Ultimate Stock-Pickers' Top 10 High-Conviction Purchases

These top investment managers put new money to work in several wide-moat names, including United Technologies.

By Greggory Warren, CFA | Senior Stock Analyst

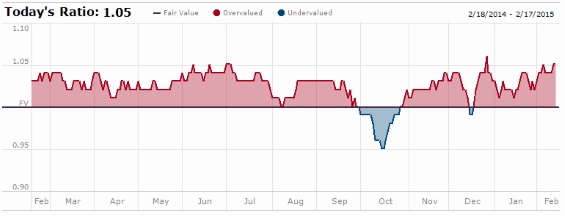

Despite the increased volatility in the global equity, credit, and currency markets that kicked off near the end of the third quarter, the U.S. equity markets (as represented by the S&P 500 TR index) still rose close to 5% during the fourth quarter. This left returns for the full year at about 14%, which was a respectable showing after a more than 32% increase for the U.S. markets during 2013. That said, we were not too surprised to see the S&P 500 post a double-digit gain last year, having mentioned early in 2014 that a good case could be made for additional stock market gains in the year ahead. At the time, we noted that during the decade ending December 2013 we saw the U.S. markets post further gains in two different years after the S&P 500 rose more than 25% in the preceding year. During 2010, the market increased 15% after gaining more than 26% during 2009, with Morningstar's stock coverage universe peaking at about 1.10 times our analysts' fair value estimates during the year. And, coming off of a nearly 29% gain in 2003, the market increased close to 11% during 2004, with Morningstar's stock coverage universe approaching 1.15 times our analysts' fair value estimates.

With Morningstar's stock coverage universe peaking at about 1.05 times our analysts' fair value estimates during 2014, further gains could be possible in the year ahead. However, those gains are likely to be smaller than what we saw last year, if the increases we saw in 2005 (5%) and 2011 (2%) are a guide. The S&P 500 was up a little over 2% on a year-to-date basis at the end of last week, even with all of the volatility created by uncertainty over oil prices, economic growth, and foreign currency exchange, as well as escalating tensions in the Ukraine (which were also a problem during the first quarter of 2014). For some of

, increased market volatility is not necessarily a bad thing. Pat English at

The extraordinary returns of the equity market in recent years, and really, over the past three decades, have seemingly dulled investors' sense of value…Until high-quality businesses are offered again at truly cheap prices, we have to content ourselves with owning high-quality businesses at somewhat elevated prices. Our stocks trade at a significant discount to the benchmarks so the relative story is still as strong as ever. We will be surprised, however, if absolute returns over the next five years are anywhere close to those of the past five years. The increased volatility that we have seen in the fourth quarter may be a harbinger of things to come, perhaps giving us more opportunities to maneuver in 2015. An investment letter we read recently that was discussing the rapid and steep drop in oil prices, quoted the renowned German economist, Rudiger Dornbusch: "In economics things take longer to happen than you think they will, and then happen much quicker than you thought they could." History shows this also applies to stock markets.

In a similar vein, Robert Zagunis at

We maintain a cautious near-term outlook on the market due to prospects of a more hawkish U.S. Federal Reserve, signs of a slowdown in global economic activity, and higher-than-average stock market valuations. Jensen aims to hold high quality businesses at reasonable prices. We believe attention to valuation may provide downside protection and that investors in high quality, reasonably priced businesses will be rewarded over the long term… Our goal remains the construction of a portfolio of companies with sustainable competitive advantages, resilient financial results, and attractive long-term growth opportunities. Importantly, we believe these companies will generate business returns consistently above their cost of capital, resulting in shareholder value creation. The return of volatility to the market is an opportunity for Jensen to take advantage of short term dislocations as an active manager. Despite our cautious outlook on the overall market, we are confident that the portfolio companies will continue to produce strong business results we believe will ultimately be reflected in stock prices.

We can empathize with Jensen's continued focus on identifying companies with strong competitive advantages that are offered at a discount in the near term, believing that firms with defined (and defensible) economic moats trading at a discount to our analysts' fair value estimates are likely to outperform in the long run. This is an important consideration in an environment where not only are most active equity managers underperforming, but many of

are finding it difficult to outperform the market. Based on data provided by Morningstar Direct, fewer than 20% of actively managed U.S. Stock funds beat their benchmarks last year, and those that did managed to do so by 180 basis points on average. Our top managers did not fare much better, with only one of the four fund managers that we track beating the market by more than 180 basis points last year.

for 2014.

