Betting on Oil

For better or for worse, exchange-traded products have made commodities markets more accessible to investors.

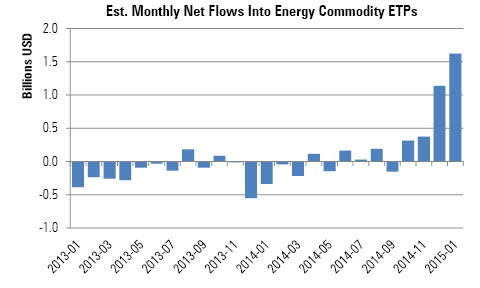

The collapse in oil prices in the back half of 2014 has prompted some bargain-hunters to take their chances bottom-fishing the volatile commodity. In just the past four months, exchange-traded products offering exposure to energy markets via futures contracts have attracted about $3.5 billion in asset flows. That figure represents a remarkable 80% of the $4.3 billion in total assets invested in the category as of the end of January.

There are currently 20 ETPs in the category, which is dominated by

- source: Morningstar

In light of renewed interest in the space, it is worthwhile to revisit how futures-based commodities ETPs work. Speculating on the price of oil is incredibly challenging, to say the least. But, getting the fundamental story right, or even the exact timing for that matter, is not enough. Investors also need to have a firm grasp of the dynamics of trading futures contracts. This includes understanding how the term structure of the futures curve impacts ETPs like USO, which "roll" futures contracts in order to maintain exposure to a commodity.

Back to the Futures Most investors obtain exposure to commodities via futures contracts, rather than owning the commodity directly, because physical storage and insurance tend to be cost prohibitive--especially for smaller investors. Futures can be an effective solution as investors and speculators are ill-equipped to handle and store barrels of oil or other perishable commodities. However, there are (potentially costly) drawbacks with futures strategies as well. For instance, as futures contracts near expiration, commodity ETPs have to roll those contracts to the next month's contract to avoid taking ownership of the physical commodity. The catch is that the futures curve--that is, the prices of contracts with progressively longer terms--can take an upward (known as "contango") or downward ("backwardation") slope. That slope can cause the return to a long-only investment in commodity futures to deviate significantly from spot price returns over time.

Contango in futures markets erodes the performance of rolling futures strategies because cheaper contracts in the expiring month are sold "low" and more expensive contracts for the next month are bought "high." The resulting drag is known as a negative "roll yield." The opposite is true for futures markets in backwardation, as selling the expiring month's contract "high" and buying the next month contract "low" produces a positive "roll yield." Underestimating the impact of the roll yield can lead to poor investment outcomes.

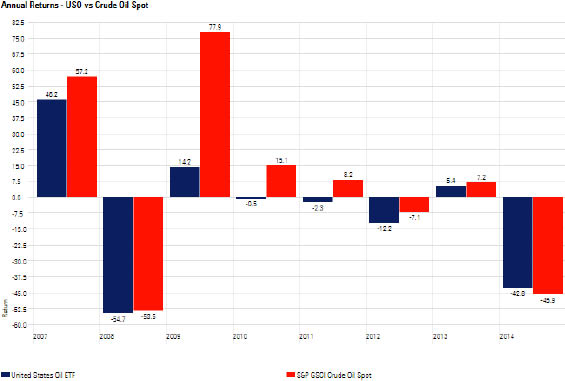

Blast From the Past Remember, the return for a rolling futures strategy consists of the spot price performance, roll yield, and collateral yield, with the first two holding the most sway. (The yield on U.S. Treasuries can be used to estimate the collateral yield, which is simply the interest earned on the capital securing the futures contracts). Looking back at USO's annual returns versus the spot WTI crude oil price returns illustrates how influential the roll yield can be on the returns of rolling futures contracts.

- source: Morningstar

The performance in 2009 stands out. Oil prices rebounded sharply after a steep decline during the global financial crisis. It appears that many investors had the right idea back then, as energy commodity ETPs had their highest ever annual net inflows in 2008 and 2009. Unfortunately, steep contango weighed heavily and USO returned about 14% while the spot price soared 78%.

Important (and painful) lessons were learned as a result. Prior to the major flood of financial investors that began around 2008, contango was actually relatively uncommon in energy markets. In fact, much of the positive return to commodity funds in the early-2000s was because oil, typically the largest single holding of a commodity index, was mostly in backwardation during that period, resulting in positive returns from rolling into further-out contracts. With that backdrop, it is understandable why so many investors enthusiastically piled in on the oil trade.

