Investors Drive Expense Ratios Down

A Morningstar study shows the average fundholder pays 15% less than five years ago.

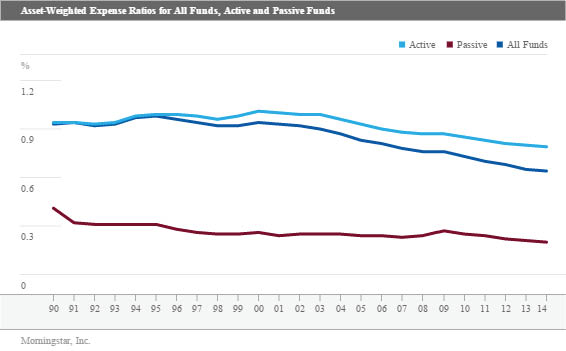

Investors are paying less for fund management. A new Morningstar study released today shows that the asset-weighted expense ratio across all funds (including mutual funds and exchange-traded products, or ETPs, but excluding money market funds and funds of funds) was 0.64% in 2014, down from 0.65% in 2013 and 0.76% five years ago. The trend is being driven more by investors seeking low-cost funds than it is by fund companies cutting fees.

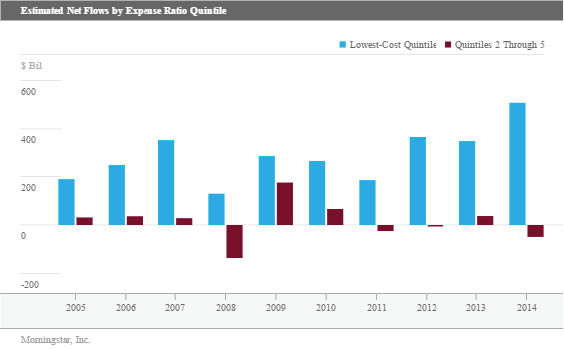

Investors Are Choosing Low-Cost Funds During the past decade, low-cost funds have been attracting far more inflows than their more-expensive peers. This has helped to reduce the industry's average asset-weighted expense ratio over time. Mutual funds and ETPs with expense ratios ranking in the least-expensive quintile of all funds attracted an aggregate $3.03 trillion of estimated net inflows during the past 10 years, compared with just $160 billion for funds in the remaining four quintiles. That is to say that 95% of all flows have gone into funds in the lowest-cost quintile. Passive funds (mutual funds and ETPs) have been prominent recipients of the capital flowing into low-cost funds. Compared with funds falling in cost quintiles 2 through 5, funds in the lowest-cost quintile are more likely to be index funds.

The asset-weighted expense ratio for index funds was just 0.20% in 2014, compared with 0.79% for active funds. Estimated net inflows to index funds in 2014 totaled $392 billion, topping the $66 billion of flows into active funds. During the past 10 years, index funds have collected $1.90 trillion in net new investor capital compared with $1.13 trillion for active funds. The difference is even starker among U.S. equity funds. Passive funds focused on U.S. stocks have attracted $671 billion of inflows during the past 10 years, compared with outflows of $731 billion for active U.S. equity funds.

Passive funds now account for 28% of the total assets in the universe we’ve examined, up from 13% in 2004. But this preference for lower-cost fare isn’t limited to the realm of index funds. Even within active funds, the lowest-cost quintile received $1.07 trillion of the $1.13 trillion of estimated net new flows during the past decade.

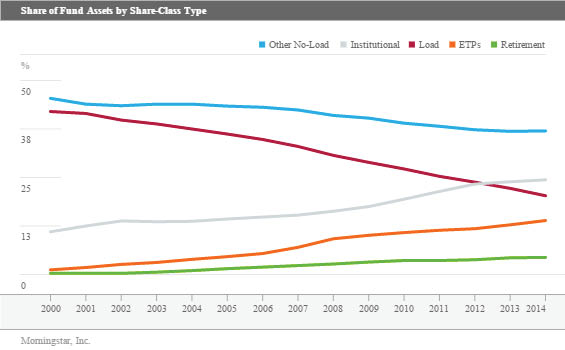

Share-Class Warfare In addition to migrating en masse to lower-cost funds, investors also are flocking toward lower-cost share classes. Investors continue to move away from load-based share classes while typically lower-cost share classes, such as Institutional shares, have gained favor.

This trend has been driven by a number of factors. For instance, advisors are increasingly using wrap or omnibus accounts that bundle individual accounts in a manner that creates scale and gives them access to Institutional share classes. Also, fee-based advisors are bypassing load shares and opting to use exchange-traded funds or other no-load options on behalf of their clients. (Advisors using no-load funds for their clients typically charge for their services outside the fund’s expense ratio. Those additional fees are outside the scope of this study, which focuses only on fund expense ratios.) And finally, defined-contribution plans now make up a larger share of fund assets, driving investor dollars toward Institutional and Retirement share classes.

Load shares, which charged an asset-weighted expense ratio of 1.02% in 2014, held just 20% of assets as of year-end, down from 37% in 2004. The asset-weighted expense ratio for all no-load share classes was just 0.54%. During the past 10 years, load shares (such as A, B, C, and D shares) saw outflows of $0.5 trillion compared with inflows of $3.5 trillion into all other share classes.

Category Group Asset-weighted expense ratios fell across each of the category groups we examined over the past five years. However, those groups that tend to levy above-average fees such as international equity, sector equity, and alternative increased their share of assets over that span. Funds that invest primarily in U.S. equities saw their asset-weighted expense ratios fall to 0.58% from 0.74% while their share of assets increased to 43% from 41%. It is no coincidence that the three category groups that experienced the largest increase in the percentage of assets invested in passive funds were also those that saw the largest declines in their asset-weighted expense ratios. It is also striking--though not surprising--to see that funds in the alternative category are by far the most expensive, charging (on an asset-weighted basis) more than twice the toll levied on the average investor dollar.

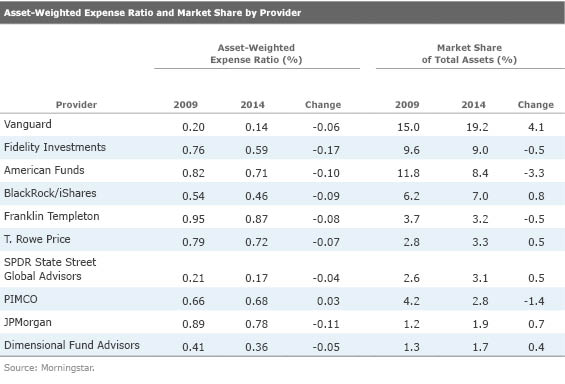

Expense Ratio Trends by Firm On average, firms sponsoring lineups with lower asset-weighted expense ratios gained market share during the past five years. JPMorgan bucked this trend, experiencing a large increase in market share despite the fact that its funds' fees are not among the industry's lowest. Vanguard had the largest increase in market share among the top 10 fund families over the past five years. The firm also has the lowest asset-weighted expense ratio among this group. Vanguard has widened its audience in recent years. In particular it has appealed to the growing field of fee-based financial advisors who might not have had an incentive to use Vanguard's funds under a pay-for-distribution model.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)