Some of the strongest statements on the market environment, in our view, came from Ronald Canakaris at

We think the ongoing slow global economic recovery and highly accommodative central bank monetary policies throughout the developed world should continue to support share prices in 2015. While these policies are beneficial to the financial markets, it is troubling to think that in the sixth year of an economic recovery, there is still a need for central bank stimulus through either zero interest rates or various forms of quantitative easing to keep the recovery on track. We are concerned that these stimulus measures could cause U.S. share prices to inflate to unrealistically high levels not supported by underlying fundamentals. This outcome could eventually lead to a severe stock market decline that would be harmful to the economy. With the latest round of U.S. quantitative easing (QE3) having ended, stock market valuations stretched, and investors generally complacent, we still expect a further increase in stock market volatility as additional central bank liquidity is no longer available to dampen volatility.

It has been against this particular backdrop that our Ultimate Stock-Pickers have been managing their portfolios, and explains why over the last six calendar quarters our top managers (many of whom have been more cautious in their approach to the markets) have generated some of the lowest levels of buying and selling that we've seen from them since the market rally started in March 2009. The following comments from Steve Romick at

There are times when we are focused on making money and there are times when we place more weight on protecting capital. This time, it's the latter.

This also helps to explain the larger-than-average cash balances at some of our top managers, primarily those that are not constrained by investment mandates requiring them to be fully invested at all times. While the 22 fund managers included in our investment manager roster had an average cash balance of 7% (and a median cash balance of 4%) at the end of the most recent period, the unconstrained funds had an average cash balance of 9% (and a median cash balance of 8%). This compares with an average cash balance of less than 5% for all U.S. stock funds tracked by Morningstar.

Market Fair Value Based on Morningstar's Fair Value Estimates for Individual Stocks

Source: Morningstar. The graph shows the ratio price to fair value for the median stock in the selected coverage universe over time.

We note that when we look at the buying activity of our Ultimate Stock-Pickers, we tend to focus on both high-conviction purchases and new-money buys. We think of high conviction purchases as instances where managers make meaningful additions to their existing holdings (or make significant new-money purchases), with a focus on the impact these transactions have on the portfolio overall. It also pays to remember that when looking at this buying activity, the decision to purchase the securities we are highlighting could have been made as early as the start of October, with the prices paid by our top managers different from today's trading levels. As such, investors should assess the current attractiveness of any security mentioned here by looking at some of the measures our stock analysts' research regularly produces, like the Morningstar Rating for Stocks and the price/fair value estimate ratio. This is especially important right now, with the S&P 500 trading at/near record highs and the market as a whole looking modestly overvalued, with Morningstar's stock coverage universe trading just above our analysts' estimates of fair value at the end of last week.

Changes to the Investment Manager Roster

Before further exploring the purchases that were made during the most recent period, we note that we've made changes to two of our top managers. As you may recall from past articles, we prefer to be proactive with the Investment Manager Roster, retaining a degree of flexibility that allows us to maintain a list of top investment managers capable of consistently generating high-conviction buy and sell ideas for investors. That said, we prefer to make changes once a year at most, gathering data points and other information as we go through each calendar year. As a general rule, we will remove a manager from the Investment Manager Roster if: 1) there is a meaningful change of managers for a fund (and our fund analysts have little confidence that the succeeding management team will be able to replicate the performance of past managers); 2) a fund closes or merges with another fund, and no longer follows the same investment processes or is no longer run by the same management team; 3) the fund is no longer covered by Morningstar's mutual fund analysts; and 4) the fund's long-term performance has fallen below benchmark returns.

