Market Is Ignoring Competitive Risks for Rackspace

Absent a potential takeout, prolonged price competition and low returns on capital will depress investment returns.

We are perplexed by

Rackspace Lacks an Economic Moat We can't identify a potential source of moat that would underpin a durable competitive advantage for Rackspace. In our cloud computing framework, we view the shift from the client/server era to the cloud/device era as shifting the economics toward cloud computing vendors, but heavily favoring applications vendors (for example, Oracle ORCL and Salesforce.com CRM) and operating system vendors, particularly those that are building development platforms (for example, Microsoft's MSFT Azure). We place vendors of infrastructure as a service, such as Rackspace, in the hardware bucket, but we expect very few firms in the IaaS segment to build economic moats. Rackspace is not likely to be one of those firms.

When looking at underlying potential moat sources for Rackspace, we are hard-pressed to identify areas where the company has carved out a sustainable competitive advantage today.

We think it is possible to build cost advantages in public cloud environments, but Rackspace lacks scale and control of critical assets (it leases data center capacity) that could help drive its costs lower than those of its competitors. Furthermore, the hardware and software Rackspace uses are available to every firm, and Rackspace's non-unique assets cause us concern. On the other end of the moat spectrum, we believe Amazon, Google GOOG, and Microsoft benefit from cost advantages though these firms don't always directly compete with Rackspace.

Because data center owners can provide access to space and power for both large and small companies, competitors can enter into the hosting and public cloud market with relative ease by leasing data center space. The manner of competition and large number of small players indicates that this market structure does not benefit from efficient scale.

Rackspace does not own or control any unique intellectual property that provides a competitive advantage, either in cost or performance for cloud solutions.

If Rackspace is able to build a moat, it will be around customer switching costs, in our view. We've largely considered managed hosting and public cloud services to be commoditylike businesses with low switching costs. Typically, customers are using nonproprietary technology and are simply renting space, power, and commodity-based servers. Also, the contract duration is not normally longer than a year, unless it includes a paid cancellation clause. Because the hurdle for a narrow moat is the ability to earn excess returns on capital for a period of 10 years, we are skeptical that Rackspace can lock in customers simply by providing high levels of service. Additionally, our model assumes substantial revenue contribution from new customers. Even if the market has switching costs, we would expect rampant price competition for these new customers as well.

New CEO + Failed Sale = Rising Stock Price? The market seems to have forgotten the turmoil and ambiguity surrounding Rackspace in 2014, as the stock price has nearly doubled from its lows of last year. In early 2014, longtime CEO Lanham Napier resigned unexpectedly. The stock had been punished as operating margins declined from the midteens in 2012 to the single digits in the back half of 2013. Shortly after Napier's resignation, the board retained an investment bank to explore a potential sale of the company. There has been a reasonable amount of M&A activity over the past several years, including IBM IBM purchasing SoftLayer for approximately $2 billion in 2013. Rackspace's board ultimately ended the process after a deal failed to materialize, despite rumors of potential interest from CenturyLink CTL (which purchased managed hosting provider Savvis in 2011).

After the company abandoned the potential sale, the board named Taylor Rhodes as CEO in September 2014. Rhodes has been serving as president since 2007, so he is intimately familiar with the company's culture, customers, hosting business, and foray into managing public cloud offerings. We are not troubled that Rhodes is at the helm, but the incidents of 2014 highlight potential internal angst about the best path forward as Rackspace competes with bigger companies with greater resources. Investors should also take heed.

Strategically, Rackspace is attempting to avoid head-to-head competition with Amazon, Microsoft and Google. Management has said the company will not match the price cuts these giants have been making for their cloud offerings and will instead try to differentiate itself through high-touch service levels. In the public cloud segment, Rackspace had been feeling the effects of a very aggressive pricing war in the IaaS cloud segment (as shown by declining gross margin per server metrics), where Rackspace provides on-demand computing resources. By most accounts, Amazon, Microsoft, and Google cut prices for various cloud services by more than 30% in 2014 after cutting prices 25 separate times in 2013.

Abandoning price competition is a noble pursuit, but success of that strategy is determined by customers, not by Rackspace. Customers will have to place a high enough value on a managed offering versus a self-service public cloud and choose Rackspace versus competitive managed cloud providers. We view Rackspace's strategy as less bad than competing directly versus Amazon, Microsoft, or Google, because the company clearly does not have the scale in data center capacity or computing infrastructure that these three giants have.

However, we believe the company will eventually be forced to compete on price, as customers will have a great deal of choice and are ultimately motivated to lower their total cost of ownership. Customers have several variables that affect their total cost of ownership equation, including staffing, uptime, insuring for uptime via service level agreements, and flexibility for future-proofing technology decisions and shorter payback periods for technology investments. Most of these TCO requirements are supporting the shift from on-premises to cloud computing environments, and we don't believe Rackspace will uniquely benefit over the long run.

Still, Rackspace contends it can offer superior servicing that affords competitive advantages in the IaaS market. While this may be true today for customers looking for managed IaaS, we expect success in managed cloud offerings will inevitably attract new competitors. In fact, there have been a small number of service providers that are providing managed services sitting atop Google's and Amazon's cheaper platforms. If these two giants take an active partnering approach to allow other companies to support public and hybrid clouds, we believe Rackspace's competitive positioning will deteriorate.

