February's Job Growth Will Be Hard to Sustain

In years past, job growth has looked remarkably strong in late winter and early spring, only to fall apart over the summer months.

It was not a good week for markets, with most world equity markets and commodities down. Weakness early in the week was due to China trimming its growth forecast to around 7% and a series of weak U.S. economic indicators. Friday's unusually strong employment report, one of the few truly good reports this week, sank markets because of fears that the Fed would move to raise rates sooner than later.

The employment report just didn't seem to line up with a lot of recent economic reports that have been quite soft. In manufacturing, the Purchasing Managers Index was down again, though still in growth territory. Surprisingly, auto sales dipped, which is not good for manufacturing. I wouldn't get too upset yet, though, because weather may have been a factor.

U.S exports didn't look good either, declining 2.9%, although labor issues at West Coast ports may be part of the problem. Weekly shopping center growth rates also continued to slow. Consumer incomes were one of the bright spots this week, with a month-to-month increase of 0.9%. However, consumers refused to spend their newfound wealth, at least for now, as the savings rate has moved up from 4.5% to 5.5% over the past two months. That could provide some fire power for additional consumer spending in the months ahead.

Jobs Market Shows Surprising Strength and Continued Momentum The U.S. economy added a surprisingly strong 295,000 jobs in February, according to the official Bureau of Labor Statistics report. That was well ahead of my expectations and the market's expectation that just 240,000 jobs would be added. The growth figure was also well above the 12-month average of 275,000 jobs added.

All of this struck us as surprising because so many other reports, including weekly unemployment claims, purchasing manager employment indexes, slower GDP growth, and poor weather, all pointed to a weaker jobs report. I do caution that this may be the best jobs report we see for some time, based on those soft spots in the economy. In addition, despite seasonal adjustments, job growth has looked remarkably strong in late winter and early spring, only to fall apart over the summer months--at least that has been the trend over the past several years. The more reliable year-over-year employment growth rate has also ticked up, but not quite as drastically, as shown below.

Hours worked were stable at 34.6, as they have been for the past five months. This is a pretty typical pattern in the middle of an economic recovery. In fact, sometimes those hours might be moving down modestly. Overall hourly wages increased $0.03, or about 0.1%, after a big boom last month. Year-over-year wages are up 2%. That may not seem like a lot, but with inflation hovering near zero, that modest gain will go a long way.

Sector News Is Both Good and Bad The really good news is that business and professional services added 51,000 jobs. It's great that the sector did well because those jobs have long hours and great pay. It is also the category that includes most of the office professionals who quickly come to mind when we think about quality jobs.

The private education sector, which has been under a lot of regulatory and business pressures, added 23,000 jobs after months of ho-hum performance. It was clearly one of the bigger surprises in the report. And despite some poor housing market reports lately, construction-related employment growth continued to be strong with 23,000 jobs added.

In a piece of mixed news, temporary help fell by 8,000 workers, the second monthly decline in a row. That is good news because it means that employers are feeling confident enough in their businesses to add permanent employees. Permanent assignments versus temporary ones should also encourage workers to spend more of their incomes, further boosting the economy. The bad news on the temp front is that it is a very good leading indicator of the overall employment report in the months ahead. In a strongly growing market, employers often hire temp workers because they can be added so quickly to the workforce. Therefore, the decline in temp workers is also a little worrisome.

One of the larger concerns in the report was that a lot of the employment growth, nearly 60,000 jobs, came from the restaurant industry. That is nearly double the recent average level. Unfortunately, workers in this category make low average wages and don't work nearly as many hours as in many other categories.

As expected, some oil and gas issues are beginning to hit employment directly, as the mining sector reported job losses of 8,000 workers.

Unemployment Rate Falls to 5.5%, Nearing Natural Unemployment Rate For a number of reasons, I usually don't focus on the unemployment rate, but it was noteworthy this week as it dropped to the high end of the 5.0%-5.5% range considered to be the natural, or normal, rate of unemployment. This tends to support our long-term thesis that we are approaching the point where labor market scarcities are going to become more prevalent.

This relatively low unemployment rate is also likely to make the Federal Reserve more prone to raise rates. The whole reason the Fed forced interest rates so abnormally low was to aid the employment market. That work now looks largely complete. However, with inflation rates (the other half of the Fed mandate) so low, they won't necessarily have to rush. However, I still believe the Fed will act in 2015. Exactly which month they do the deed is still an open question.

Weather Hits Auto Sales

Auto sales for February came in at 16.23 million units, sharply below estimates of 16.7 million annualized units. They were also lower than the 16.74 million units sold in January. The doom-and-gloomers are trumpeting the third straight monthly decline and the lowest reading since all the way back to last April. The optimists among us noted that sales were 5% above year-ago levels and this was the best February since 2006. And the improvement came despite some pretty lousy weather in both periods and a change in

Senior auto analyst Dave Whiston is not panicking. He is sticking with his forecast of 16.9 million-17.1 million units for all of 2015. While good, that would represent slower growth than in 2014, when sales increased from 15.5 million units to 16.5 million units. In other words, if Whiston is right, we will be adding half as many units in 2015 as in 2014. I am in agreement with Whiston.

Last year I panicked when I saw the low auto numbers, which, in retrospect, were really weather-related. Luckily, the auto manufacturers ignored my advice and kept producing autos at a very healthy pace last winter, properly anticipating a huge spring bounce. In addition, a higher percentage of pickups and other large vehicles means that slower unit growth will have a smaller impact on the Big Three, especially their profit levels. Light trucks carry higher price tags, have less competition, and carry higher margins.