Much like in past years, we changed two names in our Investment Manager Roster this year. Both of the changes were centered on Large-Cap Value funds--

As for the replacement funds, we've made every effort to replace the outgoing managers with managers who have similar investment characteristics, allowing us to maintain an appropriate level of diversity among the mutual funds in our list of top managers. The first replacement manager for the Investment Manager Roster is American Century Value (AVLIX), which (along with Vanguard PRIMECAP)

for the 2014 Morningstar U.S. Stock Fund Manager of the Year award. Fund managers Phil Davidson, Kevin Toney, Brian Woglom, and Michael Liss were recognized for the work they do running three different mutual funds--

The second replacement manager,

Top 10 High-Conviction Purchases Made by Our Ultimate Stock-Pickers

Company Name

Star Rating

Size of Moat

Current Price (USD)

Price/FVE

Fair Value Uncertainty

Market Cap (USD Mil)

# Funds Buying

United Tech UTX

3

Wide

121.25

1.05

Medium

111,520

4

Oracle ORCL

3

Wide

43.93

1.05

Medium

193,089

3

Actavis ACT

4

Wide

285.37

0.86

Low

76,637

2

Google GOOG

3

Wide

549.02

0.92

High

377,888

2

TE Connectivity TEL

1

None

70.76

1.36

Medium

28,899

2

Schlumberger SLB

4

Wide

88.38

0.84

Medium

115,885

2

GE GE

4

Wide

25.15

0.84

Medium

255,199

2

Apache APA

5

Narrow

67.05

0.68

Medium

26,209

2

Cisco CSCO

2

Narrow

29.43

1.13

Medium

150,340

2

ExpScripts ESRX

3

Wide

84.9

0.95

Medium

62,604

1

Stock Price and Morningstar Rating data as of 02-13-15.

Our early read on the buying and selling activity in the fourth quarter has revealed a number of situations where our top managers were not only buying stocks with conviction, but making new money purchases in those names. Like past periods, most of the higher conviction purchases were dedicated to companies with economic moats--particularly those with wide economic moats. That said, the number and similarity of purchases (and sales) across our top managers has dwindled as the market has continued to move higher, making it all that more difficult to find strong buy (and sell signals) across multiple managers. The top two names on our list this time around--

It's worth noting the lack of Energy sector names on the list. Just two companies--

As for the first of the top two high-conviction purchases made during the period, United Technologies was the target of two new-money purchases and four total high-conviction purchases during the fourth quarter (and early part of 2015). Steve Romick at FPA Crescent was the largest purchaser of the stock, adding 1.9 million shares to his fund during the period. Romick noted the following about his purchase in his fund's quarterly letter:

We firmly believe that if we understand a business first and then invest when its price becomes attractive, we will perform well over time. UTX is an example of such a business. As part of our research process, we look at a number of companies and industries each year...[M]ost of that research does not result in a purchase or sale. We regularly nix potential investments because we find them too expensive or too difficult to understand. When we pass on investments solely due to valuation, we are left with "on deck" opportunities. These are companies that the group has thoroughly researched but decided that the price wasn't attractive enough to warrant purchase. We keep track of these companies and patiently wait for the day when they become available at a price that represents good, long-term value. UTX was one such opportunity that presented itself during the short-lived market dip last October.

UTX is an industrial conglomerate with leading positions in aerospace systems, aerospace engines (Pratt & Whitney), helicopters (Sikorsky), elevators (Otis), climate control (Carrier) and fire/security systems. Each division is a leader in its respective field and features important long-term competitive advantages. UTX generates roughly 50% of its profits from aerospace and 50% from commercial buildings. The strength of the operating businesses has allowed UTX to earn an average return on invested capital in the mid 20's through the recent economic cycle (i.e., the last 6 years). Based on our estimate, UTX was available at an owner's yield of approximately 7%...[which] presented a reasonable entry price to a wonderful collection of businesses. What's more, we think earnings will grow faster than GDP and we anticipate company executives will prudently manage capital over the long-term. We hope to hold businesses like UTX for a long time and welcome the chance to add to our position at lower prices.

Ronald Canakaris at ASTON/Montag & Caldwell Growth also put new money to work in United Technologies, which was one of five new positions for his portfolio (the other four were

We think commercial and military aerospace conglomerate United Technologies stands to benefit from a robust commercial aerospace aftermarket. The stock had lagged prior to the Fund's purchase, providing what we saw as an opportunity to buy it at a rare discount to the S&P 500. We reduced the position after the abrupt and unexplained departure of the firm's CEO, and plan on holding a smaller position until further clarity is provided.