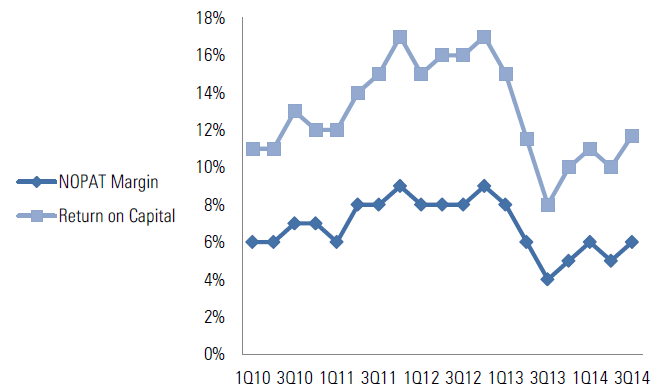

ROIC Trends Concern Us Understanding Rackspace's return on invested capital is critical to our understanding of the economics of the company as a cloud services vendor, not only in today's environment, but also as we consider future capital efficiency and profit potential. Rackspace has two primary businesses, both of which require capital to acquire data center space (typically through leases), servers, and networking capacity. These capital expenditures are necessary to meet current customer demand for computing, storage, and other core infrastructure services. To a lesser degree, the company also spends money developing software capabilities to manage this infrastructure in the most cost-efficient manner possible.

In the IT value chain, enterprise customers are looking to allocate their own capital more efficiently, so they are turning to managed hosting and IaaS providers, spending less in capital expenditures and depending on service providers like Rackspace to make the necessary capital investments to build and support the computing infrastructure. Because IaaS vendors are building and managing computing capacity, which includes data center space, power, bandwidth, and servers, these cloud vendors are, by necessity, capital-intensive. In fact, Rackspace's capital intensity was 24% of revenue in 2014, compared with large telecom providers such as AT&T T and Verizon VZ, which typically spend substantially less than 20% of revenue. We would not expect (nor have we modeled for) capital expenditures to decline as a percentage of revenue below the midteens. Perhaps most notably, capital expenditures related to customer gear (which ignores data center buildouts, software development, and operating lease expenses) range from the mid- to high teens. Customer gear is purchased to meet near-term demand.

Management has embraced the significance of this capital-intensive model and publishes the company's return on capital performance regularly. We applaud management for presenting this view, but we have three primary issues with this metric: First, the company's return on capital calculation ignores off-balance-sheet liabilities, which primarily consist of operating leases for data centers that have meaningful long-term commitments, exceeding 15 years in some instances. Second, even if we assume management's ROIC calculation is appropriate, Rackspace's performance has trended downward over the past two years. Third, management's incentive compensation is benchmarked by revenue growth, not profit or return on capital.

Even the company's view for returns on capital would not convincingly support a positive investment thesis for our purposes. The degradation in returns from 2012 to 2013 has reversed over the past four quarters.

Bigger Exposure to Public Cloud Competition Since 2013 Has Depressed Returns on Capital

Source: Rackspace

Investors should also consider that Rackspace's public cloud business was extremely small several years ago, and the competitive nature of cloud delivery options is likely to weigh on returns on capital as well. As the market evolves, we expect most customers to access multiple public clouds to flexibly access cheaper pricing, better performance, and specific functionality. Public cloud revenue represented less than 25% of revenue in 2012, and we expect that percentage to increase to nearly 40% by 2019.

We also believe the company's return on capital calculation may be overstating returns, at least as investors should use them to compare with the firm's cost of capital. Rackspace commits to long-term operating leases (including minimum lease terms and price escalators) in order to support the investment of the data center space providers to invest in their capacity as well. These suppliers to Rackspace also are striving to earn their cost of capital. In our calculation, we consider the value of these operating leases. We don't believe the company's current ROIC profile is sufficiently above its cost of capital (9%) to support a moat, at least from a current financial perspective.

The decline since 2013 is important, in our view, as the past provides a reasonable window to potential negative implications of increased competition.

Management is trying to steer the company away from customers that are purchasing cloud solutions based solely on price. However, even small moves in pricing can quickly alter the firm's margin and ROIC profile, because the cost structure of delivering computing infrastructure is based only on the computational load on the data center. For example, if pricing declines 10%, the firm's operating margins may also decline 1,000 basis points (for example, to 5% from 15%), because the cost inputs do not change.

Our lack of confidence about the potential for a moat heightens our concern about the risk of price competition. As a result, we do not expect Rackspace to earn persistent excess returns on capital.

Investors Are Exposed to Material Downside Risk Given our view of Rackspace's lack of competitive advantages, we believe the stock is overvalued. Our fair value estimate is $31 per share, or 35 times our 2015 earnings estimate. Our valuation is driven by three critical assumptions: First, we think the firm will be unable to expand ROICs materially, which will limit the operating margin expansion into the midteens in roughly seven years. Second, we project that returns on capital will equal the company's cost of capital after our explicit forecast period. Third, we model revenue to grow at a 12.4% compound annual growth rate over the next five years, led by cloud computing, which we already forecast to grow at a 19% CAGR.

The current stock price is just above our bull-case valuation of $49. In this scenario, we assume Rackspace has an economic moat and can exert pricing power over its customers. Here the firm can expand operating margins to more than 20% within the next five years, while ROICs reach the high teens. Additionally, we assume Rackspace earns excess returns for 20 years, which would be in line with a wide-moat company. Finally, we would expect revenue to grow at a 15% CAGR through 2019.

In our view, the market is pricing Rackspace close to perfection, and we strongly recommend investors look elsewhere at this time.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)