The Only S&P 500 Index Funds You Will Ever Need

We highlight the five best funds in a crowded field.

More money is indexed to the S&P 500 than to any other benchmark. With some 49 S&P 500 Index funds available with 145 different share classes, picking the best might seem like a daunting task. It turns out, however, that only a handful of these funds are true stand-outs.

The first thing to consider when looking for a good S&P 500 Index fund is its size. Passive fund managers differ from active managers in this regard. Active managers want to remain nimble so that they can easily implement their investment ideas without causing an inordinate market impact in the securities they wish to trade. In fact, active managers often consider closing to new investors to keep assets at reasonable levels (and perhaps add a bit of exclusivity to their funds).

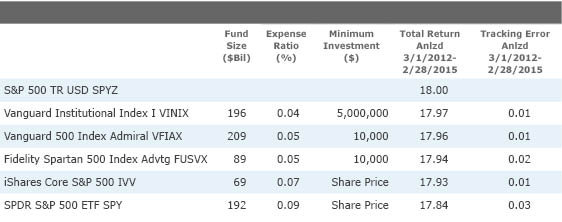

Market-cap-weighted index funds, on the other hand, benefit from larger scale because they are able to more efficiently track an index and spread fixed costs over a larger asset base. Indeed, 85% of the assets in S&P 500 Index funds are with just five funds, compared with 30% of actively managed assets in the top five actively managed large-blend funds. So, it is no coincidence that the largest S&P 500 Index funds typically have the best performance. Here we highlight the best S&P 500 Index funds and how they differentiate themselves from the pack.

A Commitment to Indexing

Many fund providers offer an index fund in their lineup even if indexing is not the core of their business. Perhaps they offer an index fund for use in retirement plans or insurance products. Firms that dedicate resources to growing their indexing business typically have better index fund offerings. As the leading index fund provider, no firm exemplifies a commitment to indexing better than Vanguard. As such, it is fitting that Vanguard has two funds on this list:

For Traders

Launched in 1993,

Tax Efficiency Minimizing tax impact requires diligent management. Funds need to minimize capital gains, track tax lots, seek qualified dividends, and harvest taxable losses all while minimizing tracking error. Fortunately, market-cap-weighted indexes such as the S&P 500 tend to be tax-efficient right out of the gate because their constituent stocks change infrequently, resulting in low turnover and less frequent capital gains. ETFs have an additional advantage due to their greater ability to handle outflows through the in-kind redemption process. This process allows an ETF to satisfy outflows by giving equity shares instead of cash and thus avoiding having to sell individual stocks. Many investors fear that massive selling after a runup in stock prices could force a traditional mutual fund to meet redemptions by selling stock at capital gains. This so-called tax-bomb scenario is unlikely to happen because most investors bail after stocks fall, not after they rise. Still, those hypersensitive to this scenario may prefer a stand-alone ETF, such as IVV, which can minimize capital gains through in-kind redemptions. Compared with SPY, IVV costs less and has done a better job matching the performance of the index.

Second-Tier S&P 500 Index Funds: Justify Your Existence

The five funds mentioned above account for 85% of assets in S&P 500 Index funds, leaving the remaining 44 funds with just 15% of assets. These second-tier S&P 500 Index funds have an average expense ratio of 0.58%, a median return during the past three years of 17.43%, and tracking error of 0.09%--more than triple the tracking error of our favorite S&P 500 funds. In aggregate, investors pay $314 million in management fees for these funds. If those assets were invested in the five lower-cost funds, investors would save $235 million. Why do they exist? Some fund providers may offer a token index fund option so that they can offer a complete lineup of fund options to clients such as retirement plans or within insurance products. For example, State Farm offers an S&P 500 fund with a weighted average expense ratio of 0.73%. These funds may still be a useful option within closed architecture plan without any good alternatives.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)