Fund Firms Cashing in Despite Move to Lower-Cost Funds

Industry fee revenue at record high, even though investors pay less for funds overall.

Asset management is often described as a scalable business. After all, the costs of managing a fund don't significantly increase when a fund goes from $1 billion to $2 billion in assets. In fact, funds spread their costs over more assets as funds grow, often leading to declines in expense ratios as assets increase.

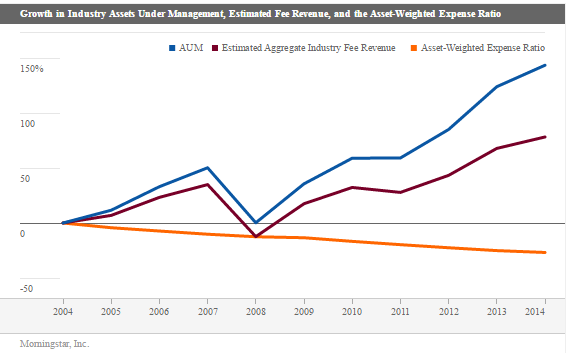

Indeed, during the past decade, the asset-weighted expense ratio across all funds (including mutual funds and exchange-traded products, or ETPs, but excluding money market funds and funds of funds) has fallen to 0.64% from 0.87%, which is a decline of 27%.

Yet, in that same span, industry assets under management have increased 143%. We can estimate industry fee revenue by multiplying the asset-weighted expense ratio by total assets under management. By this measure, industry fee revenue is at an all-time high, reaching $88 billion, up from $50 billion 10 years ago. That is an increase of 78%. Thus, a much larger share of the benefits of the increase in assets under management have stayed with the fund industry rather than being returned to fund shareholders.

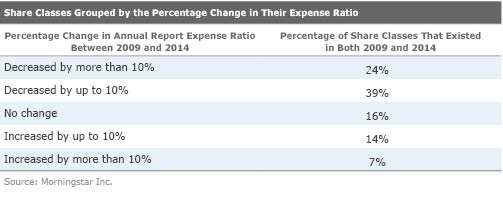

(Some) Fees Are Falling (Though Not by Much) The asset-weighted expense ratio for all funds fell to 0.64% in 2014 from 0.76% in 2009, a decline of 15%. However, during this span, just 63% of the fund share classes and ETPs that existed in both 2009 and 2014 reduced their expense ratios and only about 24% of them saw their fees fall by more than 10%. Meanwhile, 21% of the share classes we examined ratcheted up their take.

Nearly half of all funds have established management-fee breakpoints in their prospectuses, whereby expense ratios are automatically reduced at prespecified asset thresholds. As the current bull market has grown long in the horns, many funds have crossed these thresholds because of some combination of asset-price appreciation and net new flows. While some fees are falling, that's been driven primarily by investors moving their assets to low-cost funds--not by steep cuts in fund expenses.

Fees by Type While the annual report net expense ratio includes all explicit fees incurred by a fund, these fees can be disaggregated and itemized according to their various sources, such as the advisor (management) fees, administration fees, distribution fees, and so on. Not all firms break out these expenses nor are they listed in a transparent and consistent way to help investment decision-makers.

Funds that held 84% of all assets as of the end of 2009 listed an advisor fee in both 2009 and 2014. The asset-weighted advisor fee for these funds was 0.45% compared with an asset-weighted net expense ratio of 0.79%. By 2014, the asset-weighted advisor fee had dropped by only 1 basis point to 0.44% while the asset-weighted net expense ratio dropped to 0.67%. So the decline in the asset-weighted net expense ratio we detail above was not so much driven by lower advisor fees as it was by lower fees covering other items such as distribution and administration.

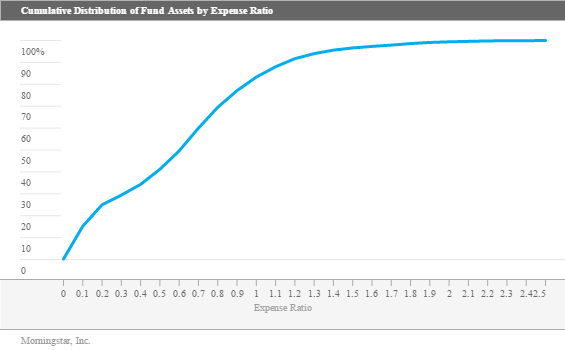

Investors at the Wheel The chart below illustrates how investors' preference for low-cost funds lowers the asset-weighted expense ratio. It shows cumulative percentage of fund assets invested at or below each expense ratio listed along the horizontal axis. The equal-weighted average expense ratio for all funds in 2014 was 1.19%. Choosing an expense ratio of about 1.19% and looking across to the vertical axis, the chart shows that funds with an expense ratio below 1.19% held 90% of total assets at the end of 2014. The remaining 10% of investors' assets were invested in funds with an expense ratio greater than 1.19%. Thus, the equal-weighted average expense ratio is a bit of a straw man. On the vertical axis, 50% represents the point at which half of the assets at invested above and half below. Reading down to the horizontal axis puts us close to an expense ratio value of about 0.64%. The asset-weighted expense ratio, which best reflects investors' collective experience, was 0.64% in 2014.

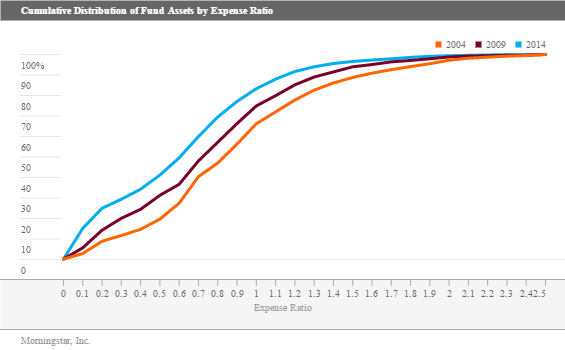

This line has shifted to the left as flows have accumulated in low-cost funds and expense ratios have fallen. The chart below illustrates this shift. In 2004, about 20% of investors' assets were invested in funds with expense ratios less than or equal to 0.50%. By 2014, 41% of investors' assets were invested in funds with expense ratios at or below this threshold. Clearly, investors deserve the credit for driving down costs.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)