Seeking Small-Cap Moats: Collectors Universe

Collectors Universe is a neat little business with considerable competitive advantages and an attractive dividend profile, but shares are too pricey right now.

Though I didn't realize it at the time, my introduction to markets came when I was about six years old and started collecting baseball cards. Each month, I'd check the Beckett price guide to see how much my cards were worth and would trade with other kids in the neighborhood and at card shops. Those were the days.

One of the first things I learned as a collector was that the quality of the card--whether it had damaged corners, print imperfections, or scratches--had a tremendous impact on its value. And back in the late 1980s, the quality of the card was subject to a lot of debate. Sure, there were general guidelines for identifying a "gem mint" and a "near mint" card, but traders would often disagree about the quality, and both parties had concerns that they might be ripped off.

That dynamic began to change not long after I started collecting, when neutral third parties began offering grading services. For a fee, their experts rated the card's quality on a scale from 1 to 10 and placed the card in a sealed holder. With an independent quality score now emblazoned clearly on the cardholder, buyers and sellers could feel more comfortable in their transactions and the marketplace became more efficient.

In addition to baseball cards, independent grading systems also took hold in the rare coin, sports memorabilia, and autograph markets. One company in particular, Collectors Universe CLCT, has been at the forefront of the movement since its early days.

Here are some quick facts about Collectors Universe (as of April 17, 2015):

- Market cap: $200 million

- Dividend yield: 6.2%

- Insider ownership: 19.8% (as of most recent proxy)

- Sell-side analysts covering: None

- Employees: 270

- Non-U.S. revenue: 8%

Founded in 1986 as a coin grading service by David Hall, who currently owns 8% of the company, Collectors Universe has since graded about 30 million coins through its Professional Coin Grading Service brand (69% of 2014 revenue) and over 22 million trading cards through its Professional Sports Authenticator brand (23% of 2014 revenue). This track record, as well as the company's reputation for consistent and accurate grading, has enabled it to establish dominant market shares and valuable brand recognition in both lines of business. Its closest competitor in rare coin grading is NGC, a privately held company with an estimated 25% market share compared with PCGS' share over 50%. In sports cards, PSA is the clear leader, with well over 75% market share, though there are smaller competitors, like SCG and the aforementioned Beckett.

While some collectors keep their coins and cards ungraded, as they prefer to physically hold the items rather than have them sealed in a case, they do so with the knowledge that it likely reduces the items' value and their liquidity in the marketplace. In short, collectors of high-value coins and sports cards have a strong incentive to have their items graded, and that's good news for Collectors Universe given its leading position in those key markets, as collectors should prefer to have their items graded by the better-known brand. Indeed, based on what I've learned, PCGS-graded coins tend to carry a higher value than coins of similar quality that have been graded by smaller competitors.

Collectors Universe typically charges a flat fee of $15 to $300 per coin, and for coins valued above $10,000, it also charges 1% of the coin's market value. For sports cards, the fee is between $8 and $25 per card. In addition to flat fees, the company has begun adding services like high-resolution photography, restoration, and re-holdering to help drive the top line. Collectors Universe has also set its sights on building its coin grading operations in Europe and Asia, where coins remain primarily ungraded. If buyers and sellers in those markets see value in adopting independent grading systems, this could be a long-term tailwind for the business.

Even though Morningstar doesn't cover Collectors Universe and the company hasn't been vetted by our moat committee to produce an official Morningstar Economic Moat Rating, I'd argue that the company has established a narrow economic moat based on an intangible-asset advantage gained primarily through its PCGS and PSA brands. I'd also argue that it would be very difficult for an upstart grading service to approach the expertise, technology, and know-how Collectors Universe possesses to become a formidable foe in the next 10 years.

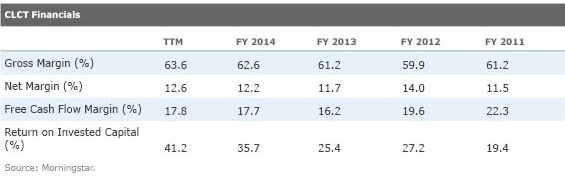

As of December 2014, Collectors Universe had $17.2 million cash on its balance sheet and carried no debt. Given the cyclical nature of collectibles demand--2008 and 2009 were relatively bad years for the company--having little to no debt seems appropriate. The company also pays a robust dividend that will be of interest to income-minded investors. Though the dividend is Collectors Universe's primary means of returning shareholder cash and acquisition activity has traditionally been minimal, the free cash-flow-based dividend cover is a hair over one and the earnings-based cover is consistently below one, making a dividend cut possible in the event of a lean year or two. As such, tread carefully if you're investing for the attractive dividend yield alone.

Though the company suspended its dividend for most of 2009, management and the board do deserve credit for buying back nearly 20% of the company's shares outstanding in July 2009 via a Dutch Auction tender offer at an average price of $5 per share. With the benefit of hindsight, that was a fine capital-allocation decision.

Risks and Valuation Beyond the risks outlined in Collectors Universe's 10-K filing, which importantly includes damage to its reputation as a fair and accurate grader of coins and collectibles, the biggest concern I have is regarding demographics. The American Numismatic Association estimates that the average age of coin collectors is over 50, which could be a headwind for the industry if retired coin collectors begin cashing in and younger collectors don't step up to absorb the additional supply.

The stamp collecting industry, for instance, has struggled with this in recent years as interest from young collectors has waned. Coin collecting may be a different story, however, given the gold and silver content of many coins and their perception as currency.

Valuation-wise, Collectors Universe doesn't look cheap near $22 (as of April 17), the stock trading with premium multiples to the market and its own historical averages.

Collectors Universe is a neat little business with considerable competitive advantages and an attractive dividend profile, but it's staying on my watchlist for now. A back-of-the-envelope dividend discount model that assumes 4%-6% initial dividend growth and 2% terminal dividend growth with a 12% cost of equity suggests a fair value range of $18.50 to $23.00 per share. I'd be more comfortable buying closer to $18 per share to secure a larger margin of safety.

Favorite Ideas As of April 17, here are my top five watchlist ideas, in no particular order.

Culp CFI. Management of this textile company is making the right capital-allocation decisions--including a recent 20% dividend increase--and the balance sheet is solid, with a net cash position of $35 million.

Douglas Dynamics PLOW. The company's acquisition of Henderson Products expands its reach into the heavy-duty snow removal truck market. Income-minded investors should like its 4% dividend yield, as well.

Natus Medical BABY. If this company can repeat what it did in neurology and build a dominant position in new niche markets in the health-care industry, today's share price may prove to be a long-term value.

Collectors Universe CLCT: This quarter's small cap dominates an attractive market niche and could benefit from expanding into markets like China and Europe.

Winmark WINA. John Morgan and team are an impressive group of capital allocators, taking the cash flow from retail operations and reinvesting it in the growing leasing business.

A quick note: Following the January article on Monro Muffler Brake, we switched from a monthly to a quarterly publication schedule for this series. I didn't communicate this as well as I should have, so my apologies for that. The next edition of this series is scheduled to be published on July 22.

Previous installments of this series:

- Monro Muffler & Brake

- Natus Medical

- Tumi Holdings

- Winmark

- Douglas Dynamics

- WD-40

- Raven Industries

- Sun Hydraulics

- John Bean Technologies

- Exponent

- Culp

- Badger Meter

- Latchways

- US Ecology

- 2014 Annual Review

Todd Wenning, CFA, owns shares of Sun Hydraulics, WD-40, Douglas Dynamics, and Culp. You can follow him on Twitter at @toddwenning.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)