Dynamic Term Structure Certain characteristics of commodities will never change. Primarily, commodities are nonearning assets; they do not produce any wealth of their own, so long-term prices will correlate closely to the marginal cost of production.

In the short term, commodity price volatility will reflect the availability of above-ground supplies and the ability of producers to increase or decrease production relative to demand. Except for the unique case of precious metals, commodity inventories are typically scant compared with annual production, and resource producers have difficulty adjusting production in a meaningful way. That's the nature of commodities, and it leads to volatile returns. Unfortunately, it is not as simple as turning the spigot on or off.

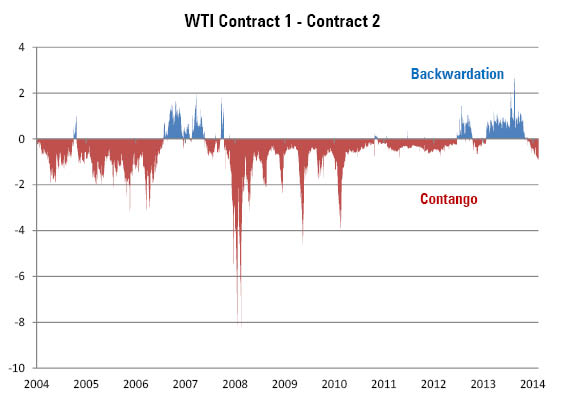

Therefore, along with fluctuating supply and demand factors, investors in commodity futures (and related ETPs) must also contend with potentially swift and meaningful shifts in the term structure of the futures contracts. The chart below, which was created by subtracting the price of the next-month contract ("contract 2") from the price of the current month contract ("contract 1"), attempts to illustrate how dynamic the futures curve can be over time. Negative figures indicate markets in contango.

- source: U.S. Energy Information Administration

It is interesting to see the relationship between the above graph and the previous figure which showed the annual returns of USO versus spot oil. The futures market flipped violently into contango during the financial crisis and persisted in that upward-sloping state for several years. This helps explain the huge discrepancy between the performance of futures and spot prices that occurred around 2009.

Moreover, recall from the first chart that investor interest waned considerably in the years following the crisis and recovery, as many investors felt "burned" by ETPs that did not meet their (misguided) expectations. It is only recently that investor assets have come back to the market. Interestingly, the renewed interest in energy futures investments has coincided with the market's move back into contango.

Déjà vu? After a long stretch of persistent contango, things appear to have normalized in the energy futures markets over the last few years. Volatility was muted as crude oil traded in a relatively tight range up until its collapse in 2014. With assets pouring in and volatility on the rise, both speculators and investors should consider whether USO is an appropriate vehicle.

The oil futures market has just recently tipped into contango, though it remains to be seen whether it ends up being a repeat of 2009. Contango has widened as oil prices have started to move higher, and currently amounts to an annualized headwind of 21% for a strategy like the one embedded in USO. This means that all things equal, if oil prices stayed flat for the next year, an investor holding USO would lose 21% on their position. We've seen this movie before. And for the unsuspecting, it doesn't end well.

Evolution of Commodity Futures Markets The million dollar question is: Has financial interest grown too large relative to the physical market because of commodity index investors? If so, then it is likely we have excessive long-only demand that can only invest in futures contracts. This could push up the prices of futures contracts, leading to a state of persistent (and sometimes extreme) contango.

If the same investors who are buying futures today were instead buying physical barrels of oil, spot prices would skyrocket as limited supplies were hoarded and stored. Instead, because futures contracts are habitually sold before expiration and the proceeds invested in the next contract, futures prices tend to exceed the combined spot price and cost of carry.

Basic economics would tell us that arbitragers should step in to store the physical commodity and take the short side of the futures prices. Storage facilities are of limited supply, however, and many of their rates are capped by government regulation. Once financial investment outstrips the available inventories and storage capacity, arbitragers can no longer perfectly hedge out short positions in the futures contracts, allowing long-only pressures to take over and push prices above what the market fundamentals would predict.

When the headlines about oil tankers sitting idle and acting as storage facilities start to roll in, that's a pretty good indication that something could be amiss in the crude oil futures market. If that's the case, then investors may wish to reconsider ploughing into USO as their preferred means of participating in a potential recovery in oil prices.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)