. (This combined coverage accounts for 50% of the category's assets.) Emerging-markets corporate funds haven't delivered attractive results relative to appropriate benchmarks and offer only a slice of this niche asset class. Therefore, we do not cover any funds from this group.

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)