United Technologies' shares have recovered from their mid-October dip, currently trading at a slight premium to our analyst's fair value estimate. The departure of CEO Louis Chenevert in late November seems to have had little impact on the stock price, even if it did raise some eyebrows in the interim. Most of the reporting that has come out following Chenevert's unexpected retirement has noted that the company's board of directors had become increasingly concerned about his excessive attention to private interests, and when he offered his resignation they accepted, elevating CFO Greg Hayes to the top job. Morningstar analyst Barbara Noverini notes that Hayes' nearly 25 years with the firm, including the last six years where he worked closely with Chenevert in his role as CFO, made him the natural replacement for the outgoing CEO. With a new management team at the helm, she expects the firm to go through a period of portfolio review and capital allocation scrutiny (allowing Hayes to signal his priorities for the firm). Noverini notes that management has already turned a critical eye on the company's supply chain, which could lead to significant improvements in working capital and inventory turns by thoroughly assessing supplier efficiency and quality. Such operational improvements could go a long way toward improving shareholder value over the long run, but Noverini notes that some of this has already been baked into the company's stock price.

While three of our top managers bought Oracle with conviction, none of these purchases involved new-money commitments, and none of the managers that were buying during the period offered up any commentary on their additional purchases of the stock. Trading at a slight premium to our analyst's fair value estimate, there is little to get excited about here, with Morningstar analyst Rick Summer suggesting that investors seek a wider margin of safety before considering the name. The same could not be said for Actavis, which is one of the few reasonably priced names on our list of top 10 high-conviction purchases, trading at 86% of our analyst's fair value estimate. It also had at least two of our top managers putting new money to work with conviction during the recent period. Ronald Canakaris at ASTON/Montag & Caldwell Growth said the following about his fund's purchase:

The [fund's] stake in Healthcare was boosted by the new purchases of Actavis and Amgen during the quarter. Actavis is a diversified specialty pharmaceutical company and recently announced a mutually agreed upon acquisition of Allergan, a stock owned in the portfolio since 2007. Actavis has made a series of transactions the last several years, including a recently completed acquisition of Forest Labs. We think management has a demonstrated ability to deliver operational synergies and, combined with Allergan, will have strong brands across multiple therapeutic categories and geographies.

Amgen is a leading biotechnology company. The company has an innovative pipeline with four new drugs submitted for regulatory approval in 2015, 10 pipeline products expected to generate pivotal data by 2016, and five branded biosimilar products expected to launch in 2017 to 2019. We expect the company's restructuring and improved Enbrel profitability to drive operating margin expansion through 2018, while the company plans to increase the cash return for shareholders through share repurchases and increased dividends.

Actavis, the pharmaceutical company that agreed to buy Allergan, is the only new portfolio company in the Fund since our last quarterly report. In combination with Allergan, we expect about two-thirds of Actavis' pro-forma revenue to come from branded pharmaceutical products, and almost 30% of sales to come from generics. This company has a terrific executive team and great assets, so we're excited about the long-term prospects of the business.

Morningstar analyst Michael Waterhouse notes that Actavis has effectively utilized acquisitions to transform itself into a major pharmaceutical contender. While he believes that some growth challenges remain in the company's generics and primary care branded drug markets, Actavis' astute focus on niche generic launch opportunities, along with its purchase of Allergan--which brings with it defensible products (including Botox and Restasis), considerable scale in the niche markets of ophthalmology and aesthetics, and an attractive pipeline of new products--should provide it with both competitive advantages and growth prospects.

Much like with Oracle, there was little insight on the purchases of

General Electric is a company with businesses we have always admired, but we have questioned management’s focus on returns when making capital allocation decisions. However, the appointment of a new CFO in mid-2013 ushered in significant changes. Since then, GE has, in our view, acquired assets cheaply (Alstom) and sold assets at good prices (Synchrony and its appliances division). In 2015 the company plans to totally revamp its variable compensation plan for thousands of employees, emphasizing factors that drive return on invested capital, which should boost future results. We believe there is substantial opportunity to improve gross margins, and the stock trades for just under a market multiple on 2016 earnings. Some investors may have a stale opinion of GE after the past 15 years of persistent underperformance, but we believe it’s a good investment at the current price.

