Our 7 Favorite Target-Date Fund Charts

Highlights from Morningstar's 2015 target-date research through pictures and tables.

Morningstar recently released its annual study of target-date funds. Here's a summary of the 2015 report, as told through the favorite exhibits of the people who put it together.

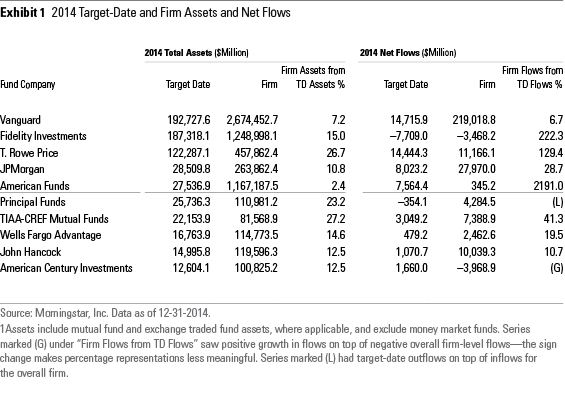

Asset Flows: Target-Date Funds' Vital Place in Asset Managers' Business Target-date funds have quickly become crucial sources of new assets for their firms. Exhibit 1 gives a flavor for this via the industry's top 10 target-date mutual fund providers; it estimates just how much target-date funds contribute to their firms' overall asset bases, as well as the proportion of 2014 net new assets that came from target-date funds. True, overall target-date fund assets make up only about 8% of the typical firm's mutual fund assets. But that share is growing, and target-date-originated flows accounted for about one third of overall flows to the firms concerned in 2014. It is striking how much business comes from a relatively small slice of many fund companies' investment lineups.

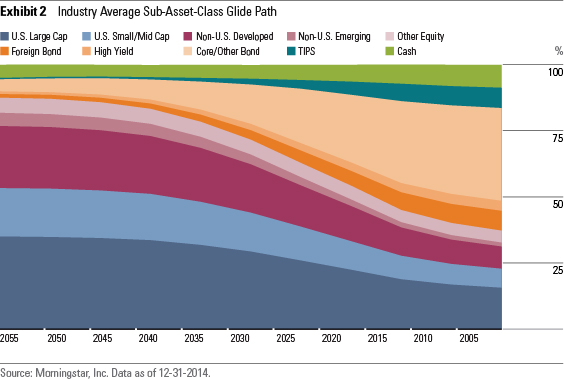

Process: Target-Date Funds' Stock/Bond Split Just Touches the Surface It is common to look at and compare target-date series by their overall equity and bond allocation over time; this high-level examination tends to be the primary driver of results, particularly in times of severe market stress. However, comparing series' equity glide paths only scratches the surface in identifying the differences in target-date managers' approaches. In addition to the overall equity exposure, target-date managers also make decisions for multiple subasset classes. Exhibit 2 shows the industry average sub-asset-class glide path based on actual holdings as of Dec. 31, 2014, across 10 distinct subasset classes.

The 10 subasset classes have behaved very differently over time, so identifying differences at the sub-asset-class level can help investors understand the primary drivers of a target-date series' past and future performance. For example, over the last decade, the average annual difference in returns between the top- and bottom-performing indexes representing the five equity subasset classes was about 35 percentage points. U.S. large-cap stocks put in a particularly strong showing in 2014, setting up American Funds Target Date Retirement series, which has the largest average relative exposure to U.S. large-cap stocks, for much success. Conversely, non-U.S. developed-markets stocks struggled last year, causing headwinds for AB Retirement series, which holds the largest average relative exposure to that subasset class.

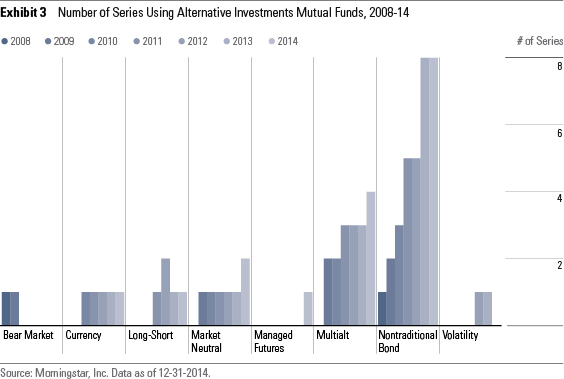

Portfolio: Alternative Investments Making Small Inroads Into Target-Date Funds Liquid alternative investments have enjoyed some of the fund industry's most robust growth, and target-date funds have contributed to the inflow of assets. Exhibit 3 shows the number of target-date series that have invested over the years in some of the main Morningstar Categories housed under the alternative investments group.

Target-date funds’ use of alternative investments notably rose post-2008’s financial crisis, at least in a partial attempt to prevent the funds from suffering as badly in future market corrections as many did during 2008’s rocky period. Non-traditional-bond funds--those that often run unconstrained sector or duration strategies--have been particularly popular of late. These funds can also pursue an absolute return mandate, where the goal is to generate positive returns, regardless of market movements. Target-date managers often turn to these strategies to help compensate for low yields and guard against future rising interest rates.

