Why You Should Invest With Managers Who Eat Their Own Cooking

Higher levels of manager investment are a good sign.

It pays to invest with managers who invest in their funds.

I've suggested this before and now I have more conclusive data pointing this way. Last year I looked at the Morningstar 500 funds and found that those in which managers invest more than $1 million produced modestly better performance than the rest of the subset. Now I've looked at the broader fund universe and found a strong link.

The SEC requires managers to disclose how much they invest in their own funds. Unfortunately, the SEC requires bands rather than actual dollar figures. Those bands are: none, $1–$10,000, $10,001–$50,000, $50,001–$100,000, $100,001–$500,000, $500,001–$1 million, and over $1 million. You can find this information in a fund's Statement of Additional Information and in the Fund Spy tool, Spy Selector, on mfi.morningstar.com.

This is very useful information, though it fails to distinguish among managers with more than $1 million invested.

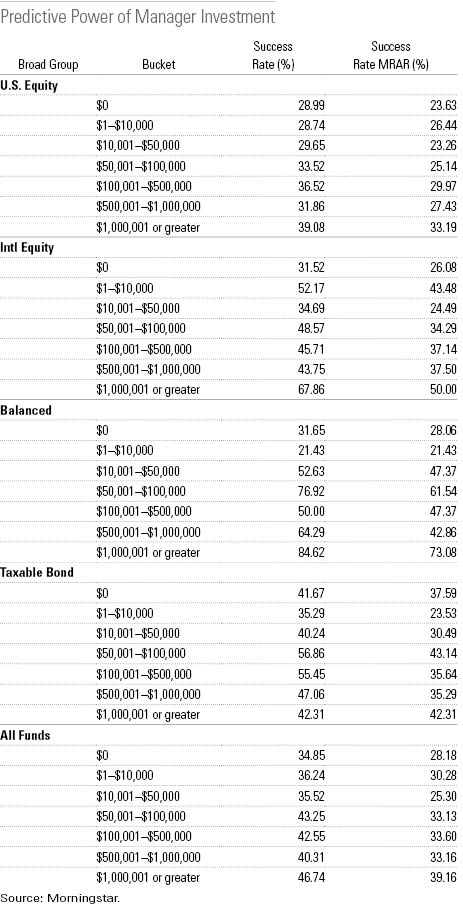

If the SEC required managers to report their total dollar amount or number of shares, we'd be able to track investments more precisely. Despite the limits, the data may still have predictive power. To test it, I looked at manager investment levels from 2009 and then tracked five-year performance from that point on. I grouped funds by top manager investment range and then asked what percentage survived and outperformed their category peers. That gave me a success rate. This, in turn, gives us an idea of whether you can improve returns by choosing funds with high manager investment levels. I excluded index funds and funds of funds from the test. We used a single share class per fund.

Results It turns out that manager investment does have predictive power. Funds in which managers invested nothing had the lowest success rate, and those in which a manager had more than $1 million invested had the highest success rate. The rate generally progressed higher with manager investment levels.

Managers investing no money in their funds had a meager 35% success rate, those with between $100,001 and $500,000 had a 43% success rate, and those with more than $1 million had a 47% success rate. Because about one third of funds were merged away or liquidated over that five-year stretch, a 47% success rate is actually quite good. If we look at a risk-adjusted success rate, the story is fairly similar. We found a risk-adjusted success rate of 28% for managers with no investment compared with 39% for those with $1 million or more.

Looking at asset classes, the trend was pretty consistent. In U.S. equities, funds with no investment had a dismal 29% success ratio versus 39% for the top rung. Attrition was higher in U.S. equities coming out of the bear market. For international funds, those with zero investment had a 32% success ratio versus 68% for those with more than $1 million invested. Balanced funds had a 32% success rate on the bottom rung versus 85% on the top rung.

Manager investment worked less well for sector funds and taxable-bond funds, however. For sector funds, the group with no investment had a 39% success ratio while the over $1 million group had a 40% success ratio. The highest two rungs in sectors were pretty sparsely represented as just 10 funds and 16 funds were represented at the start of the period. So, it could be that there just isn't enough data. For taxable bonds, the top performers were in the middle of the investment range. However, the number of funds in the top two groups was fairly small again. If there's more going on than a lack of data, I don't have an explanation for why these two asset groups defy the manager investment trend.

Municipal bonds showed a positive trend for moving up in investment level, but like the figures for sector funds and taxable-bond funds, the limited amount of data leads me to avoid conclusions. Muni funds in which managers invested more than $1 million had an 80% success rate, but that comes from a mere five funds.

Why the Predictive Power? There are likely some direct and indirect effects going on here. No one knows a fund better than its managers and naturally they can evaluate it well for their own needs. They can evaluate people and process and are savvy investors when it comes to fees. So they are more likely to buy low-cost funds as we saw in previous studies. If a fund has high costs, they might invest in some other vehicle such as a separate account or simply buy the fund's underlying holdings directly for their own accounts.

In addition, manager investment tells us that a manager has aligned his interests with shareholders'. Those with high investment levels likely believe strongly in the strategy and people in place. On the other hand, those who view their fund simply as a product to be sold may not be as likely to invest in a meaningful way.

Manager investment can also be an effect of success. Successful fund managers are likely to be paid more and therefore invest that money in their funds. To the degree those managers continue to succeed, the investment level will have predictive power. In fact, we're seeing more bonuses paid in fund shares, which furthers this effect.

Funds in Which Managers Are Investing More In all, 36 managers of Morningstar 500 funds moved into the top investment level in 2014. Let's take a look at those where there were no other managers at the fund already in the top level.

Meridian Growth

MERDX

Chad Meade and Brian Schaub joined Arrowpoint in 2013 and quickly invested in the Meridian fund that they took over in September 2013. Given their success at

AMG Yacktman

YACKX

This fund's trio of managers, Stephen Yacktman, Donald Yacktman, and Jason Subotky, went from nothing invested to more than $1 million in 2014.

TCW Total Return Bond

TGLMX

Comanager Tad Rivelle is the first past the $1 million threshold, as Mitch Flack and Bryan Whalen have $100,001–$500,000 in the fund. The three came on board when TCW bought MetWest to take over in the wake of its messy divorce from Jeffrey Gundlach.

PIMCO Total Return

PTTRX

Speaking of messy divorces, Mihir Worah and Scott Mather quickly invested more than $1 million in this fund after they became managers in the wake of Bill Gross' departure.

FMI Large Cap

FMIHX

Thirteen years into his tenure, Patrick English has finally topped the $1 million investment level in this fund. He also has more than $1 million in FMI Common Stock FMIMX.

Arbitrage Fund

ARBFX

John Orrico crossed the $1 million threshold in this fund, which has a Morningstar Analyst Rating of Bronze.

Fidelity Worldwide

FWWFX

William Kennedy boosted his investment to more than $1 million in this fund.

Fidelity Select Energy

FSENX

John Dowd raised his investment level to more than $1 million. As I noted earlier, that's pretty unusual for a sector-fund manager.

FPA Perennial

FPPFX

Eric Ende's investment range rose from the $500,000–$1 million range to more than $1 million. It's possible that this was simply due to appreciation, as it was a move of just one investment level, but it is a good sign in any case.

Fidelity Trend

FTRNX,

Fidelity New Millennium

FMILX, and

Fidelity Value

FDVLX

Also moving from the second rung to the top rung were Matthew Friedman of Fidelity Value, John Roth of Fidelity New Millennium, and Daniel Kelley of Fidelity Trend.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)