Buyer Beware With Managed-Futures Funds

Investors have swiftly rushed into managed-futures funds this year, but the category isn't out of the woods yet.

After languishing for several years, managed-futures funds bounced back in 2014, with the average fund notching a 9% return. Investors appear to have taken notice, pumping more than $1.4 billion into the category in the first two months of 2015, including a single-month record of $800 million in January.

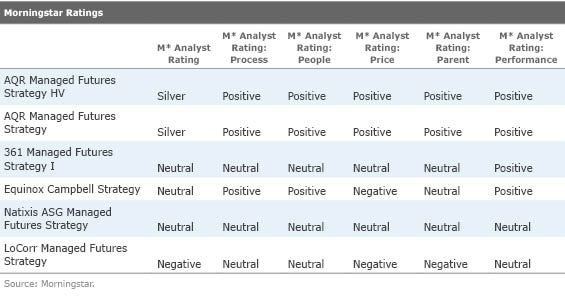

Performance-chasing aside, there's some reason for enthusiasm. Managed-futures strategies employ an intriguing approach--trend following--that research has shown holds promise in enhancing a portfolio's overall risk-adjusted returns. Unfortunately, though, most of the available managed-futures funds are too pricey, too opaque, or unproven. Indeed, only one of the five distinct managed-futures funds we cover (which together account for about 70% of that Morningstar Category's aggregate assets under management) garners a Positive rating. While the category is showing signs of improvement in transparency and price, for the time being it's appropriate for investors to approach these strategies with a cautious mindset.

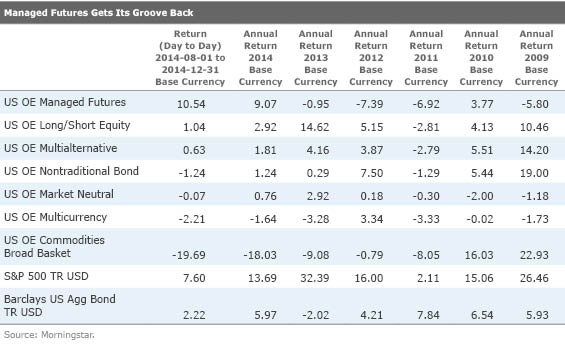

Managed-futures funds became the poster children for the benefits of liquid alternatives after they flourished during the financial crisis; assets poured into existing funds while a flood of new products entered the nascent category in succeeding years (Morningstar established the managed-futures category in 2011). In the years that followed, however, managed futures has been the worst-performing alternative strategy among Morningstar's alternative categories. Starting in August 2014, that trend may have finally turned in the strategy's (and patient investors') favor as volatility returned to markets, most notably the commodity market, creating a more-favorable environment for managed futures to generate positive returns.

From Aug. 1 through the end of the year, managed futures was the top-performing alternative category (see Exhibit 1). The 50 funds in the category delivered a whopping 10% average return during that four-month span. A number of funds in the category, like top performers Altergris Futures Evolution Strategy EVOIX, Equinox Chesapeake Strategy EQCHX, and LoCorr Long/Short Commodity Strategies LCSIX, even managed to handily beat the S&P 500's 13% annual return with gains of more than 20% for the year. For the full year, the category average return was 9%. That looks particularly attractive compared with the averages of far more popular liquid alternative categories like multialternative (up 1.81%) and long-short equity (up 2.92%). This marks the first calendar year in which managed futures outperformed either category since the financial crisis.

What has led to this sudden burst of strong performance, and can investors expect more of the same going forward?

How Managed-Futures Funds Work To answer those questions, it first helps to understand a bit about the theory behind managed-futures investing. Managed-futures strategies try to take advantage of momentum, the idea that winners will keep winning and losers will keep losing, in one or more asset classes. These strategies typically use quantitative, rules-based models to detect and invest in these trends via futures contracts. In doing so, they have the ability to take advantage of both positive and negative trends, which means going long or short asset classes or narrow market segments (typically via futures contracts) as conditions warrant. Trend-following strategies tend to excel amid market turmoil since bear and bull markets typically take several months to develop and peak. The length of time bull and bear markets take to develop gives trend-followers a chance to ride the trend downward or upward. During the financial crisis, for example, the S&P 500 peaked in October 2007 but didn't hit its bottom until March 2009. That proved to be an ample amount of time for trend-followers to catch onto the trend and hold on through the extreme drops of the fourth quarter of 2008, when the strategies on average delivered robust returns. They don't do as well during bursts of volatility, such as the summer of 2011, when markets fall and rebound over a short period of time.