While I am not worried about full-year auto sales, these temporarily low results for January and February will potentially make a serious dent in the consumption numbers for February. As noted above, consumption numbers for January were just OK. February is likely to be worse. This is another reason to moderate optimism about 2015 GDP growth rates. Also, this year's slow start could slow the manufacturing sector. That may already be showing up in the Purchasing Managers Index, discussed below.

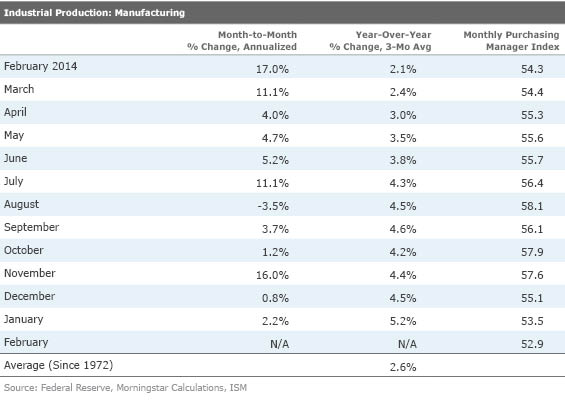

Manufacturing Holding Its Own The ISM Purchasing Managers Index for manufacturing slipped modestly in February from 53.5 to 52.9. That is actually quite an accomplishment given the West Coast port labor actions and some relatively bad weather. Even under ideal conditions, small changes in the index aren't particularly meaningful. A large and powerful move under 46 or so would be a real reason for panic.

Year-over-year growth in industrial production (what ISM is meant to forecast) has remained relatively stable over the past several months, which supports our no-panic thesis. However, the move to 52 from 57 last summer suggests that manufacturing isn't accelerating any more or lighting the world on fire. The days of ever-increasing exports and energy-related equipment sales are behind us. And the auto industry, while improving, is also beginning to slow.

I suspect that after industrial production peaked at just over 5%, year over year, manufacturing growth is likely to drop back to a 3%-4% growth rate in 2015, but still above the long-term average of 2.6%. Nevertheless, the manufacturing growth reduction we are expecting is one of the reasons we are less bullish than others on our GDP outlook for 2015.

The individual category data wasn't terribly helpful this time around. The new orders reading, the most forward-looking element, registered 52.9, identical to the composite reading and also trending down. One slightly scary part of the report is that the employment component fell sharply from 54.1 to 51.4. That is a more meaningful decrease and suggests that manufacturers are becoming more cautious.

The export reading, at 48.5, is now in decline mode. With a stronger dollar and a lower need for commodity-related equipment, this isn't terribly surprising. While the West Coast ports issue is widely blamed for the PMI decline, we noticed that inventories, backlogs, and supplier delivery indexes were all up sharply. Those items all increase the index and are likely the result of supply-chain backups, but they were all offset by the current production subcomponent, which was down because some imported raw materials were not available for production.

Home Price Growth Picks Up Again

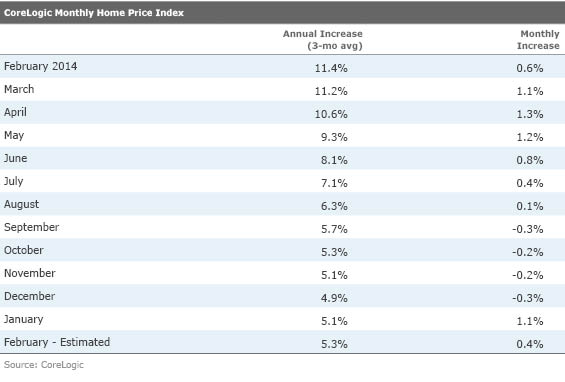

We were surprised to see home prices jump by 1.1% between December and January, according to the latest

The preliminary numbers for February mercifully showed a smaller increase. However, this is just an estimate based on pending but not closed sales. In any case, the year-over-year prices are moving up again and are ever so slightly above our 4%-5% target for all of 2015. Given that existing-home sales have been so sluggish and disappointing lately, we are a bit surprised by the sudden move up in prices. No real need to worry just yet. Perhaps it was a one-month statistical fluke. We shall see if the other two major home price surveys at the end of the month confirm the CoreLogic data.

Retail Sales Will Dominate Next Week's Economic Reports The most closely followed report next week will probably be the retail sales report for February. With exports slowing and manufacturing losing some of its mojo, and government spending growth still modest, consumption is critical for GDP growth. The retail sales report will be a great early indicator, as it makes up about a third of the consumption report, which in turn is 70% of the U.S. economy.

Retail sales have generally been weak the past couple of months, surprising analysts who thought falling gasoline prices would drive sales sharply higher. Retail sales fell 0.8% in January, although a lot of the outright decline was due to falling gasoline prices. Nevertheless, a lot of other categories were soft, too. Analysts expect sales to rebound in February to 0.5%, at least partially because gasoline prices rebounded so strongly in February (unit sales won't change, but higher prices per gallon artificially inflate the retail sales report--the opposite of what happened in January). I think that is way too optimistic given the disappointment in auto sales, even worse weather than in January, and modestly slowing weekly shopping center growth rates.

Also due next week is the job openings report that has been on fire for months. The report provides some supplemental data on the health of the labor market. It also either confirms or raises questions about the monthly employment report. We suspect that openings may drop off a little in this report but remain close to the near-record 5 million openings reported in the prior month.

We aren't fans of the small-business sentiment report as a whole. Like many sentiment-based reports, it's generally a concurrent if not lagging indicator. However, we have taken a liking to the subsections on hard-to-fill jobs and planned raises. Both of these have moved up sharply in recent months.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)