ETF Performance Is Not All Written in the Stars

A look at how the Morningstar Rating for funds applies to ETFs.

The Morningstar Rating assigns 1 to 5 stars to a fund based on its risk-adjusted-return ranking compared with funds in the same Morningstar Category. In contrast to the forward-looking Morningstar Analyst Rating, the Morningstar Rating for funds is a completely backward-looking statistical measure of performance. The breakpoints between the five levels are determined so that approximately 10% of the funds in each category earn 1 star, 22.5% earn 2 stars, 35% earn 3 stars, 22.5% earn 4 stars and 10% earn 5 stars. The distribution is symmetrical and bell-shaped, with very few funds receiving either a 1- or 5-star rating.

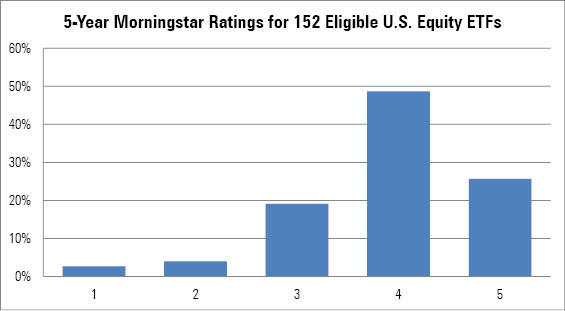

Because the star rating was originally designed before the widespread popularity of exchange-traded funds, the breakpoints are still based solely on mutual funds, and then ETFs are slotted according to those same breakpoints. Thus, ETFs are not forced to follow that same bell-shaped distribution. Of the 152 U.S. equity ETFs that have been around long enough to have a five-year rating, 39 have earned 5 stars while just four ETFs have 1 star. In fact, 75% of ETFs have 4 or 5 stars while just 7% have 1 or 2 stars.

Source: Morningstar Direct.

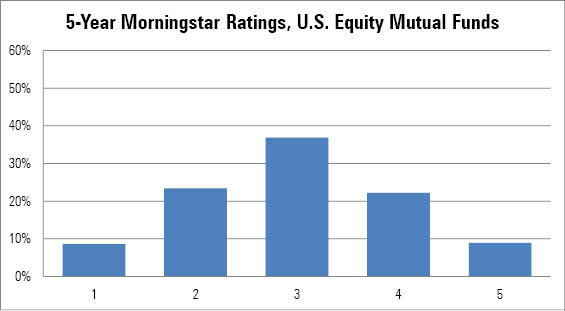

Source: Morningstar Direct.

For equity mutual funds, the distribution is clearly bell shaped, but the contrast with ETFs is stark. There are a number of reasons why the distribution of star ratings for ETFs is so positively skewed, and we discuss several below.

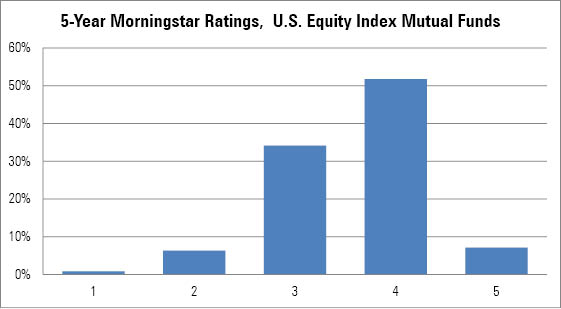

Index Performance Market-cap-weighted equity index funds have been unusually hard to beat during the past five years. In an efficient market, we might expect an index fund to beat about half of active managers before fees. While index funds' cost advantage may help them do better than the average active manager, they have done better than expected during the past five years with the S&P 500, beating about 80% of active managers. This sort of outperformance is unsustainable as investors are unlikely to continue to pay higher fees for worse performance. As index funds outperform, more investors will switch to index funds, and this could make the market less efficient and easier for an active manager to beat, at least according to one theory. If we look at the star ratings for index mutual funds, we also find a positively skewed distribution, although there are still not as many 5-star index mutual funds as there are 5-star ETFs. However, it is difficult to distinguish whether the good performance of index funds during the past five years has been due to the strong performance of indexes or the fact that index funds are low-cost.

Source: Morningstar Direct.

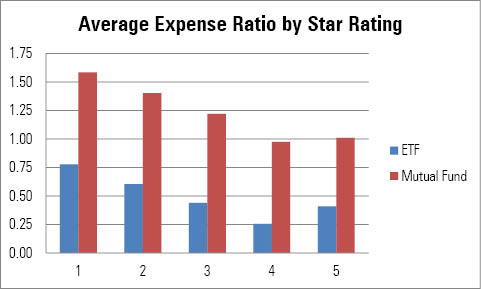

Fees Funds with 4 or 5 stars tend to be lower cost on average. ETFs tend to be lower cost than mutual funds, and this gives them a performance advantage that shows up in the star rating. The average equity mutual fund with a five-year star rating costs 1.20%, while the average equity ETF with a five-year star rating costs just 0.36%.

Source: Morningstar Direct

.

Strategic Beta

A number of 4- and 5-star ETFs are strategic beta funds. These funds often land near the border between one category and another going deeper in value or smaller in size, and thus, taking a greater amount of risk than a typical fund in the category. While the star rating is adjusted for downside risk, equity funds have been in an incredible bull market for the past five years, so riskier funds are probably not being adequately penalized. For example,

Free to Choose There are some high-cost and poor-performing mutual funds that continue to exist in part because of captive distribution. Some bad funds might get stuffed into a 401(k) plan with limited choice or within an insurance product. In addition, some financial advisors might have an incentive to sell a certain mutual fund that gives them the best commission or revenue split. In contrast, the market for ETFs is a bit more competitive. Investors are typically free to choose any ETF on the market, and there are few restrictions. Thus, underperforming ETFs are likely to close. The Morningstar Rating for funds is not adjusted for survivorship bias.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)