Momentum investing, because of its ability to profit from down markets, has historically shown very little correlation to stock markets; that has made it particularly attractive to investors. There's been much academic ink dedicated to why momentum exists in markets and whether or not it's likely to continue. The case for why it exists is largely rooted in behavioral economics. Investors tend to buy when things are going up, extending the gains, thereby drawing in even more investors until eventually the trend collapses. Whether or not it's likely to continue in the future, particularly as strategies seeking to profit from it continue to attract assets, is more open to debate. The best systematic traders continually update their models to adjust to new information and market behaviors.

For the past few years, these funds had been limited by a lack of significant trends to follow. Some managed-futures fund managers point their finger at the Federal Reserve's quantitative easing program for reducing volatility in most major asset classes. That program officially ended in October. Managed-futures funds started to perk up as QE was winding down, and perhaps more importantly, as oil began its eventual 50% free-fall. That plunge was the first major asset collapse since the financial crisis, and trend-followers were able to capitalize on it. The U.S. dollar's surge versus other developed-markets currencies in the fourth quarter was another positive for the group.

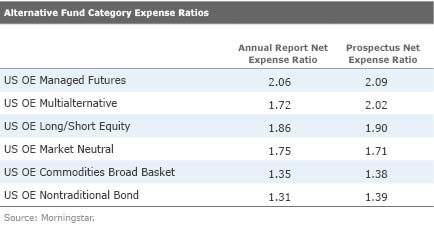

Open and Hidden Costs of Managed-Futures Funds Another continuing challenge to the returns of managed-futures funds is fees. This category has the highest average expense ratio of any Morningstar category. Exhibit 2 shows both annual report and prospectus net expense ratios for the managed-futures category relative to other alternatives categories. Because most multialternative funds use a manager-of-managers structure, the prospectus expense ratio is usually the more accurate figure for that category.

To make matters worse, those expense ratios actually understate the true average expense ratio. That's because a handful of funds, particularly series of multiple vehicles offered by Equinox Fund Management, LoCorr Fund Management, and Altegris Advisors, have an unorthodox and shareholder-unfriendly way to gain access to subadvisors. Unlike traditional funds that use subadvisors, these firms don't hire the subadvisors to manage money for the fund directly. Instead, they use a total return swap to gain access to the net of fee returns of the subadvisors' hedge fund strategies. By using the swap, the fees that the subadvisors charge in their hedge funds, usually between 1% and 2% management fees and up to 20% performance fees, aren't included in the fund's annual report net expense ratio. But those indirect costs still have an impact on returns.

Fund companies that employ the swap structure often say it's the only way to get access to the best commodity trading advisors, who are unwilling to give up their performance fees. Over time, it's possible that those CTAs could overcome their own fees and the additional layer of mutual fund fees to deliver consistently solid performance, but these firms typically aren't exhibiting best practices for transparency by hiding away fees in the fine print. In the end, of course, the published returns of the funds will be net of all fees, so the additional costs will create a higher performance hurdle.

There have been some positive movements along that front in recent mutual fund launches. Abbey Capital, American Beacon, and LoCorr each launched managed-futures funds in 2014 that have access to CTA managers without using total return swaps, so their fees are as advertised. It's a good sign to see newer funds moving toward more transparency and lower fees in the mutual fund format.

Fees are a big reason that only one managed-futures mutual fund and its higher-volatility sibling have garnered a Positive Morningstar Analyst Rating thus far. Morningstar currently covers five of the roughly 50 managed-futures funds that comprise the category. Those strategies, and their ratings, are shown below.

Conclusion Managed-futures strategies have strong roots in academic theory, and historically the strategy has been a good alternative return stream for investors invested in traditional asset classes. But thus far, managed-futures funds have left a lot to be desired. High fees plus limited transparency plus limited track records equal a category with slim pickings for now. There are signs of the category maturing--with lower costs and better transparency--that are encouraging for the future prospects of the strategy in mutual funds. We'd caution against performance-chasing, given how poorly investors have timed entry and exit into these funds in the past. However, for investors who understand the role managed-futures strategies can play in a portfolio and who are willing to make and stick to a strategic allocation, there is potential value.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)