Scott Davis at

While both

Top 10 New-Money Purchases made by Our Ultimate Stock-Pickers

Company Name

Star Rating

Size of Moat

Current Price (USD)

Price/FVE

Fair Value Uncertainty

Market Cap (USD Mil)

# Funds Buying

Actavis ACT

4

Wide

285.37

0.86

Low

76,637

2

United Tech UTX

3

Wide

121.25

1.05

Medium

111,520

2

GE GE

4

Wide

25.15

0.84

Medium

255,199

2

ExpScripts ESRX

3

Wide

84.9

0.95

Medium

62,604

1

UnitedCont UAL

3

None

66.23

1.18

Very High

24,041

1

Delta DAL

-

-

44.5

-

-

36,426

1

CapitalOne COF

4

Narrow

78.88

0.85

Medium

43,628

1

Amgen AMGN

4

Wide

153.48

0.86

Low

116,976

1

UnitedHealth UNH

1

Narrow

109.44

1.39

Medium

103,992

1

Yahoo YHOO

4

Narrow

44.42

0.77

High

42,556

1

Stock Price and Morningstar Rating data as of 02-13-15.

Of the five other new-money purchases on our list this time--

Capital One is another name trading at a fairly meaningful discount to our analyst's fair value estimate. Morningstar analyst Dan Werner notes that, as a result of bold acquisitions and organic growth, Capital One has evolved from a monoline credit card company to a diversified holding company offering a broad spectrum of financial products and services to consumers and businesses. The company can be divided into three segments--credit cards, consumer banking, and commercial banking--but credit cards still constitute a large percentage of its net income. In the past, he was impressed by the consumer and commercial lending growth as the improvement in the overall economy took us into 2014. For the year ahead, though, he sees the credit card business as the catalyst for balance sheet growth, which should help net interest margins as higher-yielding assets are added to the loan portfolio. With a diversified balance sheet, and the highest yielding asset class (that is growing while realizing normalized loan losses), Werner thinks that Capital One looks attractive at today's prices. The managers at

We initiated [a] new positions in…[c]redit services company Capital One Financial…one of the most recognized brands in financial services and the 8th largest bank in the U.S. The firm has national scale as a top five credit card and auto lender and a significant traditional branch banking presence with commercial lending capabilities in a number of large U.S. markets. We expect Capital One’s core credit card and auto loan segment to experience continued loan growth as a function of an improving economy, an improving job market and increasing confidence in consumer spending decisions. Capital One also benefits from the continuing shift in favor of electronic payments (i.e. ApplePay) versus cash and check. We believe Capital One will continue to generate healthy returns in a business model that is capital generative and the market will reward Capital One for its earnings power and its management’s new focus on returning capital to shareholders versus acquisitions.

As for the final name on the new-money purchase list, we were surprised to see the managers at Jensen Quality Growth initiating a new position in UnitedHealth Group during the fourth quarter, as the shares were consistently above our analyst's fair value estimate of $79 per share. That said, they did sell off another overpriced stock--

During the fourth quarter, the Investment Committee sold one company, Automatic Data Processing, and purchased a new company, UnitedHealth Group. At the end of November, the Investment Committee decided to reduce the portfolio’s existing position in ADP and other names and use the proceeds to add a new holding, UnitedHealth Group. While we believe ADP, a human capital management solutions company, has some of the strongest fundamentals of any business in the Composite, we reduced the position for valuation reasons. As those valuation concerns continued after the November trim, the Committee decided to sell the entire position at the very end of December.

UnitedHealth Group (UNH) is the largest managed care company in the U.S. It comprises United Healthcare, a traditional health insurance business, as well as a variety of health services businesses under the Optum brand. We believe the company’s size and scale create a powerful competitive advantage, both in terms of operating leverage and negotiating power with its provider network. In our view, one of the company’s key business drivers will be its ability to leverage its data collection efforts on behalf of its pricing strategy for the health insurance business while simultaneously creating value-added offerings in the Optum businesses. After careful analysis and debate, the Investment Committee concluded that the investment thesis for UnitedHealth Group is supported by strong competitive advantages, attractive growth prospects, a healthy balance sheet, and manageable risks. At its purchase price, we believe the stock valuation is reasonable and provides the opportunity for solid long-term gains.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Greggory Warren has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)