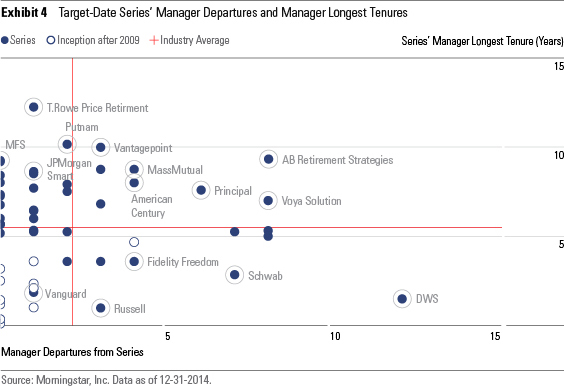

People: Manager Departures Deserve Careful Consideration It is common practice to look at a portfolio management team's average manager tenure to measure its stability, but it is also helpful to review series' departures. In fact, focusing exclusively on the tenure of a team's current members can be misleading. For instance, while Chris Nikolich has acted as AB Retirement Strategies' day-to-day skipper since its 2005 inception, the series has suffered eight manager departures since then, as shown in Exhibit 4. Most recently, Dan Loewy and Vadim Zlotnikov replaced former lead skippers Seth Masters and Dokyoung Lee. The series' manager churn has contributed to its Morningstar Analyst Rating of Negative. Schwab's target-date group has also experienced significant turnover, with four different teams taking the reins since its 2005 launch. However, with Zifan Tang at the helm since early 2012, that team has recently demonstrated stability; Morningstar increased the series' People score to Neutral from Negative in December 2014.

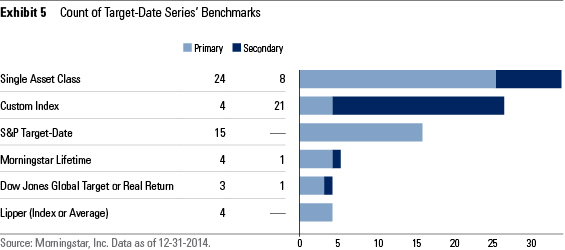

Performance: No Industry Consensus on Benchmarking Comparing short- and long-term returns with the industry average can provide context when evaluating a single target-date series' results. A more difficult task is comparing a target-date fund with an appropriate index, especially because there's so little industry agreement on the matter. As shown in Exhibit 5, 32 target-date providers use broad indexes (such as the S&P 500 or Barclays Aggregate Bond Index) as the primary or secondary benchmarks in their prospectuses. Twenty-five series use custom-blended benchmarks based on their strategic asset allocations, which can help investors measure management's skill in selecting underlying assets to fill the portfolio or its tactical prowess, but it does not provide a means to evaluate the effectiveness of target-date series' strategic asset allocation. The S&P Target-Date benchmarks take a stab at addressing that latter issue, using an industry-average weighting for various asset classes. In addition, several index providers have launched target-date benchmarks that follow a predetermined glide path, including Morningstar and Dow Jones.

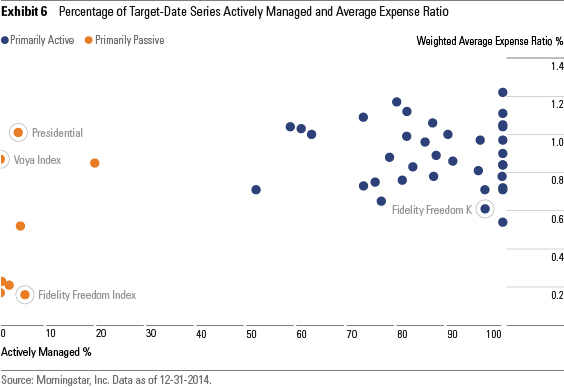

Price: Index Funds Don't Necessarily Equate With Lower Fees As expected, index-based target-date series are the industry's low-cost leaders, as shown in Exhibit 6. The weighted-average expense ratio of passively managed series is 0.45%, well below the 0.78% asset-weighted industry norm. But investors should not assume that index-based management automatically equates with a bargain. Voya Index Solution, Nationwide Target Destination, and Presidential Managed Risk series all carry asset-weighted average fees above industry average norms despite their predominant use of passive management.

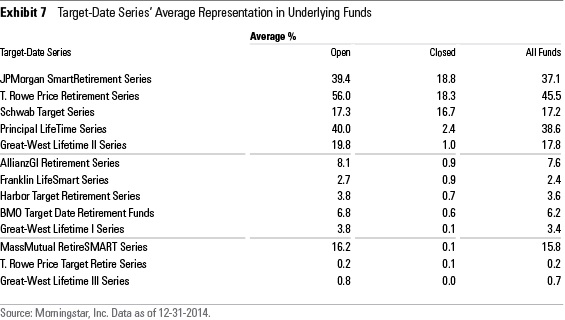

Parent: An Important Client As target-date funds have become important sources of new inflows for their fund companies, they've also become large investors in their underlying funds. In many cases, the underlying funds derive a large portion of inflows from the target-date series that hold them. For example, on average, more than 45% of the assets in the funds that comprise the T. Rowe Price Retirement Series are owned by the target-date series. JPMorgan SmartRetirement Series and Principal LifeTime Series each own more than a third of the assets of their underlying funds. Exhibit 7 shows target-date series that invest in in-house underlying funds (labeled as "Closed"), arranged by the average percentage of assets of those closed funds owned by the target-date series.

To the extent that such underlying funds have ample capacity, the popularity of a firm’s target-date series may not present a problem to the constituent funds. In fact, most portfolio managers appreciate the kind of steady inflows that target-date series can provide, as stable inflows can be easier to manage than more-erratic or excessive flows in or out of a mutual fund. Further, some fund families have pre-emptively taken steps to preserve a fund’s capacity. For example, T. Rowe Price has closed several of its constituent funds, such as T. Rowe Price Small-Cap Stock, to new investors to leave some runway for the fund as the target-date series continues to funnel money to those closed funds. In this regard, the closed-architecture series has the advantage over open-architecture counterparts, as it has more control over which funds are open or closed.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)